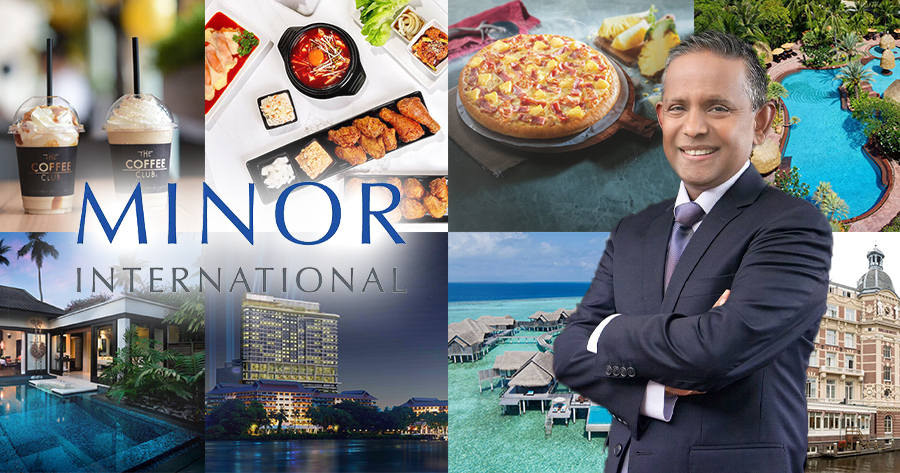

Minor International Public Company Limited (SET: MINT) today announced its first quarter 2022 financial results, posting a significant increase in core EBITDA of more than five times y-y to Baht 2,737 million from Baht 521 million in the same period last year, driven by the performance of all three business units. MINT continued its strong recovery momentum with 13 successive months of y-y core EBITDA growth, driven by the relaxation of COVID-19 restrictions in most of MINT’s key regions, which resulted in greater travel activity, increased dining traffic and an improving retail trading environment. Notably, core EBITDA for MINT’s hotel operations returned to positive territory, while core EBITDA for its restaurant and lifestyle businesses remained positive and are expected to continue to improve. At the profit level, MINT reported a significant improvement from a core loss of Baht 5,211 million in 1Q21 to a core loss of Baht 3,582 million in 1Q22. The y-y improvement was largely the result of Minor Hotels’ reducing losses and Minor Lifestyle’s return-to-positive profit in the quarter. Meanwhile, Minor Food extended its streak to seven consecutive quarters of profitability. On a reported basis, including non-recurring items, MINT recorded a loss of Baht 3,794 million for 1Q22, compared to a loss of Baht 7,250 million for 1Q21. With a more productive and efficient operating platform and strong debt management initiatives (including its refinancing plan and particularly the successful issuance of Baht 7 billion unsubordinated and unsecured debentures in 1Q22), MINT is well-positioned to further capitalize on business recovery in the coming months.

Minor Hotels recovered strongly across all regions with core EBITDA turned positive to Baht 1,460 million from core loss of Baht 602 million in 1Q21, while the bottom line core loss was also significantly lower to Baht 3,729 million in 1Q22, compared with a core loss of Baht 5,343 million in 1Q21. This recovery was attributable to better flow-through from the hotel business’ revenue growth, aided by operating efficiency enhancements. For Minor Hotels’ European hotel portfolio, stronger demand from both leisure and corporate segments, successful pricing strategy as well as the reopening of hotels that were temporarily closed in the prior year drove y-y performance improvement, with average room rates reaching 2019 pre-COVID-19 levels in March and surpassing them in April 2022. Strong operating performance in the Maldives continued with RevPar surpassing pre-pandemic level for the third consecutive quarter. Meanwhile, the relaxation of Test & Go scheme in Thailand has resulted in an increase in international tourist arrivals, particularly in March, and this as well as sustained domestic tourism helped contribute to a rebound in Thailand hotels’ performance. The Australian hotel business also reported continued recovery, as RevPar exceeded pre-pandemic level by 5%, despite extreme weather and flooding in the states of Queensland and New South Wales and remaining COVID-19 restrictions in certain states.

Minor Food 1Q22 EBITDA grew by 8% y-y to Baht 1,160 million and core profit remained in positive territory due to strong growth of the Thailand hub and in spite of COVID-19-related lockdowns in China. Restaurants in Thailand showed improving trends with positive bottom-line growth from increasing traffic in all sales channels, particularly the dine-in business following the removal of government restrictions on operating hours and seat distancing. In the quarter, all of its brands in Thailand achieved positive samestore-sales growth and put effort into improving customer satisfaction, dine-in experience and service quality through staff training programs.

MINT remains committed to continuing to improve liquidity and strengthen its balance sheet. MINT’s liquidity position was strong with Baht 20 billion of available cash and Baht 32 billion of unutilized credit facilities as at end of April 2022. In terms of balance sheet position, MINT’s net interest-bearing debt to equity ratio stood at 1.51x, well below MINT’s debt covenant of 1.75x. Nevertheless, MINT has secured a debt covenant waiver through to the end of 2022. Additionally, Fitch Ratings upgraded NH Hotel Group’s rating from B- to B and revised the outlook from negative to stable while rating of its senior secured debentures was also upgraded from B+ to BB-. The rating reflects NH Hotel Group’s ongoing business recovery from the expected improvement and higher predictability of global travel, as well as improved liquidity, supported by debt refinancing and asset disposals in 2021.

As COVID-19 restrictions continue to ease, travel and consumer consumption are on a strong upward trajectory. Travel prospects for the summer season in Europe and the rest of 2022 are very strong. International tourism is expected to accelerate in Australia and Thailand given the full reopening of international borders and the dropping of quarantine requirements, and the robust recovery will continue in the Maldives. For Minor Food, the easing of restaurant restrictions in Thailand is expected to drive resumption of customer traffic. The short-term outlook in China is uncertain due to government’s stringent measures to curb the pandemic, however, MINT is confident that sales will rebound quickly once restrictions are relaxed. In Australia, the return of tourists and business travelers should contribute to economic recovery and operating activities are expected to improve as COVID-19 restrictions begin to fade.

Mr. Dillip Rajakarier, Group CEO of MINT, commented, “I am excited to share that MINT continues its positive trajectory to achieve pre-pandemic business performance. To highlight, MINT achieved April 2022 hotel occupancies of 70%-90% for Rome, Barcelona, Berlin, Amsterdam, and Madrid, all of which are key cities of our hotel business. Coupled with our hotel forward booking foresight and our strong restaurant platforms, I am confident that MINT will deliver strong Q2, Q3 and Q4 profit performance, reflective of global tourism turnaround post-pandemic.”