Intouch Holdings Public Company Limited (SET: INTUCH) has announced that the independent financial advisor (IFA) approved the decision of disposing Thaicom Public Company Limited (SET: THCOM) to Gulf Energy Development Public Company Limited (SET: GULF).

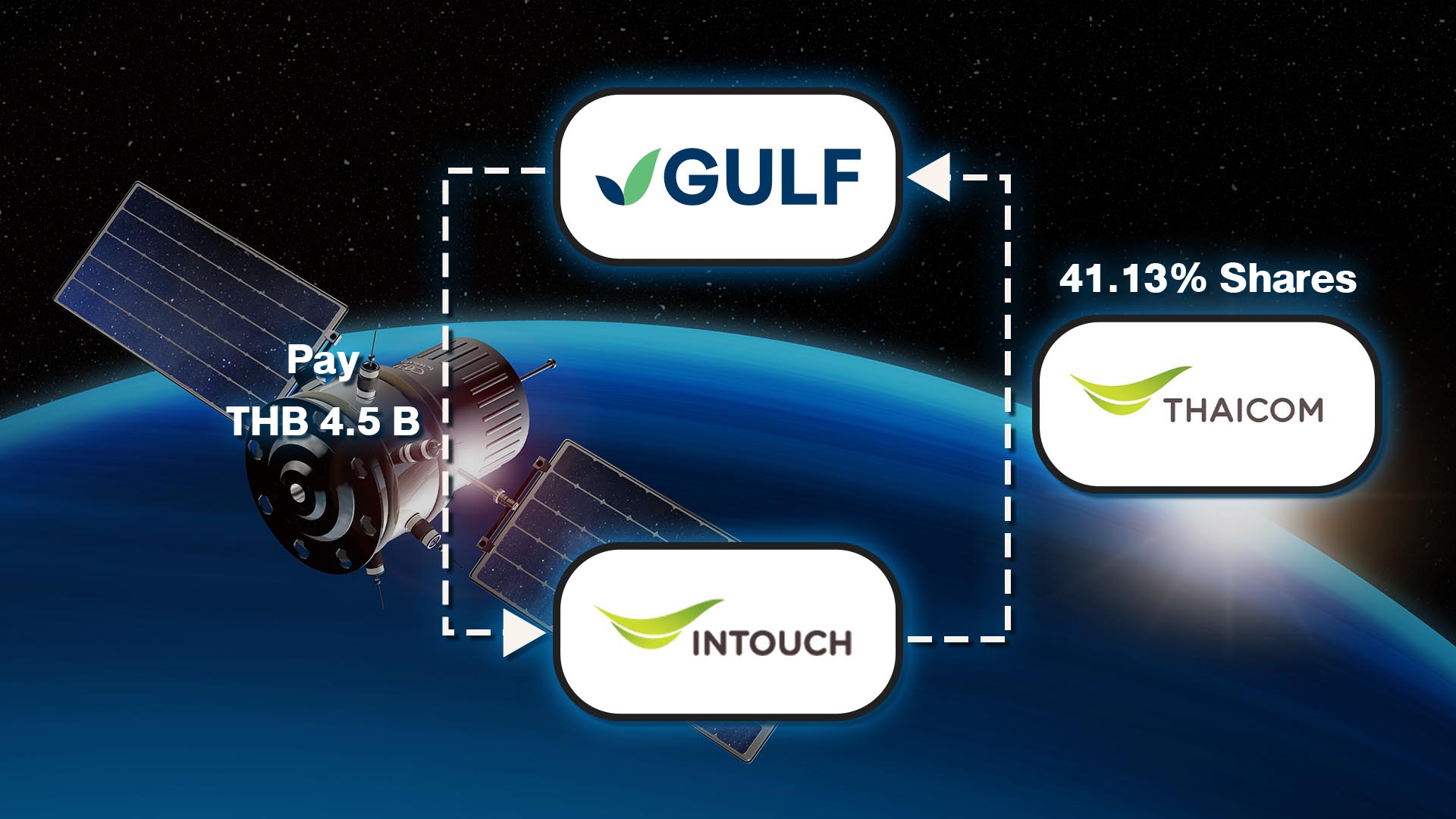

The Board of Directors of INTUCH on November 2, 2022, approved the disposal of all shares of THCOM which are held by INTUCH, amounting to 450,870,934 shares (or 41.13 percent of the total issued shares of THCOM to GULF and/or GULF Ventures Company Limited which is a subsidiary of GULF (collectively, “GULF Group”), at the price of THB 9.92 per share, totaling approximately THB 4,472.64 million.

In considering the reasonableness of this transaction, Avagard Capital Company Limited, as an independent financial advisor, analyzed the objectives of the transaction, operational capability by considering historical data from the past three years’ annual financial statements or since the start of the business, estimated information provided by management, including publicly available information in order to analyze the advantages and disadvantages of entering into the transaction.

INTUCH has the opportunity to generate a return on investment and can use the cash from the disposal of THCOM shares to create benefits or returns to the shareholders of INTUCH in the form of dividends. In this regard, entering into the transaction is deemed to be appropriate and beneficial overall as INTUCH will have profits and no tax burden from the profit received from the disposal of THCOM shares.

Moreover, INTUCH can reduce the uncertain legal risk for the ongoing litigation and the future dispute, and can focus on exploring the new investment opportunities to deliver sustainable growth and return to shareholders.

From all of these, the IFA has an opinion that the disposal of THCOM shares mentioned above done under INTUCH’s policy and for benefit to INTUCH’s shareholders after entering into the transaction is a reasonable transaction which is for the maximum benefit of INTUCH and INTUCH’s shareholder.

Regarding the appropriateness of price, the IFA has an opinion that the fair value for the disposition of shares of THCOM at THB 9.92 per share is appropriate since it is in the IFA’s valuation range of THb 9.83 – 9.97 per share by the Discounted Cash Flow approach which reflects future operating performance under business operation plan and fair assumptions of THCOM.

The IFA has the opinion that the transaction is an appropriate transaction and the shareholders should approve the transaction. Whereby, the shareholders should consider the information, opinions and details in preparing the opinions of the IFA mentioned above, including the advantages and disadvantages of entering into this transaction. However, the decision to approve or disapprove of entering into this transaction is mainly at the discretion of the shareholders.