The share price of Banpu Public Company Limited (SET: BANPU) at the time of 10:13 AM on Monday was at THB 4.46, an increase of THB 0.12 or 2.76% with a total trading value of THB 23.08 million

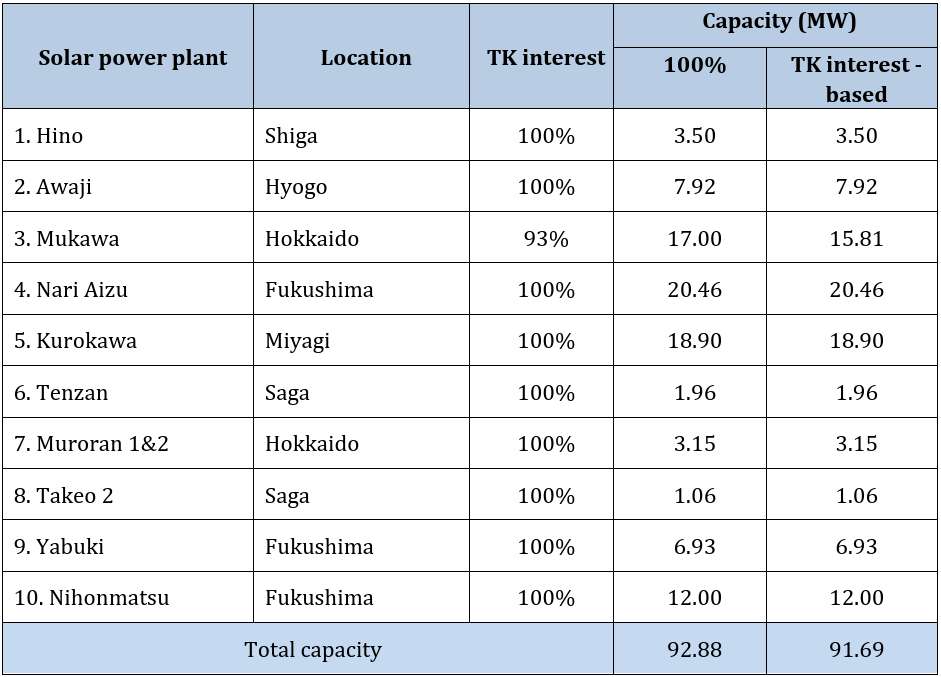

BANPU has informed the Stock Exchange of Thailand that on 13th June 2025, Banpu Renewable Singapore Pte. Ltd. (BRS), a subsidiary of Banpu NEXT Co., Ltd. (Banpu NEXT), entered into an agreement for the disposal of its investment interest under the Tokumei Kumiai (TK) structure in 10 solar power plants in Japan, with a total TK interest-based capacity of 91.69 MW to an investment vehicle managed by affiliates of Actis LLP for a total transaction value of approximately JPY 19,764 million (equivalent to THB 4,460 million). The transaction is expected to complete within 3Q2025.

The following solar power plants have been divested as part of the transaction.

Following the divestment, Banpu retains a portfolio of fully operational solar power plants in Japan, with a TK interest-based capacity of 54.00 MW (equivalent to 60.00 MW on a 100% basis). These assets continue to generate stable revenue and consistently deliver TK cash dividends.

Yuanta Securities (Thailand) noted that the disposal aligns with Banpu’s business strategy to optimize capital management, ensuring sustainable long-term growth. Banpu NEXT is held equally (50:50) by BANPU and Banpu Power Public Company Limited (SET: BPP).

According to initial analyst estimates, these projects currently generate a combined profit of around THB 200 million per year. Following the sale, BANPU and BPP will each see a reduction in attributable annual earnings of THB 178 million and THB 100 million, respectively, equivalent to 2% and 1% of each company’s 2025 forecasts by the analyst, assuming the deal is closed by mid-3Q25.

However, Banpu NEXT is set to receive THB 4.5 billion in cash proceeds, which will be used to support new investment opportunities and enhance future returns.

It is expected that any profit from this transaction will be recognized in Other Comprehensive Income (OCI), bypassing the company’s profit and loss statement, as the investment is structured under a TK arrangement.

Overall, the brokerage firm views this development as neutral and maintains a “Speculative Buy” rating on BANPU with a target price of THB 4.70, as well as a “Buy” recommendation for BPP with a target price of THB 8.25.