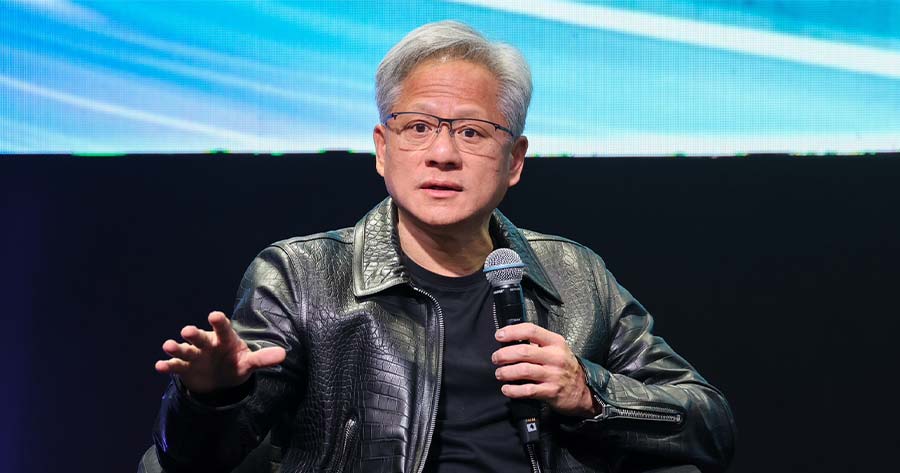

Jensen Huang, CEO of Nvidia, has begun offloading portions of his vast stake in his own chipmaker company, marking his first transactions under a newly adopted trading plan that could see him liquidate up to $865 million of stock by the close of 2025.

Regulatory filings submitted to the U.S. Securities and Exchange Commission on Monday revealed Huang disposed of 100,000 Nvidia shares for a total of $14.4 million across two sessions on June 20 and June 23. This move is part of a new 10b5-1 trading program established in March and disclosed in Nvidia’s most recent earnings report.

With an estimated net worth of $126 billion—almost exclusively tied to Nvidia shares—Huang now holds the position of the world’s 12th wealthiest individual, according to the Bloomberg Billionaires Index. Since its inception, the index estimates he has sold more than $1.9 billion in Nvidia shares.

Huang’s structured trading plan, a common approach among major executives to avoid accusations of insider trading and to reassure investors, allows him to sell up to 6 million shares in total through year-end.

At Nvidia’s closing price of $144.17 on Monday, the sale would net approximately $865 million. Filings also indicate that another tranche of 50,000 shares is set to be sold soon.

The disposal of shares isn’t limited to the CEO. Nvidia board director Mark Stevens sold over 600,000 shares for about $88 million on June 18, as detailed in a separate SEC filing.

Stevens previously announced he would divest as many as 4 million Nvidia shares this month, having already reduced his position by more than 2 million. Unlike Huang, Stevens’ transactions are not conducted through a prearranged 10b5-1 plan.

Stevens’ wealth now stands at $9.8 billion, based on the latest Bloomberg calculations.