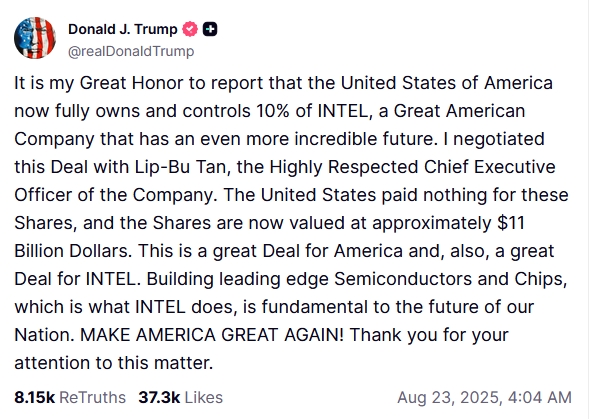

In a notable move to leverage influence in the high-tech industry, the U.S. government has acquired a significant 10% stake in Intel Corporation, as disclosed by Commerce Secretary Howard Lutnick on Friday.

This initiative marks a further step in the administration’s strategy to increase governmental oversight and support within corporate spheres, in this case, targeting the semiconductor sector.

The investment announcement sparked activity in Intel’s shares, which experienced a rise of approximately 5.5% during the regular trading session, with a continued increase of 1.05% in post-market trading.

Specifics of the transaction reveal the government’s acquisition involved an $8.9 billion investment, buying 433.3 million shares at $20.47 per share—a figure below Intel’s current market valuation. This transaction facilitated the U.S.’s entry into ownership without acquiring governance rights, such as a board seat.

The funding strategy includes a $5.7 billion allocation sourced from blocked funds within the CHIPS Act, a legislative measure designed to enhance and encourage the manufacture of secure microchips on American soil, coupled with an additional $3.2 billion from a separate program aimed at producing secure chips domestically.