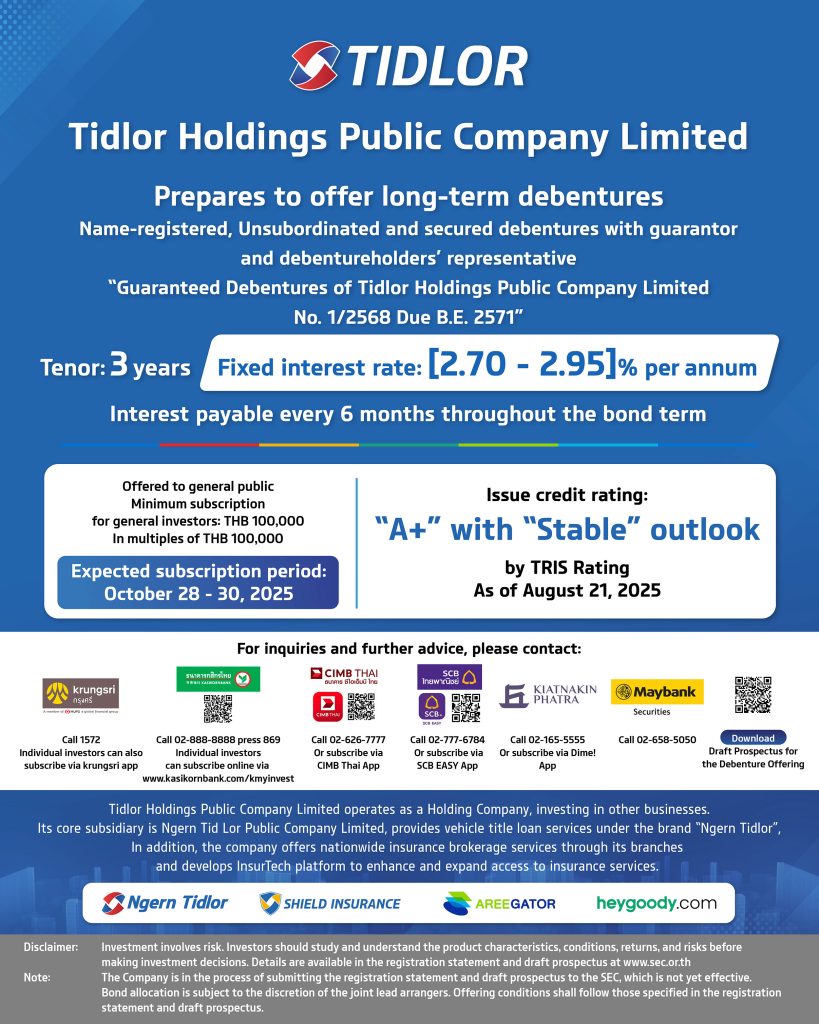

Tidlor Holdings Public Company Limited (Tidlor Holdings, (SET: TIDLOR)) has submitted a registration statement and draft prospectus to the Securities and Exchange Commission (SEC) in preparation for its inaugural debenture issuance. The Debentures have received an A+ credit rating, instilling strong investor confidence. These will be senior secured debentures, guaranteed by its core subsidiary “Ngern Tid Lor Public Company Limited”, with a debenture holders’ representative appointed.

The Debentures will have a 3-year maturity and offer a fixed annual interest rate ranging from [2.70 -2.95]% per annum, with interest payments scheduled every six months. The minimum subscription amount for retail investors is THB 100,000, with increments of THB 100,000. The debentures offering is available to the general public. The subscription period is expected to run from October 28 to 30, 2025, through six leading financial institutions as joint lead arrangers: Bank of Ayudhya, KASIKORNBANK, Siam Commercial Bank, CIMB Thai Bank, Kiatnakin Phatra Securities, and Maybank Securities (Thailand).

Tidlor Holdings and the Debentures have been rated “A+” with a “Stable” outlook by TRIS Rating Co., Ltd. as of August 21, 2025. The rating reflects the group’s strengthened position following its corporate restructuring, particularly the performance of its core subsidiary, Ngern Tid Lor PLC, a leading provider of vehicle title loans and insurance brokerage services. Additionally, Bank of Ayudhya (BAY) is a major shareholder, further reinforcing investor confidence.

This marks Tidlor Holdings’ first debenture issuance following its completed restructuring in May 2025. Proceeds from the debenture issuance will be used to refinance maturing debt instruments within the group.

Currently, the registration statement and draft prospectus are under review by the SEC and are not yet effective. Investors are encouraged to review the documents via www.sec.or.th or contact any of the six joint lead arrangers for more information.

- Bank of Ayudhya Public Company Limited – All branches (For individual investors, subscription available via krungsri app or call 1572)

- KASIKORNBANK Public Company Limited (Individual investors can subscribe online via kasikornbank.com/kmyinvest, except for foreign nationals and legal entities, who may subscribe via the head office and branches) Call 02-888-888, press 869. Also available through Kasikorn Securities Public Company Limited, acting as the sales agent for KASIKORNBANK Plc.

- CIMB Thai Bank Public Company Limited – All branches or subscribe online via CIMB Thai App or call 02-626-7777

- Siam Commercial Bank Public Company Limited – All branches or call 02-777-6784, or subscribe online via SCB EASY App Including InnovestX Securities Co., Ltd., acting as a selling agent of Siam Commercial Bank PCL

- Kiatnakin Phatra Securities Public Company Limited Call 02-165-5555, or subscribe online via Dime! App (including Kiatnakin Phatra Bank Public Company Limited, acting as a selling agent of Kiatnakin Phatra Securities PCL)

- Maybank Securities (Thailand) Public Company Limited Call 02-658-5050

Note: The Company is in the process of submitting the registration statement and draft prospectus to the Office of the Securities and Exchange Commission (SEC), which is not yet effective. The allocation of debentures is subject to the discretion of the joint lead arrangers. The offering conditions shall be in accordance with those specified in the registration statement and draft prospectus.

Disclaimer: Please ensure you understand the product characteristics, conditions, returns, and risks before making an investment decision. Further details can be found in the registration statement and draft prospectus as outlined below.

Tidlor Holdings Public Company Limited has been assigned a corporate credit rating of “A+” with a “Stable” outlook by TRIS Rating Co., Ltd. This rating reflects the Group’s strong financial performance and consistent business growth. Additionally, the Company possesses a solid organizational foundation and receives both business and financial support from Bank of Ayudhya. The A+ rating is classified as “Investment Grade”, indicating low risk and a strong ability to meet debt obligations. Moreover, the A+ rating is considered among the highest within its industry peer group.