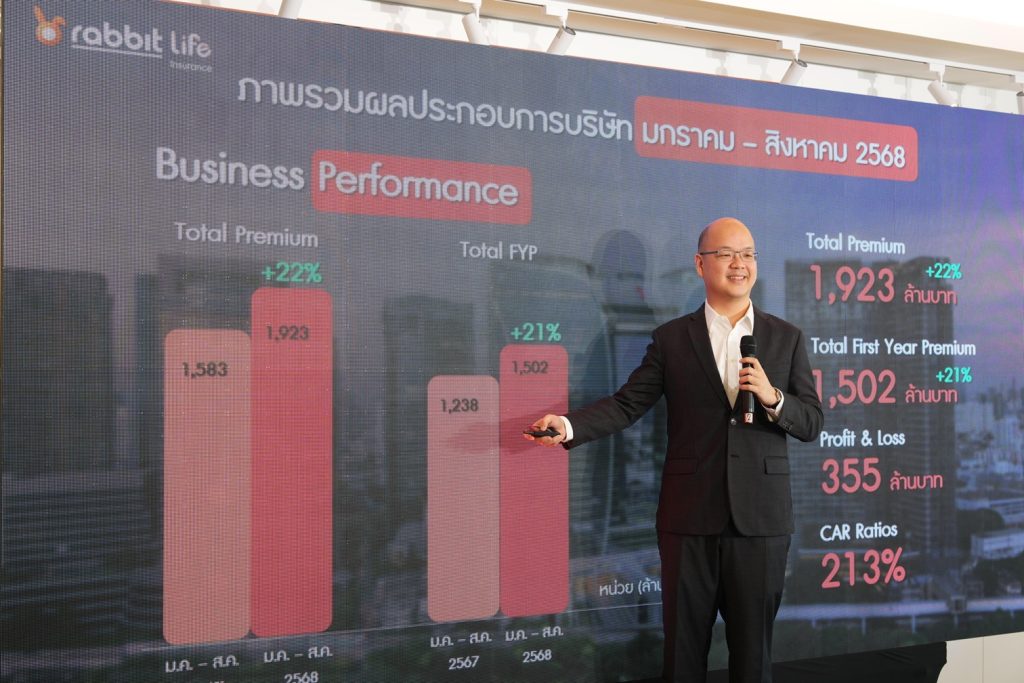

Rabbit Life Insurance Public Company Limited, also known as Rabbit Life, a subsidiary of BTS Group Holdings Public Company Limited (SET: BTS) has reported a strong performance for January-August 2025, with total premiums of 1,923,849,043 baht, representing a 22% increase compared with the same period last year. The company’s most popular products were Whole Life Insurance, Health Insurance, and Annuity Insurance, respectively, driven by the strength of all sales channels.

Building on this success, Rabbit Life is preparing to accelerate momentum in the final quarter of the year with tax-saving products, while also laying out its roadmap for 2026 with a bold Data-Driven Insurance strategy designed to unlock consumer insights and enhance customer experience across all age groups.

Mr. Korn Chinsawananon, Managing Director of Rabbit Life Insurance, said, “From January to August 2025, Rabbit Life achieved total premiums of 1,923,849,043 baht, up 22% year-on-year. First-year premiums (FYP) reached 1,502,306,196 baht, up 21%, while profits stood at 355,602,893 baht. Our Capital Adequacy Ratio (CAR) was 213%, reflecting the company’s financial strength and reliability. This success stems from continuous product development tailored to consumer needs. Our three standout categories this year were:

- Whole Life Insurance: Long-term life insurance policies that were the most popular in 2025, aligning with modern consumer behavior that places strong emphasis on life planning and building sustainable security for families. This product group achieved significant sales growth by tenfold, equivalent to 495,560,037 baht.

- Health Insurance: Addressing the needs of modern consumers by offering flexibility to adjust coverage in line with individual lifestyles, while also being cost-effective when combined with other existing welfare benefits, this category recorded impressive growth of 144%, equivalent to 26,428,551 baht, driven primarily by the strong performance of Health Smile, a comprehensive lump-sum health plan that has received highly positive feedback from consumers.

- Annuity Insurance: Designed to support Thailand’s transition into an ageing society, annuity insurance help customers plan for retirement with greater stability and tangible security. This product group recorded sales growth of 115%, amounting to 60,184,779 baht in total premiums. Popular products in this category include Bumnarn Mungme 85/65 and Bumnarn Mungme 85/55 Plus.

In addition, the company’s performance was strongly supported across all major distribution channels. The agency channel remained, generating new business premiums that grew by 136%, equivalent to 351,182,052 baht. The broker channel also delivered robust growth of 79%, or 250,891,125 baht. Meanwhile, the online channel (Internet Sales) continued to perform excellently, maintaining a strong fourth position in the market. New business premiums from this channel reached 67,560,365 baht. The success achieved across all channels reflects the strength of Rabbit Life’s quality agency network, as well as its effective partnerships with business allies, which have expanded the customer base in a sustainable and efficient way.

“For the final quarter of the year, the company has laid out an omni-channel strategy by developing and refining every touch point in order to deliver the best possible experience for customers. This includes, in particular, our online insurance purchasing system, which is fast, user-friendly, and allows customers to customixed their coverage according to their individual needs. We also offer the iService system, which provides close after-sales care, ensuring peace of mind and enabling customers to contact the company at any time. At the same time, we are launching marketing campaigns both online and offline to reach every generation of customers who want to plan their taxes and finances effectively. The focus will be on boosting sales of tax-deductible insurance products, such as Hero 10/1, Hero 10/3 and Hero 10/5 which are expected to help the company close 2025 with total premiums exceeding 2.6 billion baht. Looking ahead to 2026, Rabbit Life is committed to building on this momentum by Levelling Up Consumer Experience through the development of products that cover life protection, health, and long-term financial planning. This will be carried out alongside driving the strategy of data-driven insurance to create more flexible, accessible solutions that reinforce our image as a brand for the new generation. We also aim to strengthen our network of quality agents, with a sales target of more than 3 billion baht in 2026, representing a 15% increase compared to the previous year.”

Mr. Thanya Suewaja, Executive Vice President of Rabbit Life Insurance, added that, “Alongside product and channel development, we also prioritize organizational growth and efficiency. To strengthen synergy with the BTS ecosystem, we have relocated our headquarters to BTS Visionary Park. This move not only reflects our readiness for sustainable growth but also provides our customers with convenient travel to this Head Office, offering seamless connectivity to the central city’s transportation system. Furthermore, modern working environment, the new office is designed to encourage collaboration, foster innovation, and integrate digital technology to improve efficiency, while also enhancing staff welfare and quality of life. This strategy is vital for attracting and retaining top talent over the long term.”

“Rabbit Life is committed to growing alongside our customers by developing products that meet every life stage. Guided by our vision to ‘Think differently to improve your life with a life insurance that hedges your bets and provides simplified solutions.’, we aim to strengthen both our organization and people, positioning ourselves as a modern life insurance company, competitive in today’s market and dedicated to long-term sustainable growth,” concluded Mr. Korn.