Gulf Development’s billionaire CEO Sarath Ratanavadi has emerged as a significant shareholder in Krung Thai Bank (SET: KTB), securing the eighth position among the bank’s top shareholders with a holding of 130 million shares, representing 0.9% of total shares.

The disclosure comes following KTB’s ex-dividend date, revealing the updated shareholder structure. Sarath’s entry into the top 20 shareholder list marks a notable development, as he now holds a notable stake in Thailand’s second-largest state-controlled bank by assets.

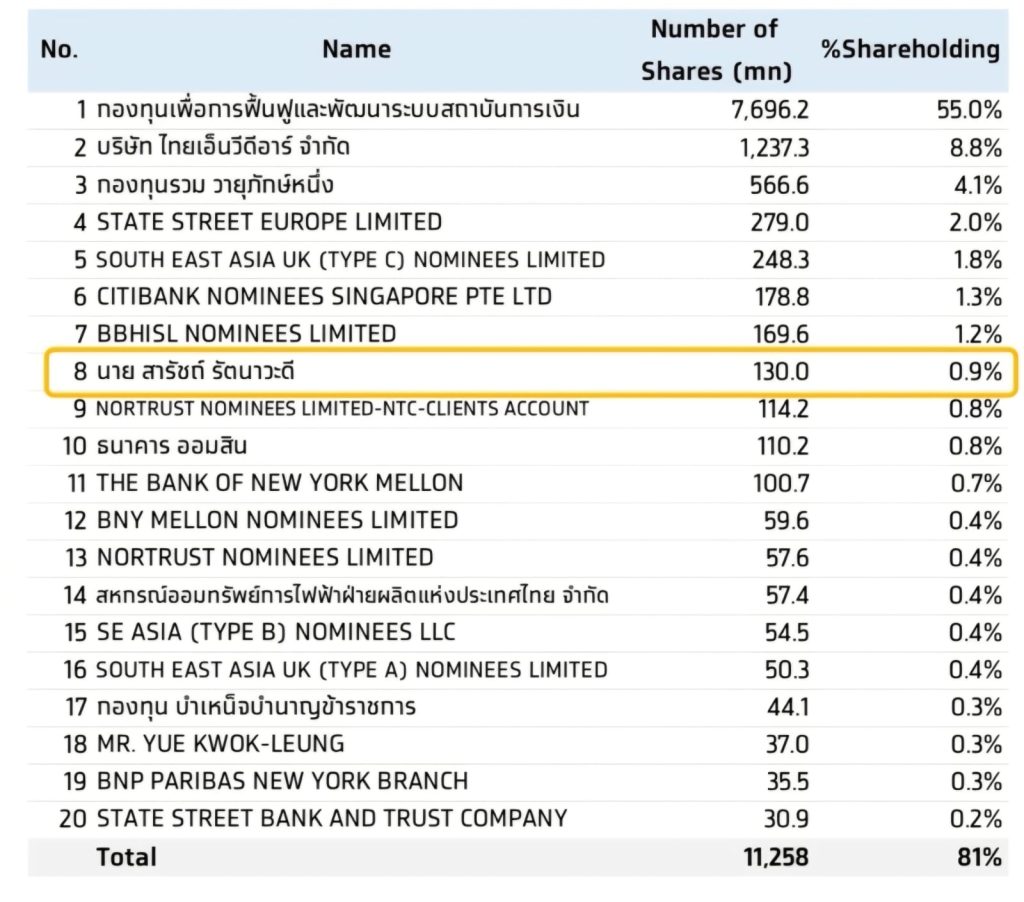

The shareholder registry shows the Ministry of Finance remains the dominant shareholder with 7,696.2 million shares (55.0%), followed by institutional investors including Thai NVDR Company Limited at 8.8% and Vayupak Fund at 4.1%. International institutional investors such as State Street Europe Limited, South East Asia UK nominees, and various custodian banks round out the major shareholders.

Sarath’s positioning at number eight, with a 130-million-share stake valued at 3.57 billion baht at current market prices of THB 27.50 per share, demonstrates his continued expansion beyond his core energy business into Thailand’s financial sector. This move aligns with growing interest from prominent Thai business figures in the banking sector amid the country’s economic recovery trajectory.

The updated shareholder structure shows relatively stable holdings among major shareholders, with only Thai NVDR Company and Vayupak Fund registering modest decreases in their stakes. Notably, BBHISL Nominees Limited jumped to 7th position with 169.6 million shares (1.2%).

Krung Thai Bank announced an interim dividend payment of 0.43 baht per share for the operating period from January 1 to June 30, 2025. The Board of Directors approved the dividend distribution on October 29, 2025.

Shareholders on the record date of November 12, 2025 are entitled to receive the dividend, with the ex-dividend date set for November 11, 2025. The dividend payment will be made on November 27, 2025.

Gulf Development is also holding about 5% in Kasikornbank Public Company Limited (SET: KBANK), citing the purpose for strategic investment not for management control.