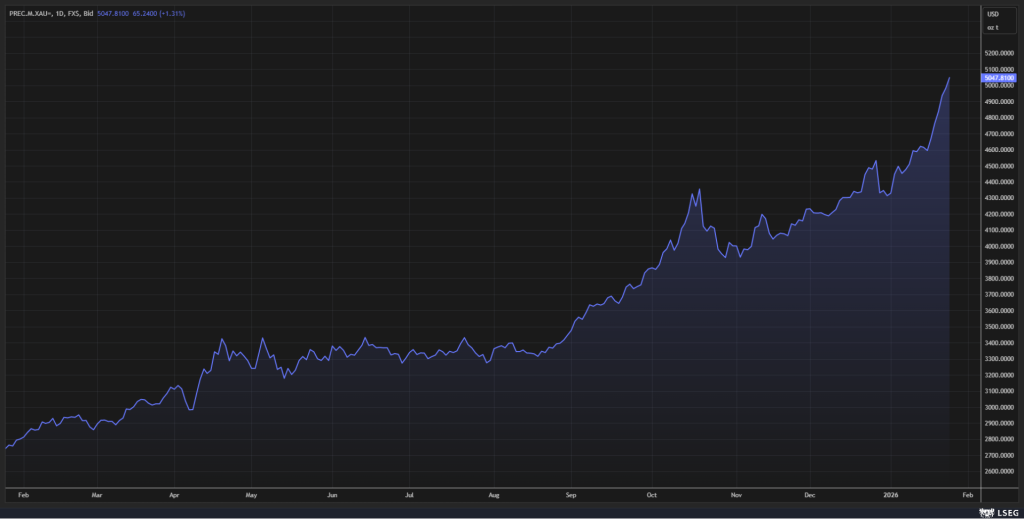

Gold reached a new record high on Monday, surpassing $5,000 per ounce as concerns over geopolitical tensions and global fiscal uncertainty prompted increased demand for the precious metal. Both spot prices and U.S. gold futures continued their upward momentum, highlighting the asset’s appeal for investors seeking safety.

During Monday trading, spot gold advanced 1.31% to $5,047 per ounce. Investors have increasingly turned to gold as risks intensify across international and fiscal landscapes.

Last week, Goldman Sachs responded to the metal’s sustained strength by boosting its year-end 2026 price estimate, now forecasting gold to reach $5,400 per ounce, up from a previous projection of $4,900. The bank attributed this revision to consistent buying from private investors and central banks in emerging markets.

Gold’s outlook remains positive, with expectations for continued diversification supporting prices in the months ahead.

Goldman Sachs updated its gold outlook, citing stronger-than-expected interest from private buyers and ongoing diversification by central banks. In a recent note, analysts identified persistent global policy uncertainty as encouraging further allocation to gold by private-sector investors. The bank’s projection assumes that these investors will retain their gold holdings through 2026, supporting higher price levels.

Additionally, Goldman Sachs anticipates an increase in ETF inflows driven by an expected 50 basis point cut by the U.S. Federal Reserve this year. Emerging market central banks are forecast to continue adding gold to their reserves at an average pace of 60 tonnes in 2026. However, the brokerage also noted that a reduction in long-term monetary policy risks could lead to gold price pressure if investors unwind macro hedges.