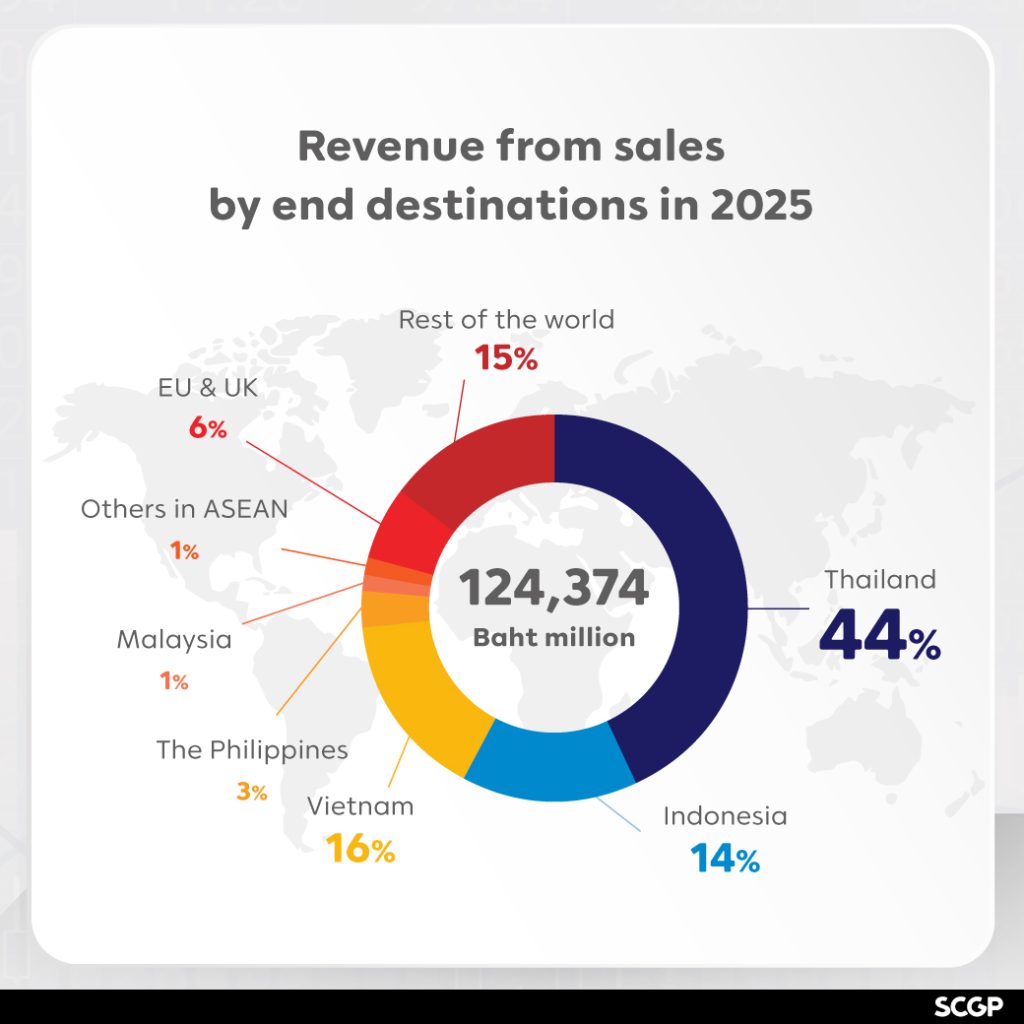

SCG Packaging PCL (SET: SCGP) announced strong operating results for 2025, achieving total revenue from sales of Baht 124,374 million, EBITDA of Baht 17,210 million, and profit for the year of Baht 4,069 million. The performance was driven by continued growth in domestic consumption and exports, together with improved cost management efficiency.

The Company plans to pay a dividend of 0.60 Baht per share. For 2026, SCGP has set a total investment budget of Baht 10,000 million and an EBITDA target of Baht 18,300 million. SCGP will continue to advance its strategy to expand consumer packaging businesses, integrate production across the entire value chain, exercise disciplined cost management, and enhance manufacturing efficiency through the adoption of robots, collaborative robots (cobots), and automation systems to strengthen competitiveness and deliver integrated solutions that meet customer needs.

Wichan Jitpukdee, Chief Executive Officer of SCGP, said that the overall packaging industry outlook in 2025 indicates growing demand across the ASEAN region, driven by domestic consumption and export activities. However, packaging prices continue to face market pressure.

In the fourth quarter of 2025, Vietnam and Indonesia recorded increased demand for food, beverage, and fast-moving consumer goods (FMCG) packaging, supported by strong economic growth, inventory buildup ahead of festive seasons, and a gradual recovery in demand for packaging paper from China. Meanwhile, demand in Thailand softened due to flooding and more cautious consumer spending.

SCGP continued to execute disciplined management practices, effective cost control, and agile adaptation to changing market conditions. These efforts resulted in higher sales volumes and improved capacity utilization. SCGP also continued to expand its consumer products and packaging businesses to enhance capability and strengthen its core businesses in line with its strategic plan.

In 2025, SCGP completed several strategic investments, including the acquisition of a 100% stake in PT Prokemas Adhikari Kreasi (MYPAK), increasing its shareholding in Duy Tan Plastics Manufacturing Corporation (Duy Tan) from 70% to 100%, and entering into a 25% joint venture with Howa Sangyo Co., Ltd. (HOWA) from Japan to produce advanced flexible packaging for the wet pet food market. SCGP also invested in establishing a syringe production base with an annual capacity of 180 million syringes at the manufacturing facility of VEM (Thailand) Co., Ltd.

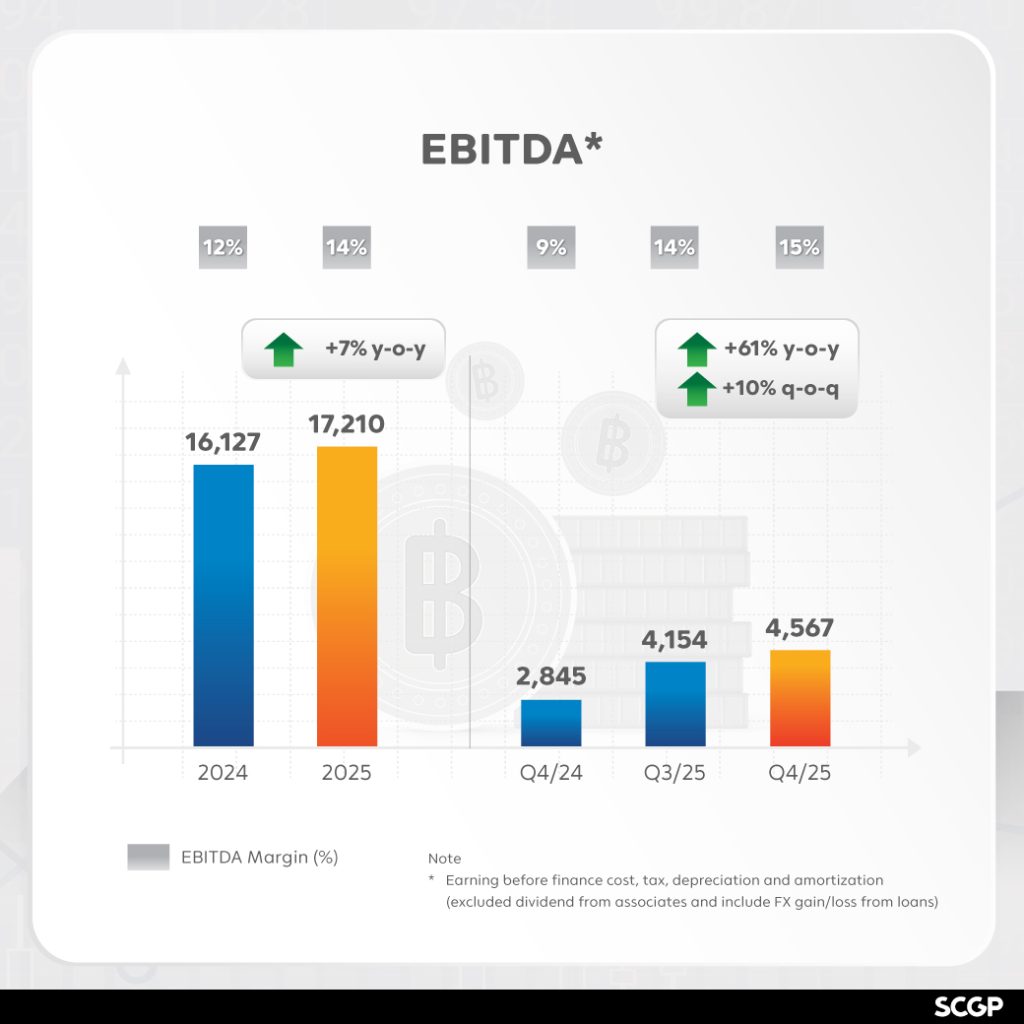

SCGP also benefited from lower recovered paper costs and declining energy prices. However, due to a decrease in selling prices for packaging products, total revenue from sales in 2025 amounted to Baht 124,374 million, representing a decrease of 6%YoY. EBITDA reached Baht 17,210 million, increasing by 7%YoY, while profit for the year amounted to Baht 4,069 million, an increase of 10% YoY.

For the fourth quarter of 2025, SCGP reported total revenue from sales of Baht 30,170 million, a decrease of 3%YoY. EBITDA amounted to Baht 4,567 million, representing an increase of 61%YoY, while profit for the period was Baht 1,206 million, increasing YoY. The improvement was supported by a recent acquisition of MYPAK, reflecting the effectiveness of the Company’s investment strategy.

The Board of Directors has resolved to propose to the Annual General Meeting of Shareholders for approval the payment of an annual dividend for 2025 at the rate of 0.60 Baht per share, of which 0.25 Baht per share was previously paid as an interim dividend on 27 August 2025. The final dividend payment of 0.35 Baht per share will be on 21 April 2026, record date of 1 April 2026, and XD-date of 31 March 2026.

Wichan added that the overall outlook for the packaging industry in the first quarter of 2026 is expected to remain growth, driven by continued growth in domestic consumption across ASEAN markets, a favorable ASEAN economic growth outlook, and increasing demand for packaging paper from China. Packaging prices and logistics costs are expected to remain stable.

SCGP aims to increase the average capacity utilization rate of its packaging paper operations to approximately 90%, up from 87–91% in 2025. Sales volumes in Vietnam and Indonesia are expected to be broadly in line with the previous quarter, as Vietnam observes the Tet holiday period and Indonesia celebrates Hari Raya. Meanwhile, demand in Thailand is expected to receive support from the Songkran festival as well as economic stimulus measures following the formation of the new government.

SCGP has allocated a total investment budget of Baht 10,000 million for 2026, covering mergers and partnerships (M&P), business expansion, and machinery efficiency improvements, with a targeted EBITDA of Baht 18,300 million. SCGP sees opportunities to expand investments in Vietnam and Indonesia, as well as to broaden its market presence in India, where the overall economic outlook is expected to demonstrate strong and resilient growth.

SCGP will prioritize investments in consumer packaging segments to enhance capabilities and strengthen production integration. In parallel, SCGP has set strategies to improve manufacturing efficiency and cost management through the adoption of robots, collaborative robots (cobots), and automation systems across production processes. These technologies will enable more reliable packaging quality control, improved raw material management, cost reduction, and consistent delivery of high-quality products to customers.

The deployment of such technologies will be expanded further across overseas plants. In addition, SCGP continues to actively manage costs, including new strategic energy mix in Indonesia, with cost-saving benefits expected to be realized from January 2026 onward.

SCGP continues to drive its sustainability agenda across the entire value chain through collaboration with customers in the consumer goods and export packaging segments, encompassing 15 projects. These initiatives cover the development and enhancement of environmentally friendly packaging innovations, the recovery and reuse of resources for recycling, the co-development of automation systems to improve manufacturing efficiency, and the certification of Carbon Footprint of Products (CFP).

In addition, SCGP has developed laboratory capabilities to provide testing and certification services for packaging paper in accordance with Thailand Green Label standards under the Thailand Environment Institute (TEI). SCGP has also applied the Extended Producer Responsibility (EPR) approach to promote efficient resource utilization throughout the product life cycle. These efforts support the SCGP’s commitment to controlling greenhouse gas emissions in line with its targets to reduce emissions by 25% by 2030 and to achieve Net Zero greenhouse gas emissions by 2050.

SCGP’s sustainable business practices have been consistently recognized through a SET ESG Rating of “AAA”, the highest level awarded by the Stock Exchange of Thailand for three consecutive years, as well as the Best Sustainability Awards and the SET Awards of Honor: Best Innovative Company Awards for the fourth consecutive year. These recognitions reflect SCGP’s commitment to achieving quality growth alongside sustainable social and environmental responsibility.