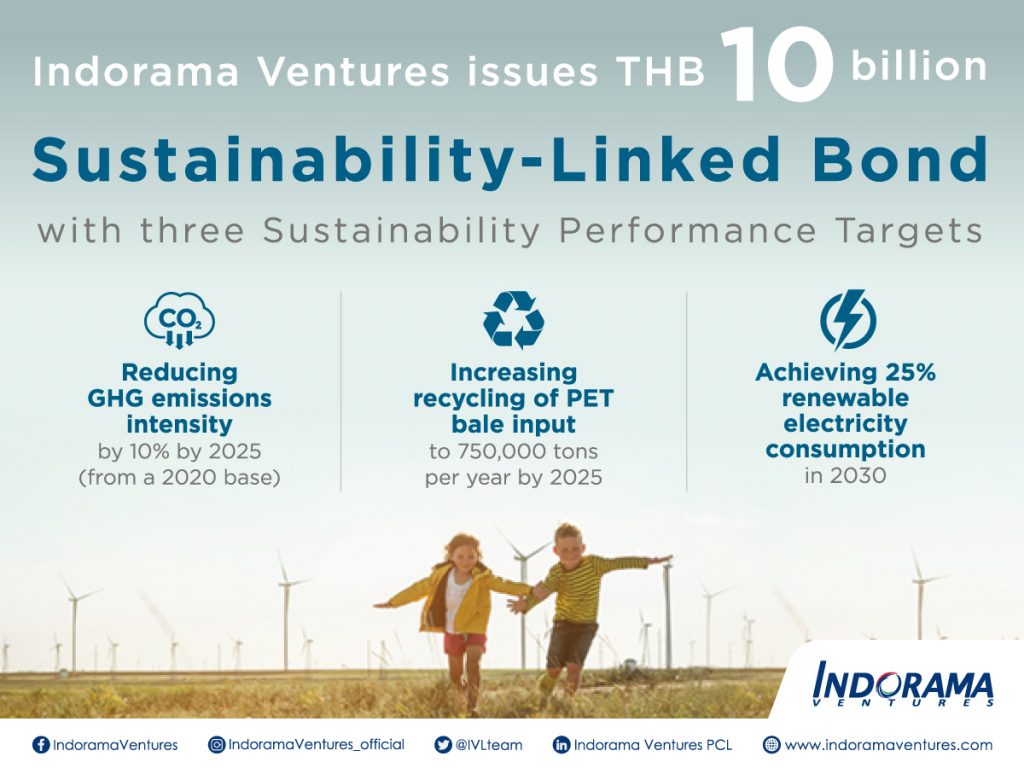

Indorama Ventures Public Company Limited (IVL), a global sustainable chemical company, issued a THB 10 billion triple-tranche Sustainability-Linked Bond (SLB), showcasing the company’s long-standing commitment to sustainable growth. It is the largest SLB issued in Thailand and the first offered to both institutions and high-net-worth investors.

Yashovardhan Lohia, Chief Sustainability Officer at Indorama Ventures (IVL), said, “This bond reflects our clear commitment to sustainability and creates incentives for the company and our stakeholders. It is an important step in our work to optimize the IVL’s capital structure and give investors an opportunity to contribute to the positive transformation of the chemical industry. With the success of this bond issuance, investors have made their position on the climate action clear as they shift capital to align their portfolios with carbon neutral targets. Today’s sustainability-linked bond is proof that the financial markets value our ambitious sustainability effort and we look forward to working together for a more sustainable industry”.

The bond is part of IVL’s financing strategy across a range of instruments linked to the company’s sustainability targets. It is aligned with internationally accepted standards including International Capital Markets Association’s (ICMA) Sustainability-Linked Bond Principles and the Loan Market Association’s (LMA) Sustainability Linked Loan Principles.

The SLB is linked to IVL’s performance of reducing GHG emissions intensity by 10% by 2025 (from a 2020 base), increasing recycling of PET bale input to 750,000 tons per year by 2025, and achieving 25% renewable electricity consumption in 2030.

The triple-tranche structure includes 5-, 7-, and 10.5-year tenors, offering coupons of 2.48%, 3.00% and 3.60% per year respectively, targeting asset managers, commercial banks, insurance companies, cooperatives and high-net-worth individuals. With the orderbook peaking at over THB 17.8 billion due to strong interest in the sustainability-linked instrument, oversubscription was around 3x over the planned issuance amount of THB 6 billion with a green shoe option of THB 4 billion.

In view of the strong order book from the investors, the company decided to exercise the green shoe option and increased the issuance to THB 10 billion, setting a new benchmark as the largest SLB transaction in Thailand. IVL appointed Bangkok Bank, Kasikorn Bank, Krungthai Bank, Siam Commercial Bank, and The Hongkong and Shanghai Banking Corporation Limited, Bangkok Branch as arrangers and bookrunners for the transaction.

On 23 September 2021, the bond was assigned an AA- rating and a “stable” outlook by TRIS Rating following a strong recovery of petrochemicals and derivatives and IVL’s growing profitability.

Under the terms, all tranches must purchase Energy Attribute Certificates (EAC) or voluntary carbon offsets in the event of failure to meet the sustainability performance targets (SPT). The testing dates for tenors with a maturity of 5 and 7 years are 31 December 2025, and 31 December 2030 for the 10.5-year tenor. SPT performance will be independently verified upon the testing dates.Proceeds for the issuance will be used to finance IVL’s corporate working capital and refinance existing debt.

Thiti Tantikulanan, Capital Markets Business Division Head at Kasikorn Bank (KBANK), said, “KBANK is pleased to be able to work with IVL on this exciting transaction, which marks an important development in sustainability for the Thai capital market. SLBs are new to Thai investors but the instrument creates the right incentives for issuers and investors. This SLB offers a greater variety of features than the simple coupon adjustment commonly seen in the market. The additional covenants to purchase Energy Attribute Certificates (EAC) or voluntary carbon offsets contributes to ESG goals and provides innovation to the market. The overwhelming investor response to the issuance is testimony to their confidence in IVL and interest in sustainability.”

In recent years, IVL secured loans linked to improvements in the company’s sustainability performance as a global leader in environmental, social and governance (ESG) integration. These included Thailand’s first Green Loan of USD 200 million and EUR 200 million from Japan’s Mizuho Bank, Thailand’s first cross-border Sustainability-Linked Ninja Loan worth USD 225 million from 16 institutions in Japan and a Blue Loan of USD 300 million arranged by International Finance Corporation and funded by Asian Development Bank and DEG.