– SET Index closed at 1,633.94 points, increased 1.50 points or 0.09% with a trading value of 70.3 billion baht. The analyst stated that the Thai stock market moved within a limited range during the earnings season and the market was focusing on the announcement of each individual stock.

The analyst expected that the Thai stock market could move higher after the end of earnings season, recommending to monitor 3Q21 GDP reports next Monday, and giving a support level for tomorrow’s session at 1,625-1,630 points and a resistance level at 1,650 points.

– Proprietary Trading buoyed SET Index by 1.50 points with a 1,427 million baht of net buy.

– MSCI Global Small Cap Indexes added BEC, TIDLOR and TIPH. Meanwhile, TKN was deleted from the indexes.The adjustment will take place as of the close of November 30, 2021.

– CNS chose SCB and KBANK as top picks after the Bank of Thailand said Thai banks are resilient to risks and relaxed dividend payment measures.

– GULF showed strong growth in all business segments, resulting in a surge in net profit by 63% to 1,588 million baht in 3Q21.

– Central Retail Crop. reported an increase in loss by 375.8% QoQ amid business disruption due to stringent government imposed movement restrictions nationwide to contain the third wave of COVID-19.

– PTG reported a net profit of 63 million baht in 3Q21, decreased 87.62% YoY, mainly due to an increase in cost of services and a drop in marketing margin.

– JMT reported a net profit of 351.7 million baht for the 3rd quarter of 2021, an increase of 24.2% YoY, mainly from debt collection.

– Third quarter earnings of Asia Aviation increased 14% YoY due to the impact of low air travel demand.

– BGRIM reported a net profit of 447 million baht in 3Q21, decreased 10.64%, while 9M21 net profit rose 30.14%.

– Stocks in Focus on November 12, 2021: JMT (Maybank Kim Eng Securities TP at ฿58.00/share) and BGRIM (KGI Securities TP at ฿60.75/share).

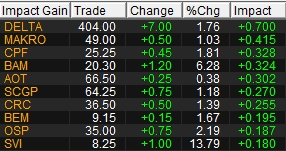

Top 10 Most Important Shares on November 12, 2021