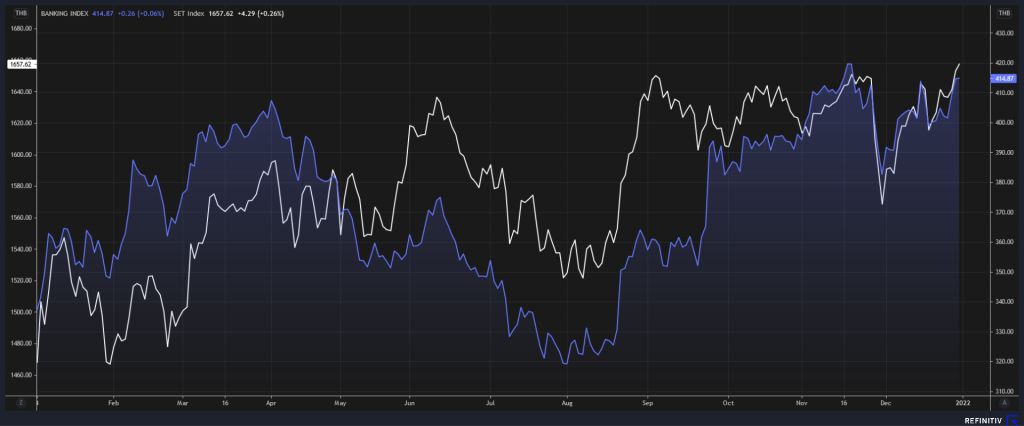

The banking sector is the second-hardest hit after the tourism sector because of the prolonged crisis of a coronavirus outbreak since March 2020. Thai banks saw their worst in the second and third quarter of 2020 when uncertainties are high, resulting in the banks to raise provision while the Bank of Thailand announced a measure to pause the banks to pay dividend.

The performance in 2020 for the banks was a disappointment, but still within estimations of the market and understandable due to the ongoing coronavirus crisis.

| Close 31 Dec 2021 |

% Change YTD | 2019 Net Income |

2020 Net Income |

Est. 2021 Net Income |

Consensus Target Price |

|

| BAY | 35.5 | 12.00 | 32,748.00 | 23,039.00 | 32,004.00 | 35.80 |

| BBL | 121.5 | 2.11 | 35,816.00 | 17,180.00 | 27,235.00 | 149.40 |

| CIMBT | 0.89 | 46.67 | 1,501.60 | 1,290.58 | – | – |

| KBANK | 142 | 25.66 | 38,726.00 | 29,487.00 | 34,789.00 | 164.21 |

| KKP | 59.75 | 15.46 | 5,988.00 | 5,123.00 | 5,632.00 | 68.79 |

| KTB | 13.2 | 19.82 | 29,284.00 | 16,731.00 | 22,165.00 | 13.41 |

| LHFG | 1.35 | 28.57 | 3,214.60 | 2,056.83 | 1,885.00 | 1.00 |

| SCB | 127 | 45.71 | 40,436.00 | 27,217.00 | 35,320.00 | 141.86 |

| TISCO | 96 | 8.19 | 7,270.00 | 6,063.00 | 6,561.00 | 104.68 |

| TTB | 1.47 | 37.04 | 7,222.00 | 10,114.00 | 9,980.00 | 1.31 |

*Net incom in Million Baht

2021 is the year expected to be a recovering period for the Thai banks and some have shown positive signs after the end of the third quarter by recording higher net profit than the whole year of 2020. CIMB Thai Bank Public Company Limited (SET: CIMBT) leads the sector with the highest gain in this category, reporting a 32% increase in net profit for its 9M21 period at 1,708 million baht, compared to 1,290 million baht in 2020. As for the major banks, BAY records nearly 19% increase in net profit on 9M21 while BBL reports a 18.5% increase.

In the meantime, all of the banks except TMBThanachart Bank Public Company Limited (SET: TTB), are forecast to report higher net profit in 2021, compared to 2020, according to broker estimates from Refinitiv as the burden on having to put high provision in reserve should ease next year moving forward.

Capital Nomura Securities (CNS) expected the Thai baht to weaken in 2022 which will benefit the banking sector. Meanwhile, the market will react to the Federal Reserve (Fed)’s four rate hikes in 2022 (March, June, September and December), which is more than previously estimated of two hikes. There will be two hikes in March and September each year in 2023-2024.

The securities company warned that there could be a downside risk to the stock market since the market only priced in two to three rate hikes next year. Still, CNS was positive that the banking sector will outperform in 2022, recommending Kasikornbank Public Company Limited (SET: KBANK) and The Siam Commercial Bank Public Company Limited (SET: SCB) with a target price at Bt175 and Bt150 per share, respectively, on their high resilience to risks from rising inflation, coupled with gaining benefit from an uptrend in rate hikes.