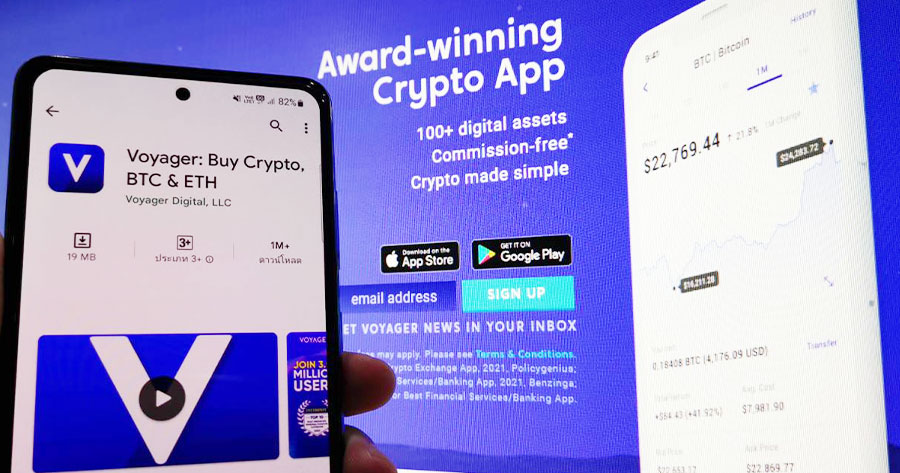

Voyager Digital (TSE: VOYG), a crypto asset brokerage firm listed in the Toronto Stock Exchange, has filed for Chapter 11 Bankruptcy Protection as the company suffered from volatility in digital asset markets.

The move came a week after the crypto brokerage suspended withdrawals, trading and deposits to its platform as it sought additional time to explore alternate strategies to cope with the situation.

The filing lists assets of between $1 billion and $10 billion with liabilities in the same range. The company stated that it has approximately $1.3 billion of crypto assets on its platform, plus claims against Three Arrows Capital (3AC) of more than $650 million.

The filing came after the company suffered from the prolonged volatility and contagion in the crypto markets over the past few months, and the default of Three Arrows Capital on a loan from its subsidiary, Voyager Digital, LLC, that prompted the company to take deliberate and decisive action by filing for bankruptcy, which should provide an efficient and equitable mechanism to maximize recovery.

In June, Three Arrows Capital, one of the most prominent crypto hedge funds, had defaulted on a $670 million loan. In the statement, the fund said that it failed to repay a loan of $350 million in the U.S. dollar-pegged stablecoin and 15,250 bitcoin worth about $323 million of the current trading prices at that time.