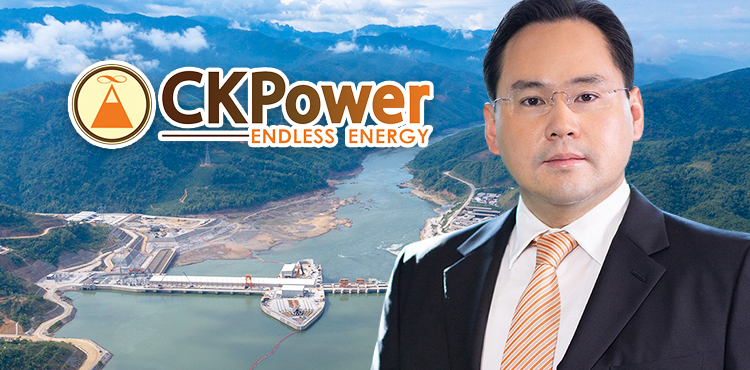

Mr. Thanawat Trivisvavet – Managing Director of CK Power Public Company Limited or CKPower (SET: CKP), one of Southeast Asia’s largest renewable energy producers, revealed that in 2022 CKPower has achieved continuous growth in all aspects of its operations, including revenue, net profit, total assets, and share of profit on investment. At the same time, the company’s debt declined driven by effective financial management.

In 2022, the company’s total revenue exceeded THB 10,000 million for the first time to reach an all-time high of THB 11,418.3 million, an increase of THB 2,083.6 million or 22.3 % from THB 9,334.7 million in 2021.

CKPower’s net profit attributable to equity holders of the company has also seen continuous growth in 2022 to reach an all-time-high of THB 2,436.2 million, an increase of THB 257.2 million or 11.8% from the previous year.

The growth was driven by an increase of the share of profit from investments in joint ventures and associates by 39.3% from the previous year due to higher average water flow experienced by the Xayaburi Hydroelectric Power Plant (XPCL), which resulted in significant growth in electricity sales volume and financial performance of XPCL compared to the previous year.

On its financial position, as at 31 December 2022, CKPower had total assets of THB 69,846.0 million, increased by 1.3% from the previous year. Its total liabilities were THB 31,906.6 million which declined by 2.9% from gradual repayments of loans from financial institutions and redemptions of maturing debentures, resulting in an improvement in the net interest-bearing debt to total equity ratio to a healthy level of 0.59 times at the end of 2022.

Mr. Thanawat stated that “CKPower’s achievement of strong performance despite facing high energy costs following volatile global energy market situation was the result of CKPower’s strategy to focus on investing in renewable energy and reducing dependency on fossil fuel which has seen high price volatility. We aim to invest only in renewable energy projects across the ASEAN region and to increase the proportion of renewable energy in our portfolio from 89% to 95% by 2024. While the rising policy interest rates in the US and other countries, including Thailand, has emerged as a key factor that may impact CKPower’s financial performance in 2023, 83% of CKPower’s consolidated long term debt is in Thai Baht currency and carries fixed interest rate. For our associated company, XPCL has a policy to manage interest rate risk using the Interest Rate Swap instruments as well as the issuance of fixed-rate debentures. XPCL continues to closely monitor the interest rate situation and manage its long-term debt to be at a proper level.”

In 2022, TRIS Ratings affirmed CKPower’s corporate rating at A with a Stable outlook. Additionally, the company was included in the 2022 Thailand sustainability investment index for three consecutive years, won the rising star sustainability awards from the Stock Exchange of Thailand, and received Excellent CG Score from Thai Institution of Director Association for five years in a roll. CKPower also received the 2021 ASEAN CG Scorecard (ACGS) award in the category of ASEAN Asset Class from ASEAN Capital Markets Forum (ACMF) and Asian Development Bank (ADB).

“The awards from domestic and international leading organizations are testaments to CKPower’s success in growing its sustainable clean energy and environmentally friendly business. The company remains committed to continuing to build our clean and stable energy business to become a leading renewable energy producer in the region.” said Mr. Thanawat.

CKPower targets to achieve Net Zero GHG Emissions by 2050. In 2022, the renewable energy power plants under CKPower produced 9,921 GWh of clean electricity, equivalent to a reduction of greenhouse gas emissions by 5.0 million tonnes of CO2e per year.