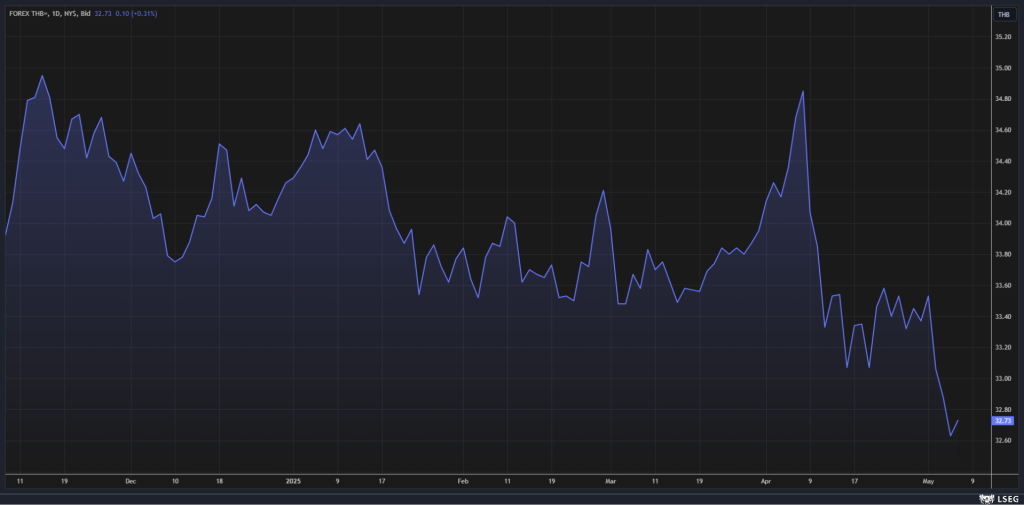

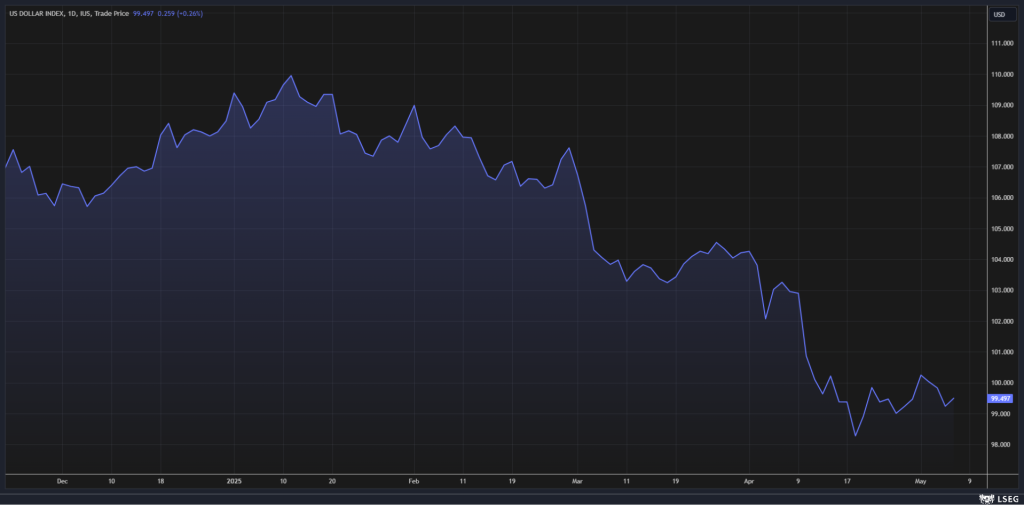

The Thai baht has recently staged a significant comeback, driven by a wave of dollar selling across Asia and sliding oil prices. After hitting a 7-month low of THB 32.63 per dollar from an early April high of THB 34.85, the U.S. dollar is under fresh pressure as Asia’s export powerhouses begin diversifying away from dollar assets. However, this story is not just about currencies — it’s reshaping corporate profits across Thailand.

According to Bualuang Securities‘ (BLS) latest sensitivity analysis, a stronger baht, falling oil prices, and lower electricity costs are all acting as tailwinds or headwinds, depending on the sector.

Baht Strength: A Boon for Airlines, Utilities, and Refiners

BLS’ data shows that for every 1 baht appreciation against the U.S. dollar, certain companies see a major lift in net profit. Airlines and power producers are among the biggest winners:

- Asia Aviation (AAV) sees a 13.9% boost to net profit.

- BGRIM, a power producer, gains 13.8%.

- TOP (Thai Oil) profits rise by 10.3%.

Lower oil prices also amplify these gains. BLS estimates that a 10% decline in oil prices adds 10% to the Transportation sector’s net profit, 2.6% to Packaging, and 1.6% to Consumer sectors — doubling down on the positive impact for names like AAV and BGRIM.

Here’s the detailed breakdown of stocks that benefit from the baht’s appreciation to their net profit:

| Stock | Impact to Net Profit (%) |

|---|---|

| AAV | 13.9 |

| BGRIM | 13.8 |

| TVO | 11.2 |

| TOP | 10.3 |

| GULF | 5.8 |

| PTTGC | 4.5 |

| PSL | 4.4 |

| KEX | 4.4 |

| CPF | 3.4 |

| SCGP | 1.4 |

| PTTEP | 1.1 |

| TRUE | 1.1 |

| CENTEL | 0.7 |

| DTAC | 0.7 |

| GLOBAL | 0.3 |

| LH | 0.3 |

| BJC | 0.3 |

| ADVANC | 0.1 |

| BBL | 0.1 |

| INTUCH | 0.0 |

Exporters and Electronics Feeling the Heat

While some firms celebrate the baht’s rise, exporters — especially in electronics — are under pressure. A stronger baht makes Thai exports less competitive globally, directly impacting profit margins.

Key names suffering include:

- SVI, with a 10.8% hit to profits.

- BCP down by 7.8%.

- DELTA sees a 7.0% decline.

The broader electronics sector, including KCE and HANA, also takes a profitability hit as foreign exchange gains from USD revenues shrink when converted back to baht.

Here’s the list of stocks negatively impacted by the baht’s appreciation to their net profit:

| Stock | Impact to Net Profit (%) |

|---|---|

| PTT | -1.4 |

| IVL | -1.5 |

| MINT | -1.6 |

| IRPC | -1.9 |

| SCC | -2.0 |

| TU | -2.1 |

| GGC | -2.2 |

| RCL | -2.3 |

| BANPU | -2.6 |

| OR | -2.7 |

| KSL | -2.9 |

| THCOM | -4.0 |

| HANA | -4.7 |

| SPRC | -5.5 |

| KCE | -6.4 |

| DELTA | -7.0 |

| BCP | -7.8 |

| SVI | -10.8 |

Currency Moves Signal Deeper Shifts in Global Markets

This latest baht rally comes amid a broader trend where Asian currencies — from Taiwan to Malaysia — are strengthening as capital flows shift away from the U.S. This reflects growing doubts about the dollar’s dominance, especially as Asian exporters seek to diversify their massive trade surpluses.

However, in the short term, this trend brings a mix of winners and losers on the Thai stock exchange. While domestic-focused companies and importers like utilities, refiners, and airlines benefit, exporters and tech hardware firms may face margin compression if the baht stays strong.