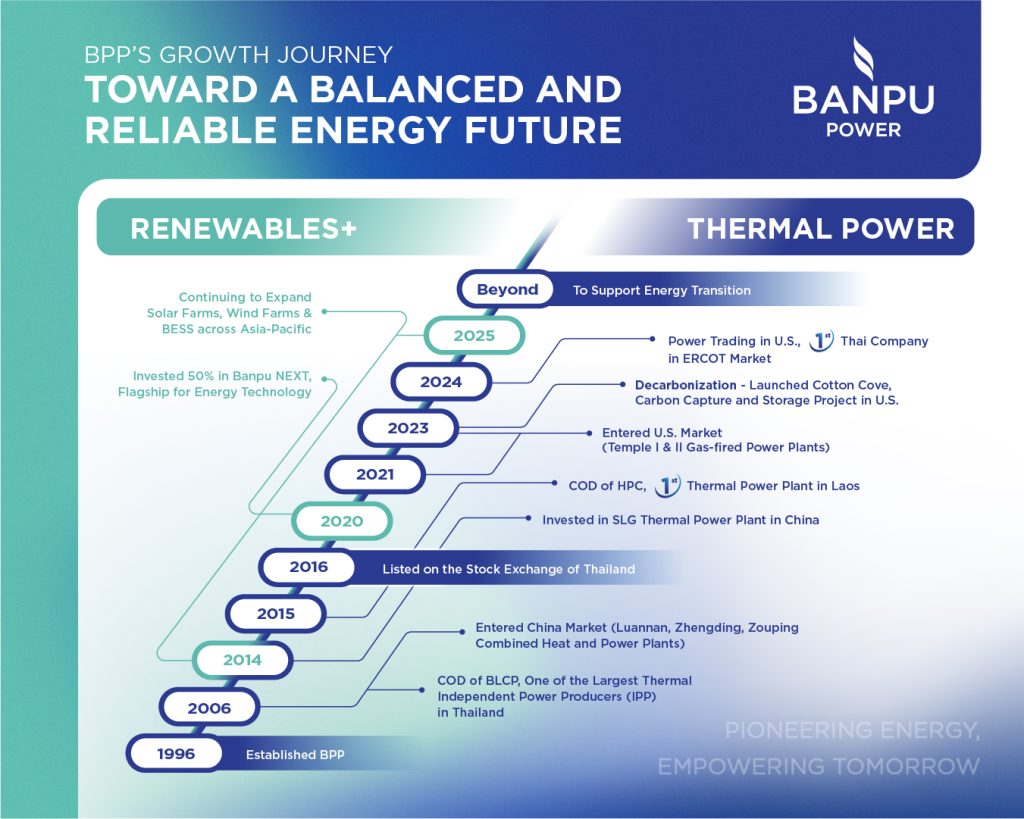

Banpu Power PCL (SET: BPP), an international energy producer company, continues to diversify its portfolio by becoming the first Thai company to enter the power trading in the ERCOT (Electric Reliability Council of Texas) market in the United States. This strategic growth demonstrates BPP’s capability across the energy value chain—from upstream energy generation to midstream power trading and downstream power retail—enhancing long-term value and revenue generation.

This approach reflects the company’s commitment to its “Pioneering Energy, Empowering Tomorrow” stance and supports its new missions to enhance capabilities and seize emerging opportunities in a rapidly evolving global energy landscape. BPP reported strong H1/2025 results, with performance driven by its power plants in the U.S. and China, as well as increased revenue from carbon emission allowances (CEAs).

Mr. Issara Niropas, CEO of Banpu Power PCL (BPP), stated, “In today’s world, where energy security underpins economic stability and national security, BPP is committed not only to advancing energy generation, but also to creating added value through power trading in the U.S. via our subsidiary, BPPUS. Leveraging digital expertise, data-driven insights, and a dedicated professional team, this milestone enables us to generate revenue from congestion revenue rights (CRR). Since launching the CRR business in Q4 last year through H1/2025, we have achieved over THB 133 million in revenue.

We are also preparing to expand into the Intercontinental Exchange (ICE) market to generate income through proprietary trading, forecasting electricity price movements. This will complement our core power generation business, which continues to deliver strong cash flow. Additionally, through BKV Energy, our U.S. power retail arm established through a collaboration between BPPUS and BKV Corporation, we have been recognized as ‘Best Electricity Company’ at the 2025 Best of the Best Awards by the Houston Chronicle, based on votes from Texas consumers. This recognition reflects trust in the quality and reliability of our power supply at affordable pricing.”

Highlights from BPP’s H1/2025 performance are as follows.

BPP recorded a net profit of THB 1,846 million, an 11% increase year-on-year, with earnings before interest, taxes, depreciation, and amortization (EBITDA) totaling THB 4,486 million. Key drivers include improved performance at Temple I and Temple II gas-fired power plants in the U.S., gains from change in fair value of financial instruments due to hedging contracts secured at favorable prices, efficient coal cost management at combined heat and power (CHP) plants in China, and higher revenue from the sale of CEAs.

Thermal Energy Business: In China, the Zhengding power plant began commercial operations in June, utilizing biomass co-firing at a 10% blend ratio with the primary fuel, an initiative expected to reduce CO2 emissions by approximately 70,000 tons per year. At the Zouping plant, construction of a northern steam pipeline began in July, with further expansion under study to extend the network east and west, ensuring a more stable and cost-efficient steam supply to local industries. Meanwhile, the HPC power plant in Lao PDR and the BLCP power plant in Thailand continued to maintain high equivalent availability factor (EAF) of 89% and 90%, respectively.

Renewables+ Business: In Japan, the Iwate Tono battery farm project, with a power capacity of 14.5 MW and an energy storage capacity of 58 MWh, achieved commercial operations in June. BPP continues to scale its battery energy storage system (BESS) business in Japan through Banpu NEXT, in which BPP holds a 50% stake, aiming to become a key player in Japan’s BESS market. Simultaneously, the company is assessing the feasibility of expanding its BESS investment into the U.S. market.

BPP has also introduced three missions to drive sustainable growth and align with the dynamic nature of the global energy transition:

- Accelerate growth through digital innovation, global operational expertise, and strategic investments in global initiatives.

- Advance the sustainable energy transition by embracing advanced technologies and innovations to drive decarbonization, while reinforcing future energy reliability.

- Enhance quality of life through community development initiatives spanning education, healthcare, and post-disaster recovery, creating long-term positive change.

“Over nearly three decades, BPP has established itself in eight strategic markets as a pioneer in energy. This journey reflects our ability to balance the energy equation through portfolio diversification, asset optimization, and continuous decarbonization—delivering high-quality, reliable energy along with steady returns for all our stakeholders,” Mr. Issara concluded.