The cryptocurrency landscape is constantly evolving, and so too are the ways users approach its inherent security challenges. A recent survey conducted by Binance TH in Thailand offers valuable insights into this evolution, revealing a community that not only adopts foundational security measures but also actively seeks smarter, more integrated protections.

This progress is encouraging—but it also reminds us that as user behaviors mature, the industry must keep pace with more advanced, proactive safeguards to confront the rising sophistication of digital threats.

Closing Security Gaps: Education Still Needed Despite Progress

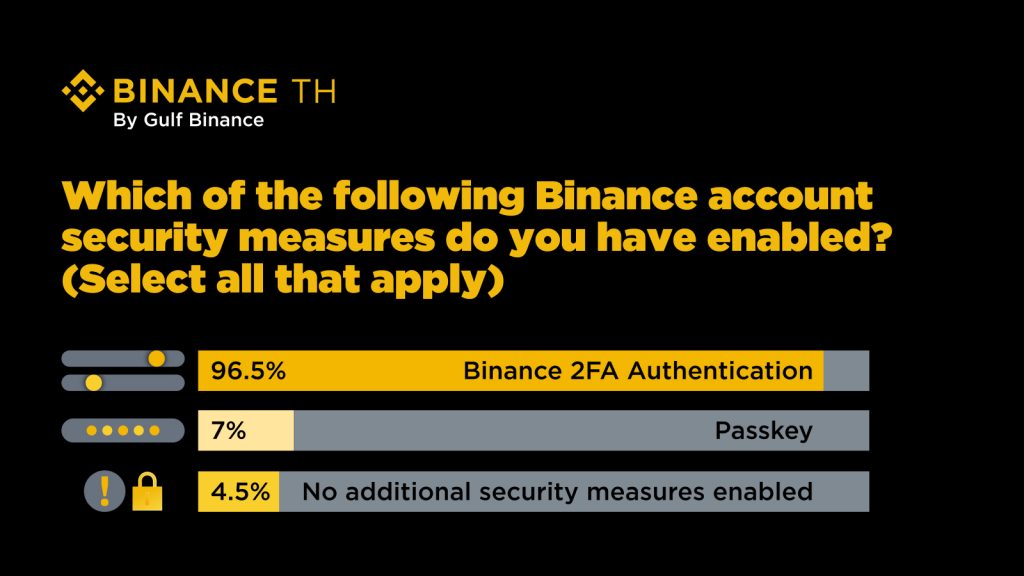

The survey highlights a positive trend: the majority of users are embracing essential security practices. A striking 96.5% of respondents have enabled Two-Factor Authentication (2FA), and 81.8% consistently verify recipient addresses before making transfers—strong indicators of increasing awareness of daily transactional risks.

However, key vulnerabilities remain. Alarmingly, 32.4% of users still store private keys or seed phrases on internet-connected devices or cloud services, underscoring the need for ongoing user education and stronger messaging around digital hygiene.

Encouragingly, the appetite to learn is high: 57.5% of respondents expressed interest in participating in interactive anti-scam simulation tests—especially when these are engaging and incentivized. This enthusiasm reflects the community’s commitment to personal responsibility and the enduring DYOR (Do Your Own Research) ethos of the crypto world.

Collective Resilience: Building on Existing Strengths

The survey also points to the crypto community’s growing resilience. While 44.6% of respondents reported experiencing a crypto-related scam, a majority demonstrated readiness to act: 66.8% said they would immediately contact the exchange to freeze assets in such events—an essential first step in loss prevention.

The high level of trust placed in exchange-based protection systems further reinforces the value of platform-based protection mechanisms but also highlights the significant role exchanges must play in safeguarding users. Robust risk controls, responsive support systems, and user-first operations are no longer optional—they are expected.

Looking Ahead: What the Industry Must Deliver

These expectations are now shaping the future of platform security. According to the survey, users are calling for more sophisticated, automated defenses: 62.5% want real-time interception of high-risk transactions, while 63.3% seek protection from malware and device-level threats. There’s also growing interest in biometric authentication (54.1%) and real-time alerts for abnormal account activity (51.2%)—a clear signal that users are ready for intelligent, seamless security solutions.

These demands align with the trajectory of the crypto industry as it shifts from reactive to proactive defense models. It’s no longer enough to inform users of risks; platforms must integrate smarter protection into every touchpoint of the user journey.

A Call to Action: Building Together with Responsibility

As security threats continue to evolve, so must our collective response. At Binance TH, we firmly believe that a secure crypto ecosystem can only be achieved through collaboration—between platforms, users, and the very stakeholders of the industry.

That’s why we are heavily investing in user education, empowering them with necessary knowledge, attitudes, and skills — because we believe that knowledge is power. At the same time, we are deploying state-of-the-art security measures on our platform and working closely with law enforcement agencies and regulators to uphold the highest standards of compliance and user protection.

Together, we can shape a crypto ecosystem that is not only innovative and inclusive—but also secure by default.

WARNING: Investment in cryptocurrencies and digital tokens involves a high level of risk. Investors should be aware that they may lose their entire invested capital. Please conduct thorough research and ensure your investment aligns with your personal risk tolerance.