PTT Public Company Limited (SET: PTT) has announced a major internal restructuring initiative focused on consolidating infrastructure and logistics assets across the Group. The move involves significant asset acquisitions and long-term leasing agreements with its subsidiaries, PTT Global Chemical Public Company Limited (SET: PTTGC) and Thai Oil Public Company Limited (SET: TOP).

The transactions, approved by PTT’s Board of Directors on 18 September 2025, will be executed by PTT Tank Terminal Company Limited (PTT Tank), a wholly owned subsidiary of PTT. As the Group’s designated infrastructure flagship, PTT Tank manages jetty and product storage services.

Strategy and Objectives

The restructuring aligns with PTT’s Asset Monetization Strategy, aimed at optimizing asset utilization, strengthening business structure, and enhancing operational efficiency. By consolidating key logistics assets—such as oil tanks and jetties—under PTT Tank, the Group expects to achieve greater synergy and maximize value across operations.

At the same time, the transactions will provide PTTGC and TOP with increased liquidity and cash flow through the sale and long-term lease of assets. This capital injection is intended to reinforce their core businesses and deliver stronger shareholder returns.

Two-Part Restructuring Plan

- Establishing New Entities and Asset Leasing

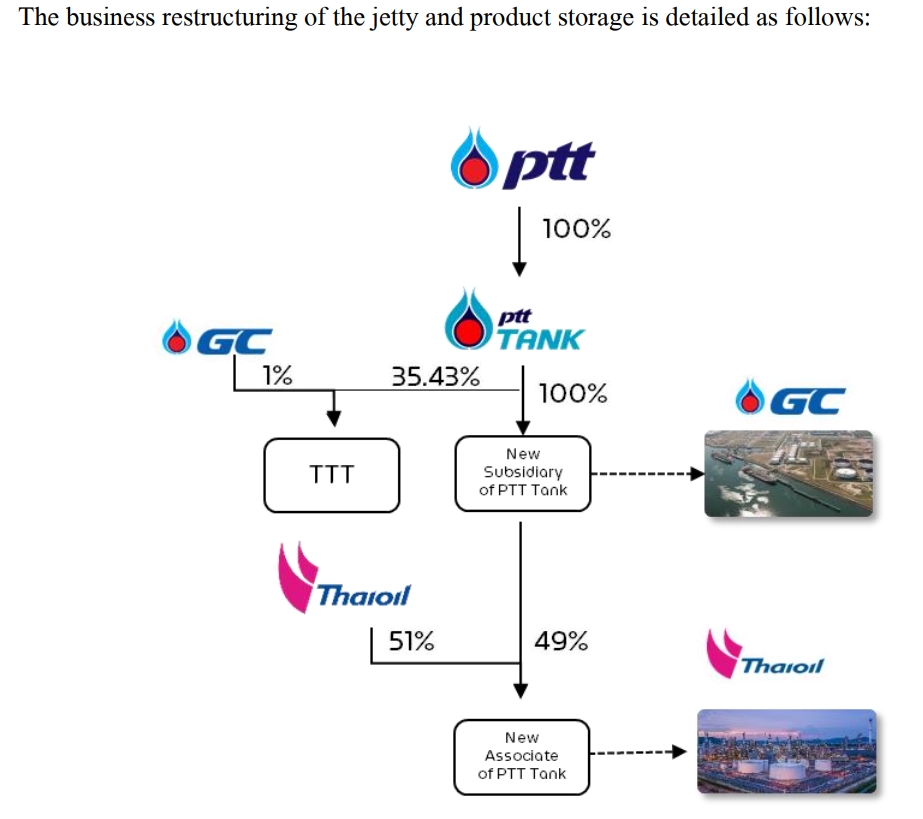

PTT Tank is implementing its first project by creating a new wholly owned subsidiary (“New Subsidiary of PTT Tank”) to facilitate two key transactions:

- Acquisition of Assets from PTTGC:

- Includes jetties, equipment, product storage tanks, truck loading systems, operational licenses, land use rights, and customer service rights.

- Investment cap: Up to THB 4,840 million (excluding VAT).

- Includes jetties, equipment, product storage tanks, truck loading systems, operational licenses, land use rights, and customer service rights.

- Joint Venture and Long-Term Lease with TOP:

- Formation of a new associate company (New Associate of PTT Tank) with TOP, where the New Subsidiary holds 49.0% and TOP 51.0%.

- The New Associate will lease critical assets from TOP, including crude oil tanks, the Single Buoy Mooring (SBM), land, and the oil lorry loading station.

- Financial commitment: Up to THB 37,402 million under a 21-year lease agreement. The New Associate will sublease these assets back to TOP for operations, with provisions for renewal if TOP requests.

- Formation of a new associate company (New Associate of PTT Tank) with TOP, where the New Subsidiary holds 49.0% and TOP 51.0%.

- Acquisition of TTT Shares

The second project involves PTT Tank acquiring shares in Thai Tank Terminal Company Limited (TTT) from PTTGC.

- Acquisition stake: Approximately 35.43% of TTT’s total issued and paid-up shares.

- Consideration: Up to THB 4,403 million.

- Earn-Out clause: An additional payment of up to THB 604 million may be made based on conditions set in the share purchase agreement.

TTT operates storage and jetty services for chemicals, oil, and liquefied gases within the Map Ta Phut Industrial Estate, under a Public-Private Partnership (PPP) with the Industrial Estate Authority of Thailand.

Timeline and Regulatory Note

The restructuring projects are scheduled to be completed gradually, starting in December 2025 and concluding in 1Q26.

PTT confirmed that these transactions are not classified as connected transactions and are below the threshold requiring disclosure under asset acquisition and disposition rules for listed companies. However, PTT is reporting them for transparency, as the acquisitions will result in new subsidiaries within the Group.