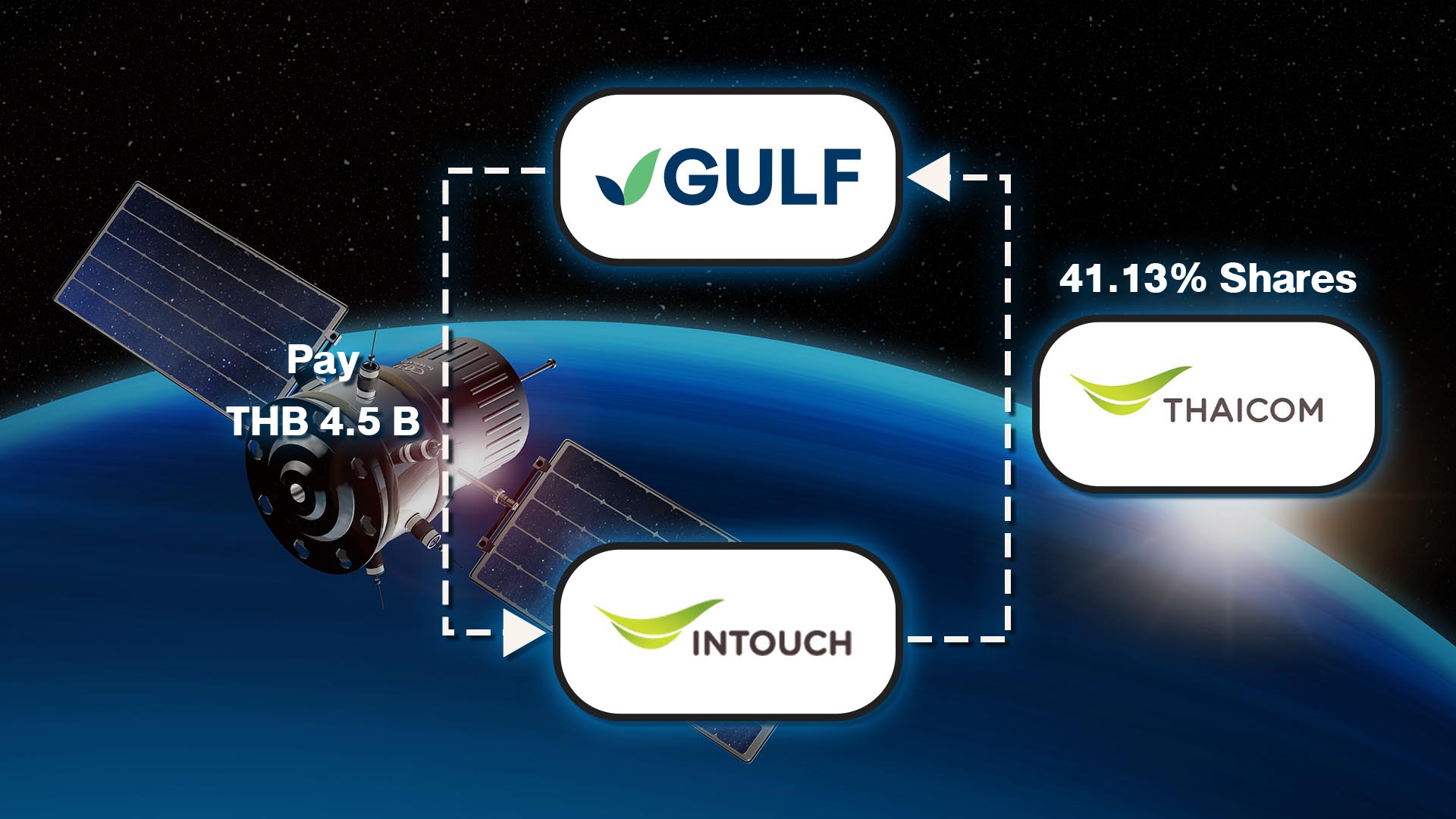

- Gulf Energy Development, Thailand’s largest infra-company, is set to expand its empire by investing THB4.5 billion to scoop all 41.13% shares from Intouch Holdings.

Gulf Energy Development Public Company Limited (SET: GULF) has announced that the Board of Directors Meeting, convened on 7 November 2022, considered and resolved to approve an investment in Thaicom Public Company Limited (SET: THCOM), operator of Thailand’s Thaicom 4, 6, 7 and 8 satellites, with the total investment value of approximately THB 10,873.33 million.

GULF, through its subsidiary Gulf Ventures Company Limited, will invest in the ordinary shares of THCOM which are held by Intouch Holdings Public Company Limited (SET: INTUCH) and to acquire all remaining ordinary shares of THCOM by means of making a mandatory tender offer for all securities of THCOM and/or the purchasing of ordinary shares of THCOM on the Stock Exchange of Thailand (SET) and/or by any other methods.

GULF will acquire THCOM ordinary shares from INTUCH, amounting to 450,870,934 shares (or 41.13 percent of the total issued ordinary shares of THCOM), at the price of THB 9.92 per share, totaling approximately THB 4,472.64 million. In this regard, GULF expects to enter into the Share Purchase Agreement with INTUCH after obtaining the approval from its Board of Directors.

After GULF has completed the acquisition of THCOM ordinary shares which are held by INTUCH as mentioned above, GULF will acquire the remaining ordinary shares of THCOM by making a mandatory tender offer for all securities of THCOM, amounting to 645,231,020 shares (or 58.87 percent of the total issued ordinary shares of THCOM) at the same price as the purchase price of THCOM’s shares which are held by INTUCH as aforementioned above (at the price of THB 9.92 per share), totaling approximately THB 6,400.69 million and/or the purchase of THCOM ordinary shares on the SET at the price traded on the SET and/or any other price and/or any other method.

In this regard, the total investment value will be within the maximum investment limit approved by the Board of Directors meeting of the Company, provided that GULF may acquire the ordinary shares of THCOM via the SET or by any other method during the period after the completion of the mandatory tender offer of securities of THCOM in compliance with the relevant laws and regulations of the Securities and Exchange Commission (SEC) and the SET.

GULF stated that the investment is aligned with its strategic direction, regarded as a growth driver for the development into related business domestically and internationally.

The funds for the Transaction will be from the Company’s internal working capital and/or credit facilities from financial institutions and/or bond issuance and/or other debt securities.