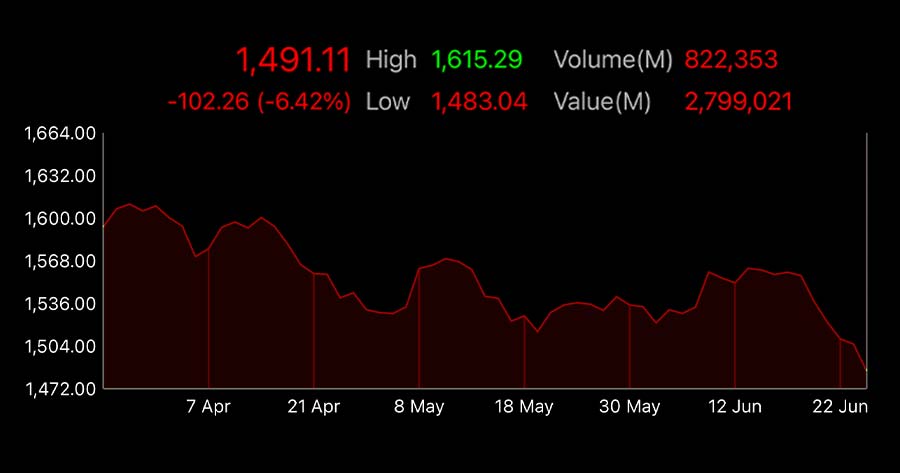

The Thai SET Index had been seeing a continued drop in its weighting in the past couple of days especially on June 26 which closed at a two-year-low of 1,486.62 points. Not only does the situation raise concerns for many investors but also questions about how their investment strategy should be adjusted.

Amid uncertainties, analysts shared a consensus on the factors contributing to the current situation which involves both external and domestic, though the latter has more substantial implications.

To begin with, the US Federal Reserve’s rate hike effort to contain persistent inflation undeniably effects a market such as Thailand. The FED previous push directly impacted foreign and institutional investors investment in the Thai market. Today, the full impact is yet to be realized in the financial market since FED announced that they are undone with rate increases and two more round remains to be seen this year.

Besides the global impact, a number of internal reasons are quite pressuring.

First and foremost is due to the vague in Thai politics. Who will eventually become the next parliamentary chair and will Mr. Pita Limjaroenrat become the next prime minister? Admittedly, without these two questions being addressed, investors would not be able to formulate an investment strategy with direction nor clarity.

Moreover, the case of STARK’s Financial Statement Fraud exposed a loophole in financial accounting practices. Last week, a special auditing reported STARK’s fake sales and purchases transactions. As a result, many auditing firms’ credibility had been reduced which has an indirect influence on the credibility of other listed companies.

Founder of Thai Value Investor Club, Dr. Niwes Hemvachiravarakorn, said that STARK incident has an impact on investors’ confidence. He noted that they are now adopting a cautious approach to investment decisions.

Additionally, DELTA, a stock with the largest market cap at approximately THB 1.2 trillion, saw a huge drop on June 20 and its price on June 27 opened at THB 97.00 which is a 17% drop in just a little of more than a week, thus, weighing much of the SET index down.

On the bright side, analyst remains positive on the fundamentals of a number of other defensive stocks which remains intact. Speculative buy is not recommended at this moment but shares with long-term growth can be an attractive such as AMATA and CRC

Especially those that also provide attractive dividends such as JUBILIE, SCB, KBANK, BBL and SCC

However, analyst expect the market may bounce back in time of a visible direction in Thai politics, but if nothing moves forward then strategies may need to be re-evaluated.