Thai Union Public Company Limited (SET: TU) has been underperforming the market this year due to customer’s abundant inventory and high raw material price. However, an analyst from Tisco Securities expects to see a better performance in the second half of this year.

TU had a total return of nearly -21% since the beginning of this year, compared to the main bourse SET Index that recorded -7.50% in six months.

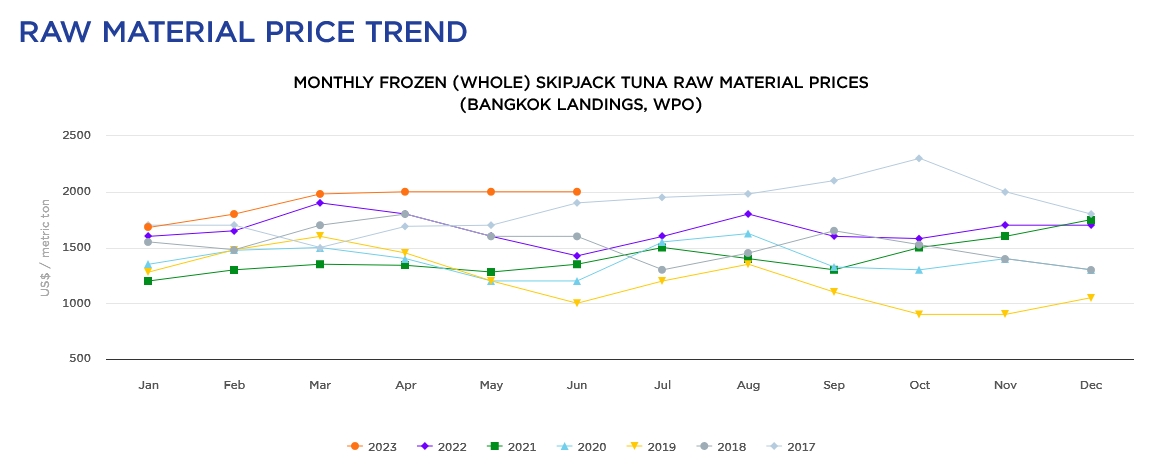

Meanwhile, monthly frozen (whole) skipjack tuna raw material prices remain at the highest level in seven years at $2,000 per metric ton since March up until June.

Tisco Securities wrote in a note stating that TU’s 2Q23 earnings are expected to remain weak as the combination of negative factors seen in 1Q23 remained at play.

Still, Tisco believed sales and margins will start to normalize after making a bottom in 1H23. Stocks’ downtrend already reflected the weak USD, potential recession impact, high costs and the worst of Red Lobster’s drag. The brokerage firm expected earnings to significantly improve in 2H23, while maintaining “BUY” recommendation but cut target price from THB22.00 to THB21.00 per share.