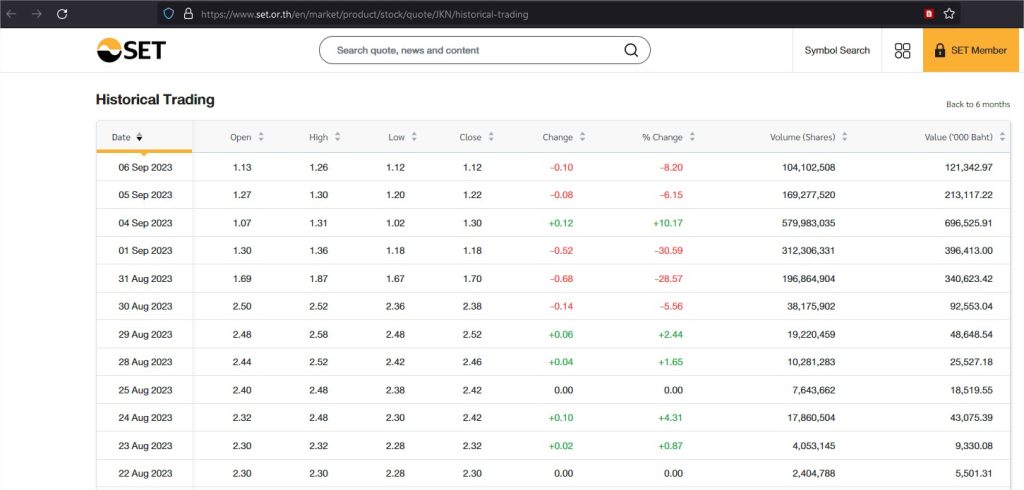

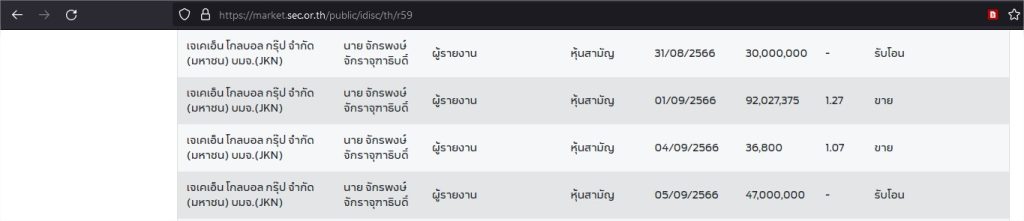

Mr. Jakkaphong Jakrajutatip, CEO of JKN Global Group PCL (SET: JKN) has disclosed to Thailand Security Commission (SEC) that there’s some major transactions under his name including the sale of over 92 million shares of JKN which in his defense, is due to forced sale from his margin account after JKN price drop by 50% (from THB 2.5 to THB 1.25) within a week after the news of JKN bond delinquency.

In return, the CEO also received a transferred share of a total 77 million shares in the past week, according to the report in SEC and SET website (https://market.sec.or.th/public/idisc/th/r59 and https://www.set.or.th/en/market/product/stock/quote/JKN/historical-trading)

He stated that he will continue to manage and hold more than 38% of total JKN shares. The company has the resolution on the bond problem and will consult and hold the meeting with all involved parties as JKN239A Bond holders will gather on this 27 Sep. The CEO noted that the company has the best intention to defend every bond holders and investors’ benefits.

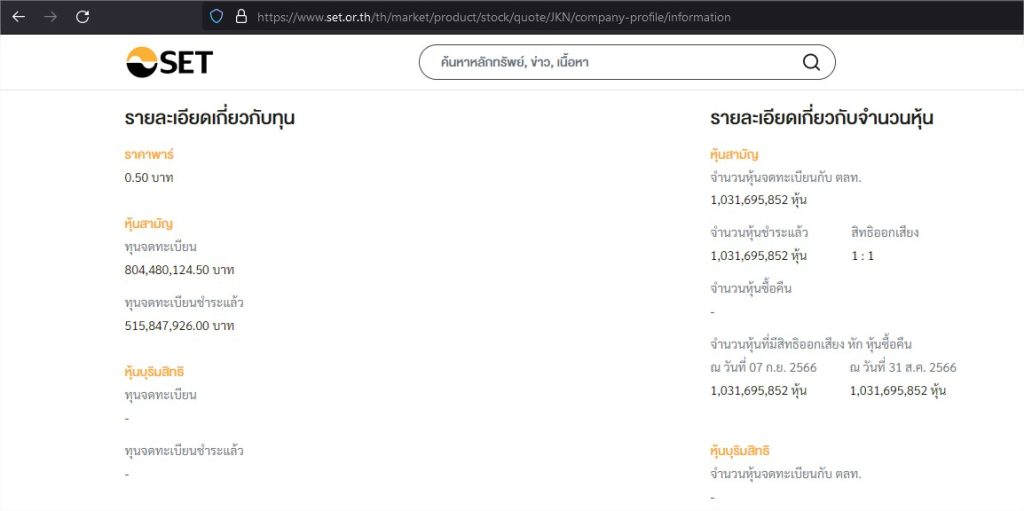

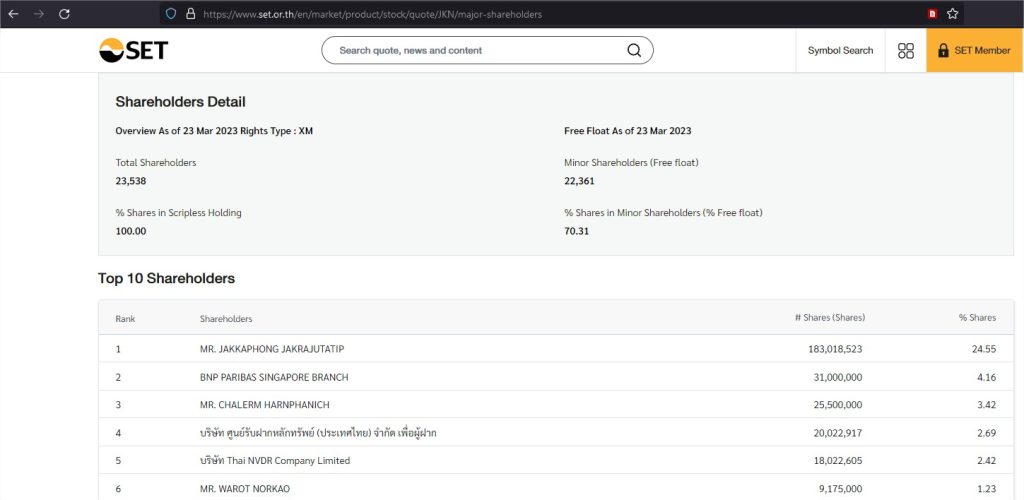

Currently, JKN has a total of 1,031 million shares according to SET website. His selling raised almost THB 117 million and after receiving the 77 million shares, he now holds around 38% or 393 million shares of JKNs total share, compared to 39.4% or 407 million shares before the sale and 24.55% or 183 million shares reported in March.

The news report earlier totaled JKN bond delinquency on 1 Sep at THB 156.6 million from the total bond worth of THB 610 million for JKN239A, which left THB 443.4 million unpaid. That’s causing JKN stock crash and halving the stock value as investor concern on more bond defaults.