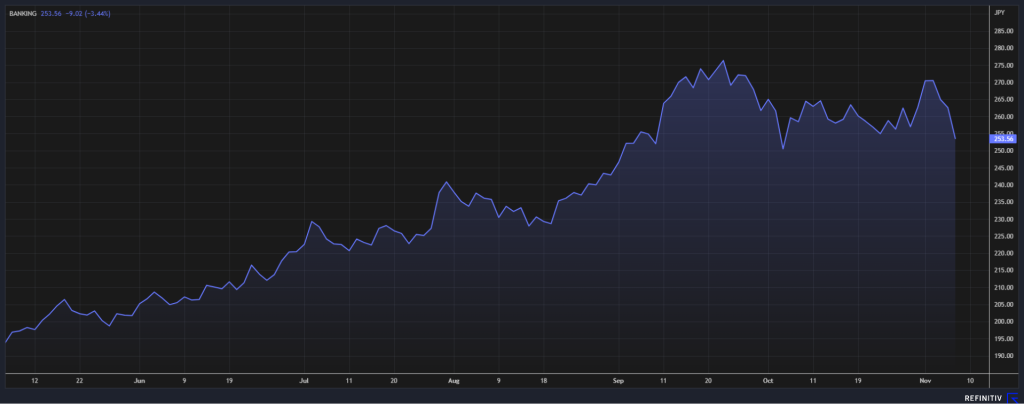

The Topix banks index made a sharp plunge in the morning session on Wednesday, dropping by more than 3% after the market lost hope of seeing positive interest rates.

The drop came after the Bank of Japan’s Governor Kazuo Ueda signalling that it is unlikely policymakers will have sufficient data to declare an end to negative rates by year-end as he continues to monitor whether a wage-inflation cycle will materialize.

This could cause a switch for investors into other sectors as Japanese banks could not get any support from its own central bank.

The yen traded in a narrow range at about 149.50 against the dollar after Ueda’s comments, which would be near the level that the government could jump in to intervene.

Ueda was named earlier this year to succeed incumbent Haruhiko Kuroda who finished his second term as the governor of the central bank.

The new governor since taking office had been stating that the central bank will conduct a broad-perspective review of its easing policy measures. He set the time frame at one and a half years for the review.