- In celebrating its 50th anniversary, XSpring announces a comprehensive business strategy to transform its organization into a fully integrated financial service provider, aiming to be an intermediary for businesses seeking capital and investors looking for financial returns.

- Building a robust financial services ecosystem comprises three business categories: financing services for clients seeking capital, investment services for clients looking to invest, and operating businesses under XSpring Group. This encompasses various sectors including investment banking, securities brokerage, digital asset investment, debt financing, wealth management, and investment in high-growth ventures.

- The company is committed to Business Transformation by reforming processes, advancing information technology, and developing human resources to achieve unity and excellence. It aims to address every investment challenge by leveraging all ecosystems through Customer Data Integration.

- Business is set to achieve 1 billion baht in total revenue in 2024, representing 47% growth from 2023 which generated total revenue of 681.1 million baht and net profit of 106.9 million baht.

Mr. Rathian Srimongkol, Chief Executive Officer of XSpring Capital Public Company Limited (XSpring), reveals that 2024 marks a significant milestone for XSpring as it steps into the 50th year since its inception through the establishment of Overseas Securities and Industry Consultants Co., Ltd., providing services ranging from securities brokerage, securities trading to investment advisory. The company underwent a business restructuring to have new major shareholders including Sansiri PCL. and Viriyah Insurance PCL. and was renamed to XSpring Capital Public Company Limited in 2021. This year represents another crucial step in organizational reform under the concept of “Lessons Learned for Better Tomorrow: Learning and Developing for Sustainable Growth”, moving forwards to become a fully integrated financial service provider for investors and capital seekers within the company’s ecosystem.

In 2024, XSpring sets its revenue target to achieve 1 billion baht, a 47% surge from the year before, driven by the changes implemented. The company announced its 2023 performance with total revenue of 681.1 million baht, which was mainly stemmed from interest incomes and dividends amounting 505.7 million baht, fees and service incomes totaling 87.2 million baht, and investment income of 75.7 million baht, resulting in a net profit of 106.09 million baht.

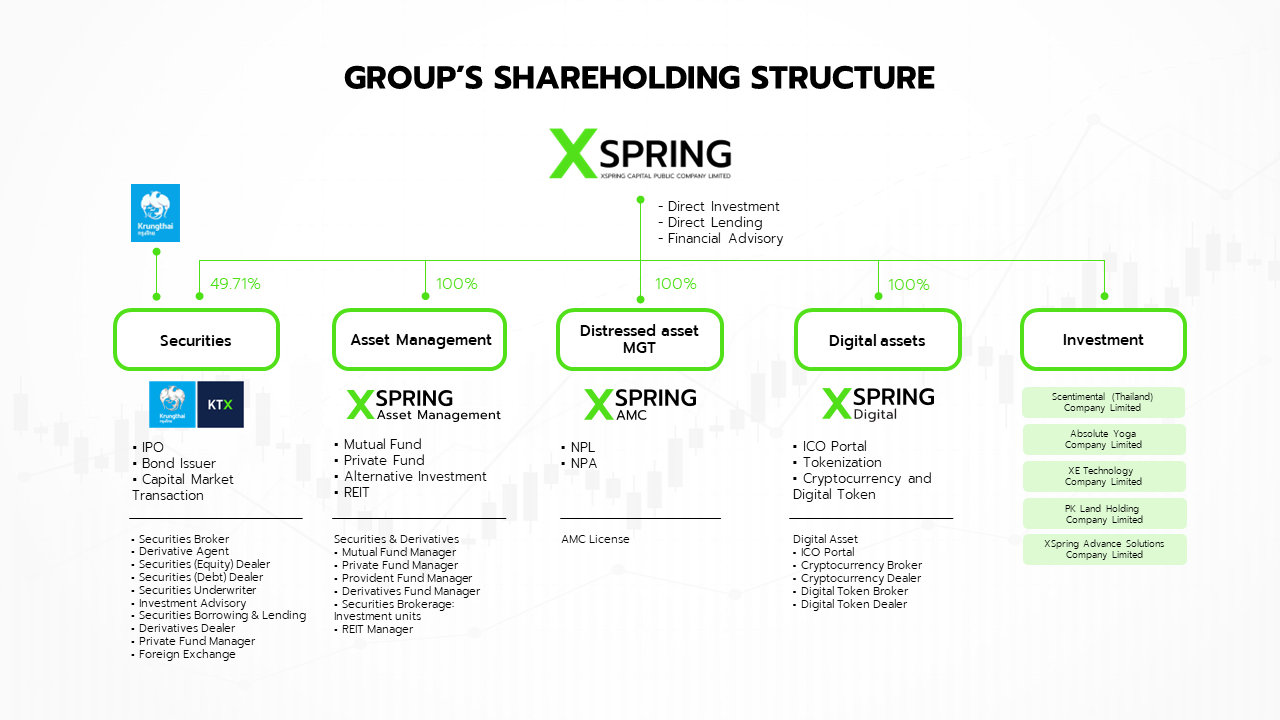

Ms. Varangkana Artkarasatapon, Managing Director of XSpring Capital PCL., said XSpring has created the group’s ecosystem to meet customer’s needs, encompassing six financial service businesses, which are divided into three groups as following:

1) Financial services for clients seeking capitals including:

– Investment Banking provides comprehensive financial advisory services with expertise in mergers and acquisitions, business rehabilitation and restructuring as well as debt issuance. This includes initial public offerings (IPO) and digital fundraising for digital tokens through initial coin offerings (ICO).

– Debt Financing promotes and supports high-potential companies to facilitate stable and sustainable business growth through direct loans and debt securities (e.g., bonds, commercial paper, and promissory notes), as well as off-market debt securities (Private Credit).

2) Financial services for clients seeking investments including:

– Wealth Management offers a variety of investment products for customers including products from 16 partner asset management companies and various funds under curation by our asset management company such as private equity funds and real estate investment trust funds.

– Brokerage provides brokerage services for securities and digital assets.

3) Businesses under the XSpring Group including:

– Investment focuses on investing in high-potential businesses domestically and internationally for maximum returns. Investments are divided into three categories: Financial Technology (Fintech), Customer-Centric, and Environment, Social and Corporate Governance (ESG) businesses. XSpring currently holds stakes in sustainability-related start-ups such as SHARGE Management Co., Ltd., which operates charging stations under the REVERSHARGER brand, and ION Energy Co., Ltd., which runs solar power business by the young generation.

– Distressed Asset Management is another business of XSpring Group that leverages real estate experiences from its shareholders and executive management to strategize the selection of quality assets. In the past year, XSpring managed its debt portfolio worth over 4 billion baht, including secured and unsecured loans, and large corporate loans, in collaboration with Plus Property Co., Ltd., a leading integrated real estate management company, as the partner in managing non-performing asset (NPA) sales.

All of XSpring’s services are driven under the Business Transformation strategy aiming for unity and excellence. This involves the process reformation, technological advancement, and human resource development to harness the ecosystem that maximizes benefits from all resources through Customer Data Integration. With the customer-centric focus, XSpring will truly serve as an intermediary between businesses seeking capital for expansion and investors seeking genuine financial wealth. This year, it plans to unveil the XSpring application, which is the platform to enhance convenience and elevate the investment experience for customers, thereby increasing the opportunity for financial success.

In addition, XSpring is committed to operating business with concerns on Environment, Social, and Corporate Governance (ESG) to ensure that its organization and the society can grow steadily and sustainably. Apart from emphasizing environmental concerns, the company has also invested in various start-ups, which have engaged in sustainable businesses. In 2023, it recognized the importance of financial planning and planned to promote knowledge and understanding of efficient financial literacy for society. This led to an initiative of the “PLAY TO WIN” project, which was in collaboration with ONE Championship Thailand and Lumpinee Boxing Stadium through the Army Sports Development Center, to enhance an equal access to personal financial management tools. Its goal is to provide financial knowledge and planning skills to boxers and personnel in the boxing industry, while also elevating the Thai sports arena with long-term financial stability. This program will be held annually to expand the coverages to all types of sports another financially vulnerable groups.

In 2024, the company remains committed to the ongoing development of society by advancing financial and investment opportunities for individuals with disabilities or those facing disadvantages in society. It will empower them with financial literacy and the capacity to guard against financial fraud. XSpring is deeply committed to conducting business with integrity and accountability, prioritizing transparency to steer the company toward success amidst economic challenges and intense competition. This commitment benefits shareholders, customers, investors, and all stakeholders, with a focus on fostering stability and sustainable growth.

XSpring Capital Public Company Limited engages in various investment businesses with high growth potential both domestically and internationally, aiming to generate returns from investment through affiliated companies as follows:-

- Krungthai XSpring Securities Co., Ltd. (a joint venture between XSpring Capital PCL. and Krungthai Bank PCL.) – Securities Brokerage and Investment Banking

- XSpring Asset Management Co., Ltd. – Asset Management

- XSpring AMC Asset Management Co., Ltd. – Distressed Asset Management

- XSpring Digital Co., Ltd. – Digital Assets