Before 2023 came to a close, South Korea set an example to those who are looking to cut corners in the capital market by imposing a fine to two global investment banks and one local broker over illegal naked short selling.

BNP Paribas was ordered to pay 11 billion won, 7.5 billion won for HSBC ($14.2 million for the two global banks) and 8 billion won for its local brokerage unit that the South Korea’s Financial Services Commission (FSC) did not specify the name of the entity for this wrongdoing.

The FSC stated that the violations were a grave matter that hurt the market order and investor trust as regulators viewed that transactions made by these three companies which lasted for months were intentional.

South Korea’s regulators acknowledged that the number of naked short selling, which is illegal in the country, is growing especially in international investment banks. The authorities decided to reimpose a ban on short selling in November to come up with a better method to prevent the naked short that distorts the true valuation of the market.

This bold move sent the Kospi Index to close 5.66% higher on the day of imposition to the highest level in nearly four years. And from that day, the main index of South Korea had risen about 12% and 19% for the whole year.

Meanwhile, Thailand is also facing a naked short problem as well, but regulators have yet to acknowledge such transactions, saying that the result from investigation shows no abnormality in the trading session. However, the Thai Exchange and Securities Committee did not stand by and did nothing. Several measures had been proposed and considered to strengthen securities to prevent the naked short.

The statement is widely different from the market’s perception that the naked short is real and also a lot by some of the big firms.

Retailers in the Thai stock market are groaning in pain as stocks in the market are being controlled by these so-called market makers that drive the price away from its actual valuation and fundamentals.

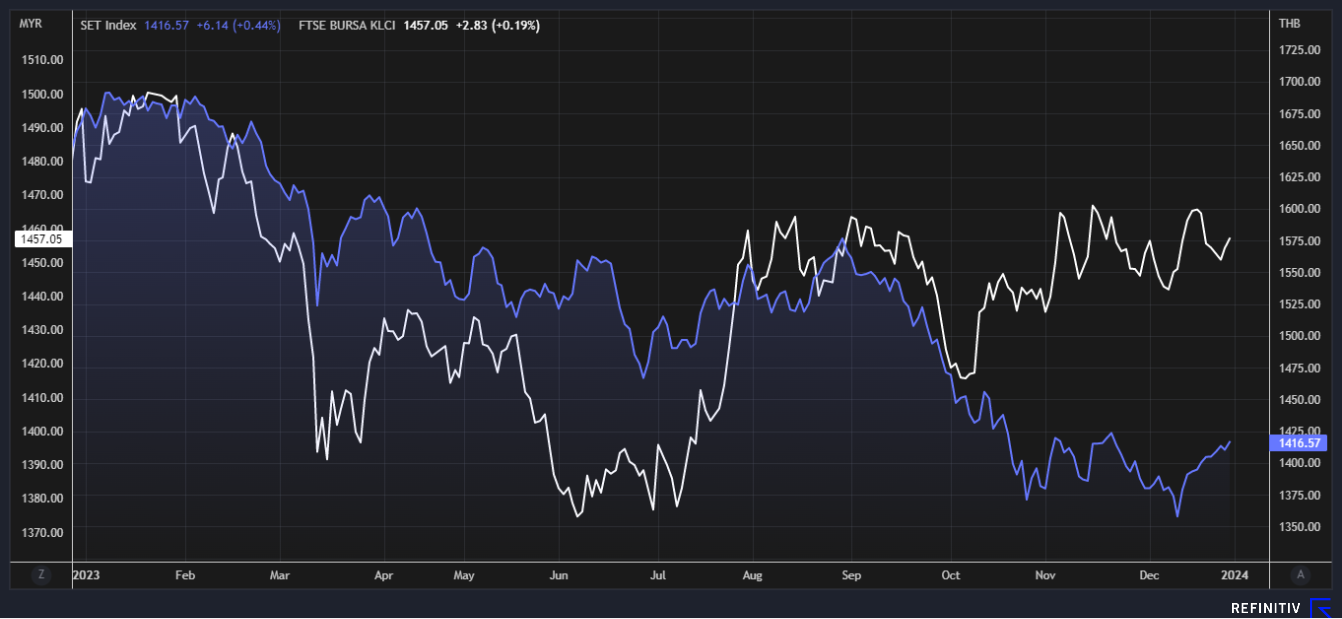

SET Index, Thailand’s main bourse, is down 15% for the year, which is the lowest in the region by a large margin. Malaysia was the worst performer in the region at one point in 2023, but the stocks had been edging higher in the final quarter of 2023. The FTSE Bursa Malaysia KLCI could finish the year down only 2-3%.

Regulators are afraid to make changes or impose restrictions on the market, fearing that the volume will decrease significantly, especially foreign investors that will lose interest in the market.

But look at the Kospi 200 Index, which is one of the indexes in which short selling has been banned by South Korea’s authorities, it was up 12.5% since the announcement of banning up to the year’s end, despite lower trading volume that is actually occurring in many markets, including the Thai stock market.

This reflects high confidence in the market to trade stocks for its true value. Making change is not always a bad thing if it is the right thing to do, especially for the public wealth as a whole.