“We may be able to train children to perform calculations, but what matters far more is helping them understand where each baht comes from and how to make the most of it,” said Kru Mike – Isaree Tungtirawat, a mathematics teacher from Thung Maha Mek School.

She shared her reflection after taking part in the “Thai Teachers Master Financial Literacy” workshop, conducted under the JA SparktheDream initiative. The programme, delivered by FWD Insurance in partnership with Junior Achievement Thailand (JA Thailand) and designed as a Train-the-Trainer model, aims to equip teachers with solid financial knowledge so they can confidently guide their students in applying these skills in everyday life.

Mr. David Korunić, Chief Executive Officer for Thailand & Cambodia at FWD Life Insurance PLC, emphasised: “Developing financial awareness early in life is essential for building confidence and fostering disciplined financial habits among younger generations. Financial literacy forms the backbone of long-term well-being, and teachers are the ones who pass this foundation on to youth. That is why we chose to begin by empowering teachers — expanding JA SparktheDream into ‘Thai Teachers Master Financial Literacy’, a pilot initiative designed to strengthen teachers’ financial competence, uplift their confidence, and enhance their overall financial quality of life.”

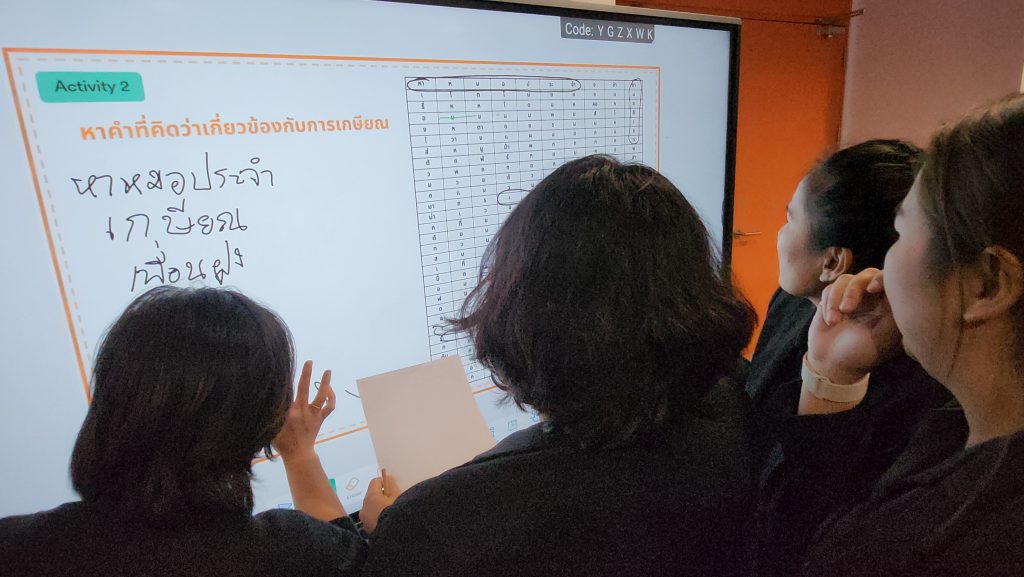

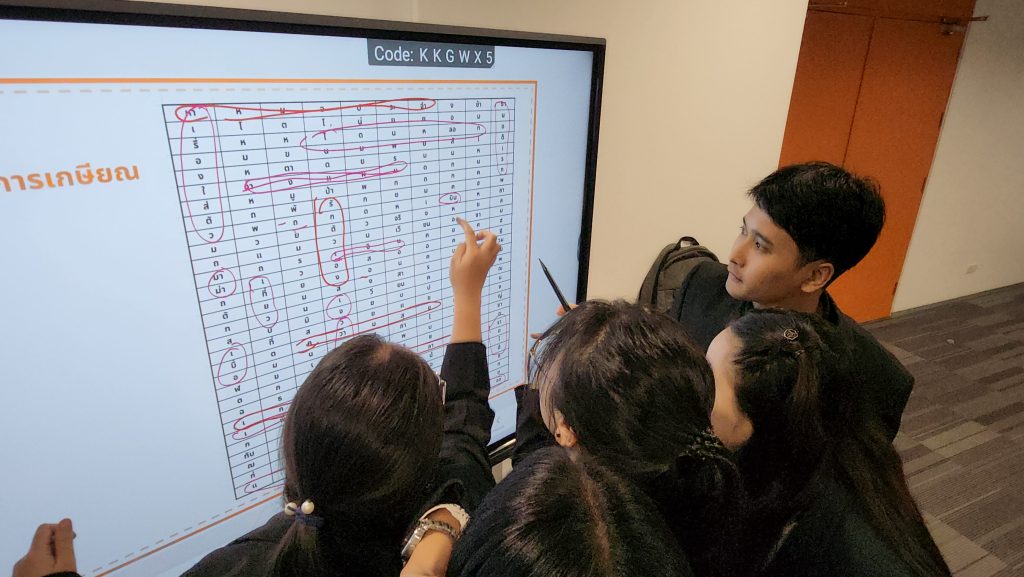

The two-day workshop gathered 33 teachers from 10 participating schools, engaging them in a series of hands-on, experiential activities. Sessions were delivered by financial specialists from FWD’s Business Training Center, including Paula – Sriprapai Namsaen, AFPT™, and Ball – Apiwit Paisansub, CFP, supported by 15 FWD volunteers who helped create a dynamic learning atmosphere filled with shared experiences.

Workshop content covered a broad range of personal-finance essentials: budget planning, debt management, saving and investment strategies, SMART goal-setting (Specific, Measurable, Achievable, Relevant, Time-bound), as well as preparing personal financial statements to help visualise income, expenses, assets and liabilities. One of the most engaging components was the Wishlist board game, designed around the theme “Manage money, fuel your dreams,” enabling teachers to explore financial decision-making through realistic scenario-based play.

The programme then transitioned into insurance and risk-management topics via Risky Lossy, another simulation game that demonstrates life-risk scenarios and highlights the necessity of proper protection tools. These activities enabled teachers to recognise their own financial tendencies — strengths, blind spots and spending behaviours that they had not previously noticed.

Across the two-day training, teachers absorbed both conceptual and practical financial skills, gaining clarity on how money management directly underpins quality of life — a perspective they can now extend to their students.

Kru Phueng – Tasawan Boonmak, from Khosit Samosorn School, reflected that this programme helped her understand financial planning as an integral part of life planning. Laying the right foundations early, she said, provides lifelong benefits. “As children we were hardly taught finance in a meaningful way. This workshop helped me realise that if we start planning today, we can live more intentionally.” She particularly enjoyed the Wishlist board game, which revealed personal behaviour patterns she had never fully recognised before. She plans to teach students to create personal income statements, helping them distinguish income from spending and appreciate financial planning from a young age.

For Kru Bouquet – Chutima Boonruedi, from Wat Parinayok Kindergarten, financial literacy is essentially “a discipline for life.” “I want children to grow up with the mindset: ‘save first, spend later,’ rather than the reverse. When parents give them money, they don’t have to use it all. And they can even talk to their parents about different ways to save.” She believes that financial discipline naturally contributes to overall personal discipline. Her plan is to share insights on saving, investment and the importance of life insurance with her community and with parents — encouraging children to start with small, simple saving habits such as putting coins into a jar. She also intends to introduce classroom-saving activities to fund class field trips, nurturing responsibility and planning skills through fun, relatable methods.

Meanwhile, Kru Mike – Isaree Tungtirawat said the workshop opened new perspectives for her as a mathematics teacher. It prompted her to reflect on her financial decisions and learn strategies for future financial planning. She intends to integrate budgeting and money-management activities into mathematics lessons so students learn through real-life application — while also instilling an understanding of money’s value and the importance of thoughtful decision-making. “We can teach children to calculate, but what truly matters is helping them understand where money comes from and how to use it wisely.”

Upon completing the “Thai Teachers Master Financial Literacy” programme, teachers shared that they had gained fresh inspiration, renewed perspectives and practical teaching tools. Many plan to apply these approaches in their classrooms through interactive games and activities that foster saving habits, purposeful spending and age-appropriate financial planning. This helps children grasp the importance of valuing money, using it thoughtfully and considering their future. The workshop has become a starting point that sparked new ideas among teachers — empowering them to expand and share financial literacy with students in meaningful, engaging ways.