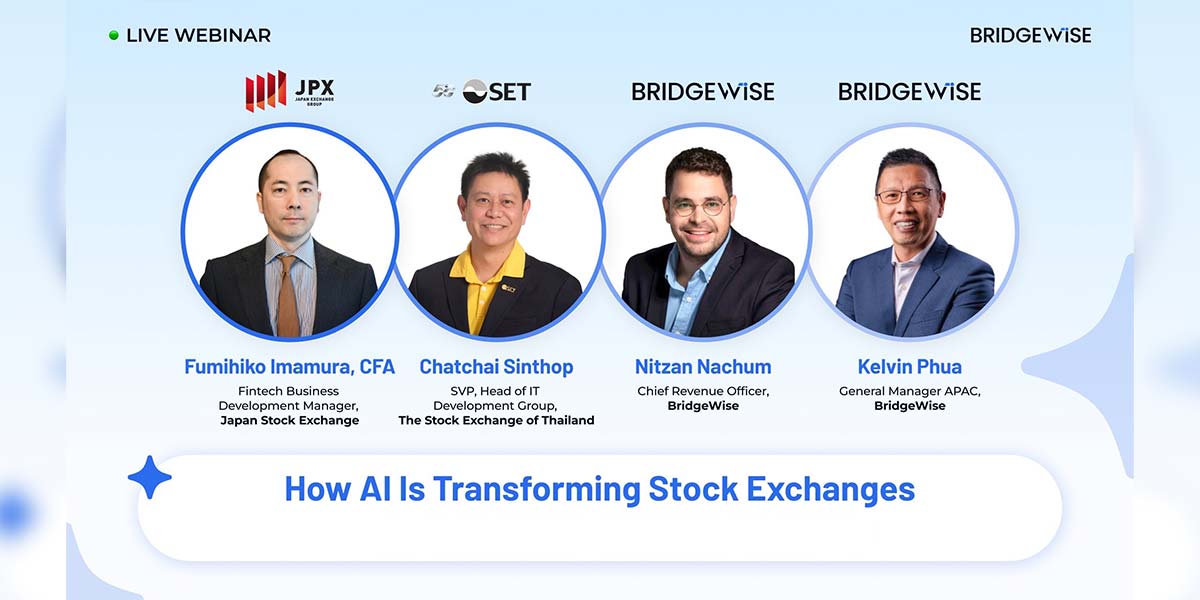

BridgeWise a global leader in AI for investment, hosted a webinar titled “How AI Is Transforming Stock Exchanges”, bringing together executives from Japan Exchange Group (JPX), The Stock Exchange of Thailand (SET), and BridgeWise to discuss how artificial intelligence is reshaping transparency, accessibility, and trust across global capital markets.

The panel featured Fumihiko Imamura, CFA, Fintech Development Manager at JPX, Chatchai Sinthop, Head of IT Development Group at SET, Nitzan Nachum, Chief Revenue Officer at BridgeWise, and Kelvin Phua, General Manager, Asia Pacific at BridgeWise, who also moderated the session.

Three Key Takeaways from the Discussion

1. AI Strengthens Market Integrity and Fairness

According to Chatchai Sinthop, Senior Vice President and Head of IT Development Group at The Stock Exchange of Thailand, the Thai capital market began adopting predictive AI and machine learning as early as 2018 to enhance market surveillance and detect potential manipulation across millions of daily transactions. By 2019, SET expanded these capabilities into investor segmentation, enabling the delivery of more personalized and relevant investment information to support better decision-making.

“Our objective has always been to ensure a fair and transparent marketplace,” said Chatchai. “AI now supports real-time supervision and disclosure analytics, helping maintain confidence among investors and regulators alike.”

“We are developing a proof of concept to map financial statements to a standardized capital market taxonomy using AI. This initiative will accelerate the dissemination of financial insights and ensure that information is equitably accessible to all stakeholders,” said Chatchai.

He also shared that SET’s Digital Supervisory Project (DSP) now leverages AI to analyze over 50,000 financial and news documents per year, while the exchange’s collaboration with Nasdaq is expected to advance AI-driven risk management and monitoring capabilities as part of SET’s 2025-2027 roadmap for “Fair and Inclusive Growth.”

2. AI Creates New Value and Discovers Possibilities

Artificial intelligence is transforming how exchanges generate value, turning data into insights and insights into opportunity.

“AI is the great equalizer, enabling every listed company to benefit from institutional-grade analysis while making insights accessible in any language,” said Nitzan Nachum, Chief Revenue Officer at BridgeWise,

BridgeWise’s AI solutions, including Bridget™and StockWise help partner exchanges cover thousands of under-analyzed companies, converting unstructured data into monetizable intelligence. By layering premium AI insights onto existing datasets, exchanges can deepen understanding of market trends, attract more investors, and unlock new revenue streams.

3. AI as a Partner, Not a Replacement

Japan’s financial market is facing structural challenges from a shrinking workforce and an ever-growing volume of data to heavy paperwork in listings and limited analyst coverage for many companies. To overcome these hurdles, AI has become not just an option, but a necessity. By streamlining market monitoring processes, automating repetitive tasks, and consolidating scattered data into actionable insights, AI is helping exchanges manage rising complexity more efficiently.

As Fumihiko Imamura CFA, Fintech Development Manager of the Japan Exchange Group (JPX) explained, the real challenge lies in minimizing risks and building the right systems around AI to ensure responsible adoption. This transformation is expected to enhance operational efficiency, improve market liquidity, and enable retail investors to compete more equally with institutional players, ultimately fostering a more inclusive and dynamic capital market.

“It is not AI or people, it has to be the right combination. Looking ahead, I believe the future standard will be AI doing the screening and calculations across large data sets, with humans guiding and interpreting the outcomes,” Fumihiko added.

Lastly, the moderator Kelvin Phua, General Manager, Asia Pacific at BridgeWise closed the session, stating that AI is no longer just a back-office technology, but a front-line enabler of growth and innovation across global markets, setting a “new standard” for stock exchanges in the AI era.

“AI is transforming how exchanges operate, how investors access insights, and how markets build trust,” said Kelvin. “The collaboration between JPX, SET, and BridgeWise reflects a shared vision, that technology should not only drive efficiency but also inclusion and investor empowerment,” He added.

Building on its global momentum, BridgeWise has recently earned recognition from leading international institutions for its role in pioneering AI-driven investment transformation.

The company was named among the Top 100 by CB Insights and included in the ESGFinTech100 list for 2025, an annual ranking of fintech innovators advancing environmental, social, and governance principles.

These accolades further underscore BridgeWise’s position as a trusted partner for financial institutions seeking to enhance both performance and sustainability through responsible AI innovation.