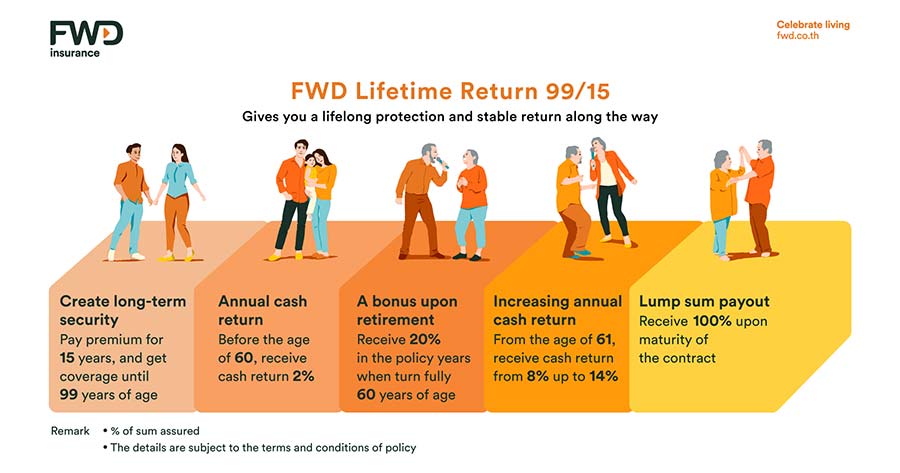

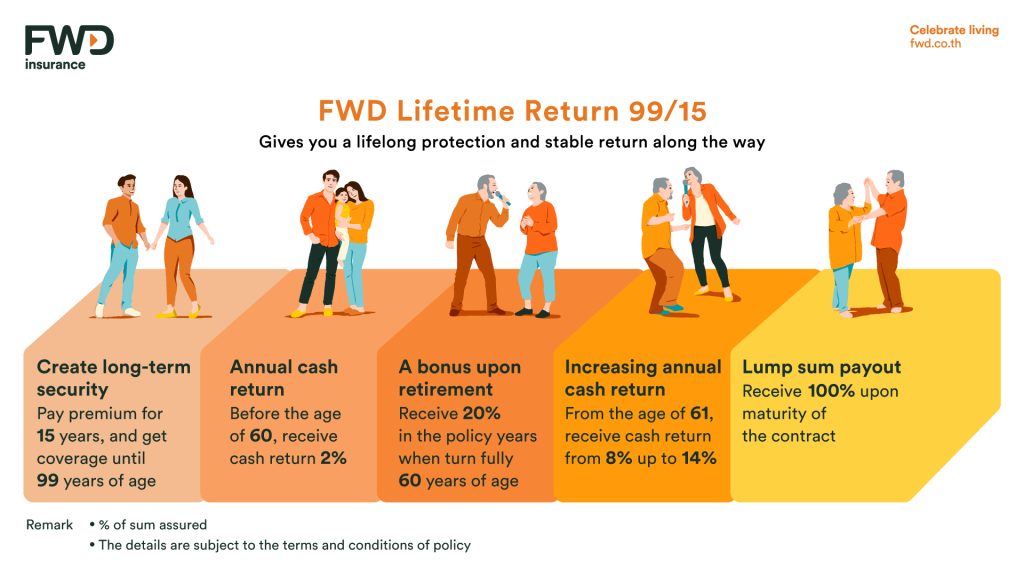

FWD Life Insurance Plc. (FWD Insurance) proudly presents its latest insurance solution, the “FWD Lifetime Return 99/15” policy. This innovative plan entails fixed premium payments over a span of 15 years, ensuring lifelong protection and providing annual cash returns until the policyholder reaches the age of 99. Moreover, upon reaching age 60, policyholders are entitled to a lump sum bonus equivalent to 20% of the sum assured, enriching their retirement provisions. This product is designed to provide stability and confidence by offering long-term financial security for families.

Mr. David Korunić, Chief Executive Officer for Thailand & Cambodia of FWD Insurance, reaffirmed FWD Insurance’s dedication to supporting individuals in living worry-free lives with the assurance that FWD Insurance has their backs. The “FWD Lifetime Return 99/15” insurance has been tailored to meet the needs of customers seeking financial security for themselves and their families. It provides lifelong protection with fixed premiums throughout the policy term, enabling policyholders to gradually accumulate savings and receive consistent annual returns starting from the first policy year. This aspect is particularly appealing to working-age individuals aiming to build long-term financial reserves and secure a significant lump sum upon retirement at age 60. Post-retirement, policyholders continue to receive annual cash returns, increasing with age, reaching up to 14% of the sum assured. This feature is advantageous for individuals intending to leave behind substantial inheritances for their loved ones. Overall, the product is designed to bring peace of mind and financial security to families, ensuring smiles and happiness are abundant throughout life’s journey.

Key features of the “FWD Lifetime Return 99/15” life insurance policy include:

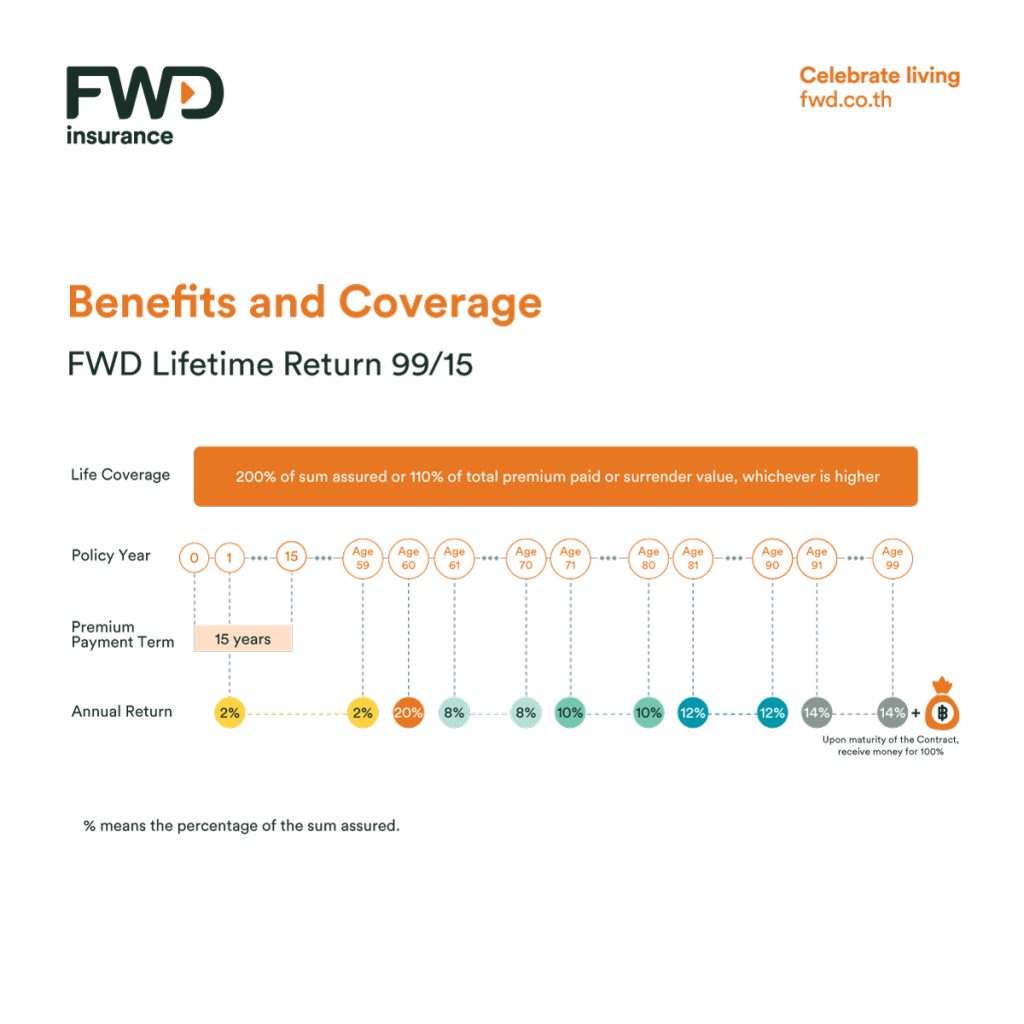

- Premium payments spanning 15 years, with coverage extending until age 99.

- Annual cash returns, commencing at 2% of the sum assured from the first policy year until just before reaching age 60.

- A lump-sum bonus of 20% of the sum assured upon reaching age 60. Subsequently, policyholders receive annual cash returns ranging from 8% to 14% of the sum assured, starting at age 61. Upon contract maturity, policyholders receive 100% of the sum assured as the maturity benefit.

- In the event of loss of life, policyholders’ beneficiaries receive a lump sum of either 200% of the sum assured, 110% of the total premium paid, or the surrender value, whichever is higher.

- The eligible age ranges from 1 month and 1 day old up to 50 years of age.