The Republic of the Union of Myanmar intends to promote foreign investments in the electric vehicle sector in Myanmar by means of a mix of legal and policy initiatives aimed at incentivizing such investments.

For the purpose of this article we have considered the year 2022 as the most critical year for legal regulations on electric vehicles (“EVs“) and have pivoted our discussion on legal developments prior to, during and after 2022”.

Pre-2022: General rules on automobile retail showrooms and importation of Vehicle’s

Prior to 2022, Myanmar had general laws regulating the importation and display of all types of vehicles in showrooms, including license requirements for owning and operating showrooms for said purpose.

As per a notification released by the MOC in March 2021, a DICA registered service company is eligible to apply for and obtain a showroom license upon fulfilling the conditions prescribed in the said notification.

Some of the key provisions of the notification are as follows:

- Foreign investors can operate these showrooms through joint ventures with Myanmar partners;

- A company that intends to open a vehicle showroom must deposit MMK 100 million in a bank account at any bank recognized by the CBM;

- The company is required to submit a tax clearance to the Internal Revenue Department;

- The area of the vehicle showroom shall be 14,000 square feet, and – the area of the storage facility shall be 5,000 square feet;

- The showroom license is non-transferable;

- The model year of the vehicles to be imported must be only one year lower than the year of arrival, and only left-hand drive vehicles must be imported;

- Vehicles to be displayed and sold at automobile showrooms can be imported on a consignment basis or by Letter of Credit or telegraphic transfer system;

- When importing vehicles, they must be imported at the port or the relevant border trade station during the license period and import only the numbers and types of vehicles specified by the MOC annually;

- Imported vehicles shall be kept only in designated vehicle showrooms and storage facilities, and separate permission is required if the vehicle is intended to be displayed and sold in places other than the showroom.

Based on informal inquiries with the officials of the Ministry of Commerce (“MOC”), we understood that although these directives do not specifically include EVs within their remit, however, as a matter of practice, they extend indirectly to importation and display of EVs as well.

Overall, there were no regulations that specifically applied to EVs – its manufacture and/or import into Myanmar. General laws applicable to all types of vehicles were deemed to apply to EVs.

2022: The Year of Electric Vehicles in Myanmar

Non-Urban Area EV Charging Station Pilot Project

On 31 August 2022, the Ministry of Electric Power agreed to a pilot project to build five electric vehicle charging stations on the Yangon-Mandalay expressway aimed at addressing the lack of charging options outside of urban areas. The duration of this project is 12 months commencing from 1 January 2023 and ending on 31 December 2023.

As per the statement of the MoEP, each of the new charging stations will be installed with the capacity to simultaneously charge 50 EVs. Further the statement also disclosed the location of the charging stations at Zero Mile No. 3 Highway junction, 115th Mile Pyu Rest Stop, 201/2nd milepost Naypyitaw C-junction, 284/4th milepost Theegon bus terminal, and 352/3rd milepost Sagaing junction.

Types of Battery Electric Vehicles, Spare Parts and their Import into Myanmar

A notification issued by the Ministry of Planning and Finance (“MoPF”) in November 2022 (valid until 31 March 2023) stated that the tariff rates specified in the 2022 Tariff List are reduced to 0% for the following types of battery-operated electric vehicles (“BEVs”) imported into Myanmar as completely built up (CBU), completely knocked down (CKD) or semi-knocked down (SKD) units, namely:

- road tractors for semi-trailers,

- buses or motor vans for the transport of ten or more people (including the driver),

- trucks,

- motor vehicles for personal use,

- three-wheeled vehicles for the transport of persons,

- three-wheeled vehicles for the transport of goods,

- electric motorcycles,

- electric bicycles,

- ambulances,

- prison vans, and

- hearses.

The said notification further stated that above tariff reduction also applied to import of accessories for the BEVs (such as traction battery pack, electric traction motor, charging station equipment, charging system equipment, suspension system and so on) with approval for importation by the Ministry of Electric Power, and spare parts for the BEVs above with approval for importation by the Ministry of Industry.

Importation of BEVs during the Pilot Project by Companies not having a Showroom License

A notification issued by the Ministry of Commerce (“MOC”) in November 2022 (w.e.f. 1 January 2023 till 31 December 2023), states that to import EVs without a license to open and operate a showroom, a company is required to do the following:

Be registered as a company, either wholly owned by nationals or a joint venture, at the Directorate of Investment and Company Administration (DICA);

- Be able to present the purchase and sales agreement for each brand of imported EVs;

- Receive approval from the National Level Committee for Development of Electric Vehicles and Related Businesses, and import according to the quality and quantity of electric vehicles permitted by the committee;

- Arrange the necessary warranty, spare parts availability, and after-sales service for the imported EVs;

- Deposit a bank guarantee of MMK 50 million at a bank recognized by the Central Bank of Myanmar; and

- Apply for a purchase permit at the MOC, for the purpose of registering the imported vehicles with the Road Transport Administration Department.

Tax Exemptions for Battery Electric Vehicles (“BEVs”)

On 17 November 2022, the law amending the Union Tax Law was enacted. The amendment provided exemptions on specific goods tax and commercial tax for BEVs (and their batteries) commencing (retrospectively) from 1 October 2022.

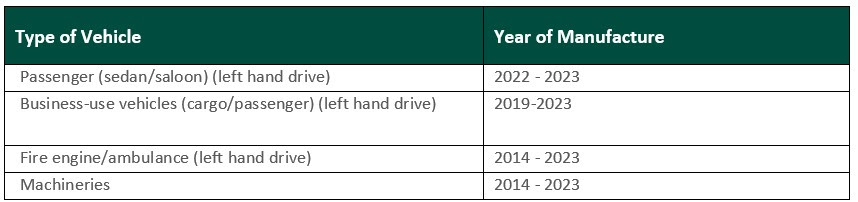

Designated Manufacturing Years for Import of Vehicles into Myanmar

Note that the MOC annually issues a list containing the types of vehicles and their manufacturing year for the purpose of importation into Myanmar.

Pursuant to a notification in December 2022, the MOC listed the following types of vehicles and designated the permissible manufacturing duration for their import into Myanmar:

The Notification also included a list of imported commercial vehicles that cannot be driven on public roads such as excavators, bulldozers, wheel Loaders, vibratory rollers, clamp loaders etc. Such vehicles may be imported into Myanmar if they were manufactured within the past 15 years or 2009 and later. We understand that this regulation will also, as a matter of practice, apply to EVs of the type described in the table above.

Electric Motorcycle Showroom Requirements

Subsequently, in January 2023, the MOC issued a notification which stated the regulations to be followed by companies intending to own and operate motorcycle showrooms when importing electric-powered motorcycles.

The requirements outlined in this notification are similar to those stated in the notification of March 2021 (please see above). Among other things, this notification states that the area of the motorcycle showroom (including office, lounge, and after-sale service center) shall be at least 5,000 square feet, and MMK 50 million shall be deposited by the showroom owner in a bank account at any bank recognized by the CBM.

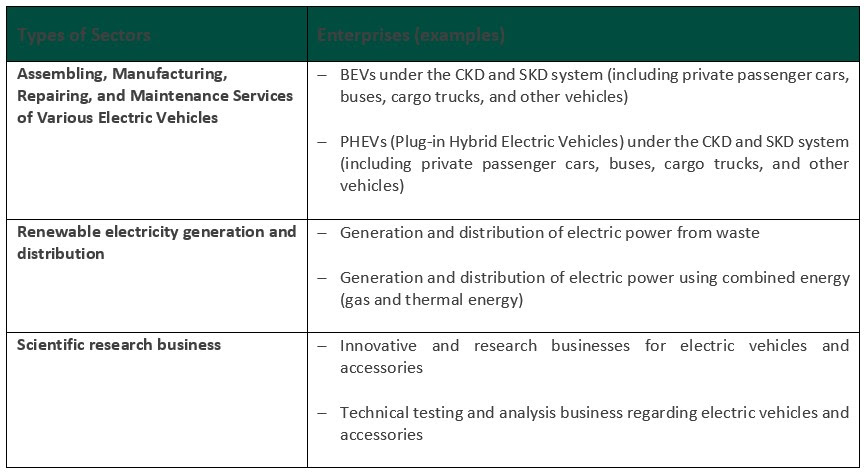

2023: Electric vehicles now a promoted sector!

The Myanmar Investment Law, 2016 (“MIL”) identifies certain sectors of the Myanmar economy as ‘promoted sectors’ and lists those sectors under a notification. Some of the sectors listed therein are supply and transport services, healthcare services, hotel and tourism services and so on.

On application to the MIC, a business in the ‘promoted sector’ will be entitled to receive exemptions or reliefs from either customs duties or other internal taxes or both on machinery, equipment, instruments, machinery components, and spare parts which are imported into Myanmar to be used during the construction period or the preparatory period of the investment business.

As recent as February 2023, the MIC issued a notification regarding the “Investment Sectors to be Promoted as a Priority (Electric vehicle-related businesses)” (the “EV Notification”).

The EV Notification lists the types of business activities in the EV sector that will be entitled to receive incentives and exemptions stipulated in the MIL. Some of the key sector and enterprises listed in the EV Notification are as follows:

Conclusion

Based on the above, we understand that Myanmar’s legal framework regulating investment in the EV sector has been developing over a few years. The recent announcement by MIC to bring foreign private investment in EVs under the promoted sector businesses category could be considered a potential step towards jump-starting investments in this sector.

For further information regarding the matter, please contact; [email protected]