Overview

On the 16th of May 2023, the New Law on Taxation (“New Taxation Law”) was promulgated by Royal Kram No. NS/RKM/0523/004.

The New Taxation Law abrogates the Law on Taxation, promulgated by Royal Kram No. NS/RK/0297/03, dated February 24, 1997 (“Former Taxation Law”), and the Law on Amendment to the Law on Taxation, promulgated by Royal Kram No. NS/RK/0303/010, dated March 31, 2003.

The New Taxation Law consists of 20 Chapters and 255 Articles – a significant increase from the Former Taxation Law which consisted of 7 Chapters and 155 Articles.

While the New Taxation Law does not reflect a complete overhaul of the existing tax framework in Cambodia, the increase in Chapters and Articles are indictative of the underlying objective to fill in gaps and ensure consistency by centralizing existing tax regulations, international tax agreements and practices under the one law.

We set out below some of the key features of the New Taxation Law.

New Chapters

As noted above, one of the main objectives of the New Taxation Law is to centralise information regarding the application and calculation of taxes under one regulation. This has resulted in the creation of additional chapters in the New Taxation Law dealing with Specific Tax, Public Lighting Tax, Accomodation Tax, Patent Tax, Tax on Advertising Billboards, Rental of Immovable Property and Tax on Immovable Property, Stamp Duty, Capital Gains Tax, Unused Land Tax and Transportation Tax.

The taxes outlined above already exist under current tax regulations with the main point being that they can now be accessed under the New Law on Taxation helping taxpayers to have easier access and understanding of their tax obligations.

Definitions

As with its predessor the New Taxation Law contains a “Definitions” Article (Article 5) which, as its name suggests, defines the key terms that are used throughout the New Taxation Law. Of note are changes to the definition of “Permanent Establishment” and “Related Party” and the introduction of a new defined term concerning “Business Alliances”. These changes reflect the international tax treaties which Cambodia has entered into and international trends.

Domestic Developments

Recent domestic tax developments have also been incorporated into the New Taxation Law in particular the 2021 Investment Law (including the minimum tax exemption, tax deduction allowances and domestic VAT on Production Inputs), the the Non-Resident E-Commerce Value Added Tax regime.

Tax Authority Powers

The New Taxation Law contains significant developments concerning how the tax authority carries out its affairs and the powers it is afforded. Of note is the inclusion of electronic communication to the existing means by which the tax authority can communicate with taxpayers. The key point being that a notification is deemed to have been provided by the tax authority on the date that the electronic communication is sent. This is of particular importance with respect to events such as tax audits which require taxpayer responses to be submitted within a prescribed timeframe (triggered by a tax authority notification). The key takeaway being that taxpayers should ensure that their contact details, including email addresses, are kept up to date with the tax authority.

The New Taxation Law also provides discretion to the tax authority to create a incentive scheme for tax officials, to fully or partially waive penalties and interest on taxpayer re-assessments, and to prioritize tax liens over general creditors rights. In addition the New Taxation Law requires third parties such as banks to respond to tax authority requests for taxpayer information within a fixed timeframe of 30 days or face a penalty.

Penalty Increase

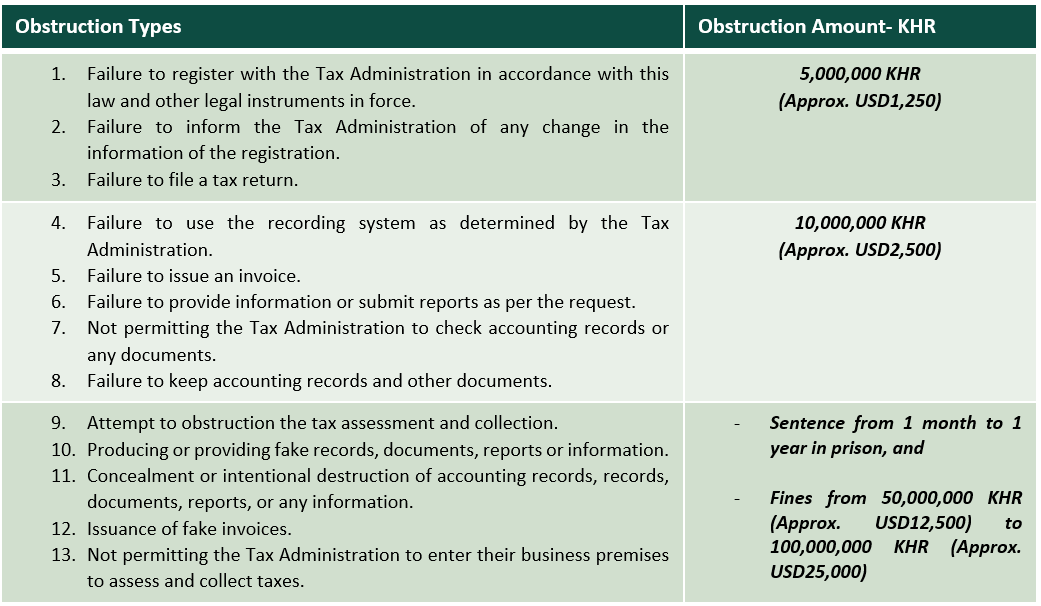

There is a significant increase in the level of fines and imprisonment terms under the New Taxation Law as tabled below. Noting that the penalty is per offence i.e. there may be multiple offences committed leading to a potential high penalty exposure.

New Crimes

The New Taxation Law has also introduced four (4) new crimes which are outlined below:

- Practicing as a tax agent without a license;

- Failing to pay collected taxes;

- Collecting taxes without permission;

- Criminal liability for legal entities.

Those who are found guilty of any of the above offenses are not just subject to a penalty (up to USD 25,000) but also potentially to imprisonment (up to 3 years).

General Anti-Avoidance Rule (GAAR)

Article 194 of the New Taxation Law provides power to the tax authority to:

“Reject and/or re-determine the real elements of any transactions if it is found that the taxpayer has prepared or had any transactions that represent false or unreal intention to reduce or eliminate the tax payable contrary to the intention of the tax provisions”.

GAAR’s can be found in a number of jurisdictions and provide a set of broad and general principles-based rules within a country’s tax code that enables tax authorities to counteract perceived tax avoidance.

There is often tension between the application of a GAAR and the need for taxpayer certainty on positions that they have taken based on their interpretation of the tax provisions. Hence it is hoped that there will be further guidance over the coming months on how the GAAR in the New Taxation Law will be applied by the tax authority and what safeguards may be available to taxpayers looking to obtain upfront certainty on tax positions that they wish to take.

Final Comments

The observations outlined above are just a small snapshot of some of the changes under the New Taxation Law. All taxpayers should be aware that the New Taxation Law took effect from the 16th of May 2023. If you are in doubt as to how the New Taxation Law may impact your business please reach out to the DFDL tax team or your usual DFDL advisor.

For further information, please contact;

Clint O’Connell, Partner, Head of Cambodia Tax Practice Group, [email protected]

Vajiravann Chamnan, Tax Director, [email protected]