Part One, click here, of our analysis of Sub-Decree 139 (“Sub-Decree 139”), that was adopted on 26 June 2023, outlined that it established a comprehensive legal framework for implementing the Investment Law that was implemented in October 2021 (“2021 Investment Law”).

One of the most anticipated features of the 2021 Investment Law, and implementing Sub-Decree 139, has been the scope and application of tax and custom duty incentives applicable to new Qualified Investment Projects (QIP). We set out below a summary of the QIP tax and custom duty incentives under the 2021 Investment Law as further clarified in Sub-Decree 139.

Basic Tax Incentives

A QIP registered under the 2021 Investment Law is eligible for Basic Tax Incentives consisting of either a Tax on Income (TOI) Exemption Period or an Accelerated Depreciation Exemption. QIPs eligible for Basic Tax Incentives include Export/Domestic or Supporting QIPs.

(1) Tax on Income Exemption

The TOI Exemption Period of a QIP begins at the year of receipt of its first activity related income. To simplify the process for the determination of the length of the TOI Exemption Period, Sub-Decree 139 has established three (3) Investment Activity Categories which classify QIP investment activities based on whether they are high/medium or low-technology or whether they fall within a priority sector as set by the Cambodian Royal Government (RGC) as follows:

- Category 1 = Nine (9) year TOI Exemption Period

- Category 2 = Six (6) year TOI Exemption Period

- Category 3 = Three (3) year TOI Exemption Period

Following the conclusion of the TOI Exemption Period a QIP will enjoy a Graduated TOI rate (GTOI) for an additional six (6) years. For a QIP that is subject to the standard TOI rate of 20% the GTOI would be implemented as follows:

- End of TOI Exemption Period

- Years 1-2 = GTOI @ 5% (25% of 20% TOI)

- Years 3-4 = GTOI @ 10% (50% of 20% TOI)

- Years 5-6 = GTOI @ 15% (75% of 20%)

An exemption of the 1% Pre-payment of Tax on Income (PTOI) also applies to a QIP for the same period as its TOI Exemption Period. A Minimum Tax exemption is also available provided the QIP maintains annual external audited financial statements. An export duty exemption applies unless otherwise stated in law.

(2) Accelerated Depreciation

Instead of the TOI Exemption Period a QIP can elect to choose a 40% depreciation rate for capital expenditure that relates to the QIP activity. A QIP electing this option will also benefit from a 200% deductibility rate for Certain Expenses for a period that correlates to the Investment Activity Category of the QIP.

Certain Expenses are defined in Sub-Decree 139 as:

- Expenses relating to training on specific skills for Cambodian employees to substitute foreign employees,

- Expenses relating to online accounting software programs,

- Expenses relating to overseas scholarships provided to Cambodian employees to study certain skills,

- Expenses relating to study, R&D, hiring foreign experts to train new technologies, Industry 4.0 – including A.I., robotics or the arrangement of big data storage.

QIPs electing the Accelerated Depreciation option will also enjoy a Minimum Tax, PTOI and export duty exemption as per the Tax on Income Exemption Option.

Custom Duty Incentives

In addition to the election of a Basic Tax Incentive, importation duties/taxes of a QIP will be borne by the RGC as follows:

- Customs duty, specific tax, and VAT on the importation of Construction Material, Construction Equipment and Production Equipment to serve a production line.

- Customs duty, specific tax, and VAT for the importation of Production Inputs of an Export QIP or Supporting Industry Export QIP to serve its production line.

- Customs duty, specific tax and value added tax for the importation of Production Inputs for certain Domestic QIP’s for their production line.

It should be noted that Production Inputs, Production Equipment, and Construction Material are all defined terms in Sub-Decree 139.

Additional Incentives

In addition to the Basic Tax Incentives a QIP will also benefit from additional incentives as set out below:

– A zero-rating for VAT on locally produced Production Inputs for the implementation of the QIP.

– A deductible expense of 150% for the following costs:

(a) R&D and innovation,

(b) Human resource development via vocational training to Cambodian workers,

(c) Construction of accommodation, canteens, food courts, nurseries, and other facilities for workers,

(d) Modernizing of production line machinery,

(e) Welfare promotion to Cambodian workers i.e., home to work transportation, food courts with

affordable meals, nurseries, and other facilities,

(f) Investment/construction of infrastructure for waste treatment.

A QIP that imports Construction Material or Equipment for the construction of accommodation, nurseries, first aid rooms, canteens, food courts that provide affordable meals exclusively for its workers at its location will be exempted from customs duty, specific tax and VAT on those imports.

Expansion QIP (EQIP)

The Taxable Income of a EQIP will be exempted from TOI and PTOI and for a period that is determined by the Investment Activity Category of the QIP. The Taxable Income of the EQIP that qualifies for the TOI/PTOI exemption is determined as follows:

- Exempted Taxable Income = Total Taxable Income × (investment capital of the EQIP/total investment capital)

- Where:

– Total Taxable Income = Taxable Income from existing QIP + Taxable Income of EQIP

– Total Investment Capital = Capital of existing QIP + capital of EQIP

A E-QIP is also exempted from Minimum Tax provided it has external audited financial statements.

Motor-Vehicle Assembly – QIP

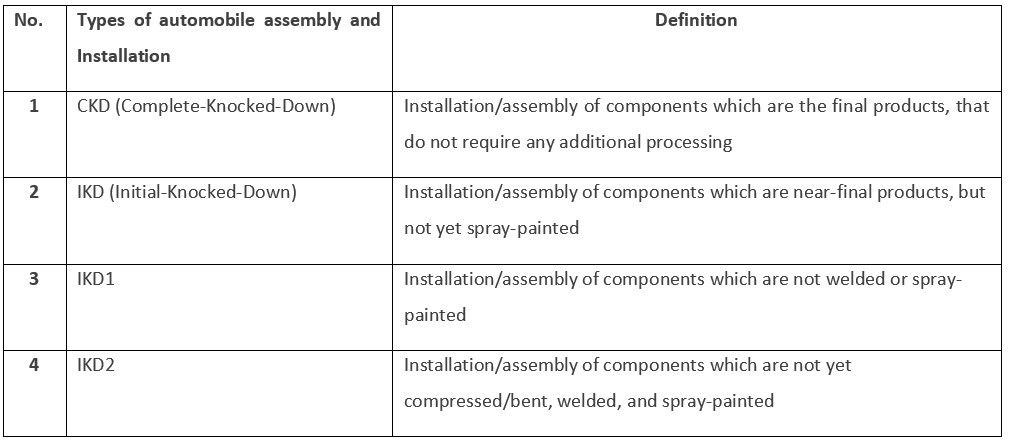

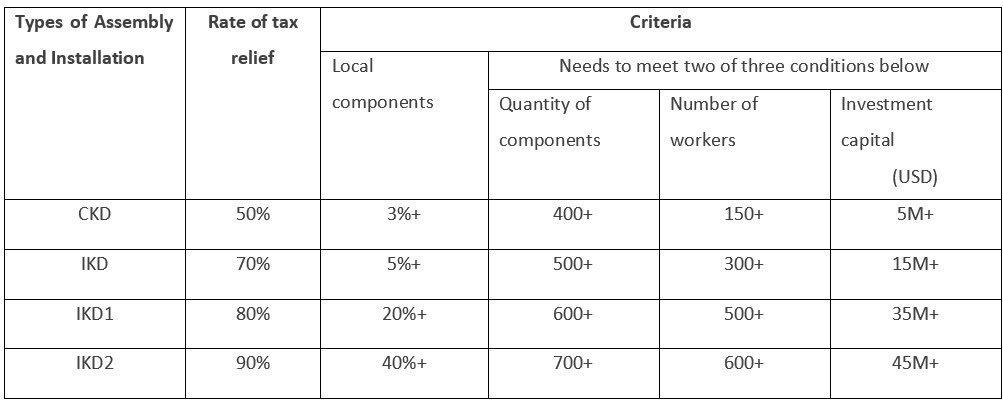

Sub-Decree 139 codifies the previously issued Notification 1906 which provided incentives on the importation of motor vehicle assembly parts for QIPs that assemble motor-vehicles for the domestic market. The rate of importation duty/tax relief for the imported parts applies to customs duties, specific tax and VAT as tabled below.

Our team at DFDL is readily available to speak with you and address any concerns you may have on how to structure your projects pursuant to the New Investment Law.

Should you have any concerns or queries on the impacts of the above New Investment Law on you or your business, please contact us at: [email protected].