“Oil runs the world”, they said. The crude oil is essential to the economy nowadays. Whenever its price rises, the inflationary effect could be felt on every household. The current world affair makes Bank of America (BofA) analysts speculate that the crude oil price could potentially double.

After the Israel-Gaza conflict broke out in recent weeks, both Brent and WTI crude oil prices had broken the $90 level, causing many to speculate that the $100 resistance might not last. The last few times that crude oil price broke the $100 level was the two periods around 2011-2013 and the 2022, which was also the high inflation period from the US Fed QE policy that some called the “money printing”. However, that’s not the main factor that will double the price.

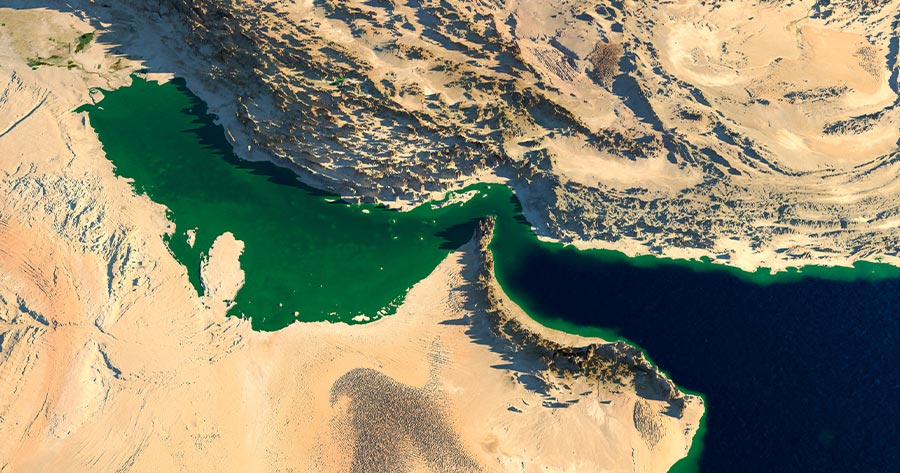

According to Nasdaq historical oil data, the oil price in the 1970s jumped over $36 a barrel from below $2, at least a 17 times higher during the middle-east conflict which was mainly around Iran. The nearby hotspot, the Strait of Hormuz, sat between the Persia and Oman Gulf, which is the world’s main sea lane for oil transportation from the OPEC such as Saudi, Oman, Iraq and Iran. If Iran decides to block this channel, it’s possible to see over $250, the BofA analyst wrote.

There’s been bad blood between the US and Iran for decades. The on-going Israel-Gaza conflict where both sides assist the opposition. The recent further sanction and accusation from the US on Iran could escalate the conflict further which may block the mentioned oil lane, causing shortage on global supply.