Silom Advisory Co., Ltd., an independent financial advisor (IFA), has published a report regarding the share purchase transaction of AIT and TKC share allocation transaction.

Turnkey Communication Services Public Company Limited (SET: TKC) announced in July that it will acquire ordinary shares in Advanced Information Technology Public Company Limited (SET: AIT), including 16.60% of shareholding from Sabuy Technology Public Company Limited (SET: SABUY) and 2.61% from Mr. Chookiat Rujanapornpajee (SABUY’s major shareholder and CEO), in the total amount that represents 24.95% of all issued and paid-up shares in AIT at a value of THB 6.80 per share, the total purchase price will be THB 2,428,460,002.80.

As part of the acquisition, TKC will raise its capital and allocate as follows:

1) Allocation of the newly issued ordinary shares of not exceeding 9,254,700 shares at a par value of THB 1.00, with the offering price of THB 25.00 per share, in a total value of THB 231,367,500.00 to Mr. Sina Oontornpan.

2) Allocation of the newly issued ordinary shares of not exceeding 8,745,300 shares at a par value of THB 1.00, with the offering price of THB 25.00 per share, in a total value of THB 218,632,500.00 to Ms. Sinanang Oontornpan.

3) Allocation of the newly issued ordinary shares of not exceeding 64,627,200 shares at a par value of THB 1.00, with the offering price of THB 25.00 per share, in a total value of THB 1,615,680,000.00 to SABUY as payment in kind instead of cash for the consideration of Share Purchase Transaction of AIT.

4) Allocation of the newly issued ordinary shares of not exceeding 10,000,000 shares at a par value of THB 1.00, with the offering price of THB 25.00 per share, in a total value of THB 250,000,000.00 to BCH Ventures Company Limited.

5) Allocation of the newly issued ordinary shares of not exceeding 7,372,800 shares at a par value of THB 1.00, with the offering price of THB 25.00 per share, in a total value of THB 184,320,000.00 to Mr. Palin Lojanagosin.

Note that the allocation to SABUY will result in the company becoming the second major shareholder of TKC.

Moreover, Mr. Palin Lojanagosin is the major shareholder and CEO of Plan B Media Public Company Limited (SET: PLANB).

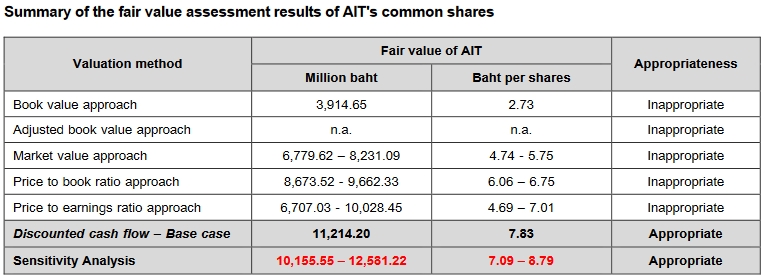

In the report, the IFA opined that the fair value of AIT’s ordinary shares by the discounted cash flow approach is an appropriate approach to evaluate the fair value of AIT’s ordinary shares because it reflects the operating results and taking into account the ability to generate future cash flow. The fair value of ordinary shares of AIT calculated from the discounted cash flow approach is between 10,155.55 – 12,581.22 million baht or equivalent to 7.09 – 8.79 baht per share and has a base case fair value of 11,214.20 million baht. and the share value is 7.83 baht per share, so it can be analyzed that the trading price of 6.80 baht is lower than the base price on the day the restructuring was completed.

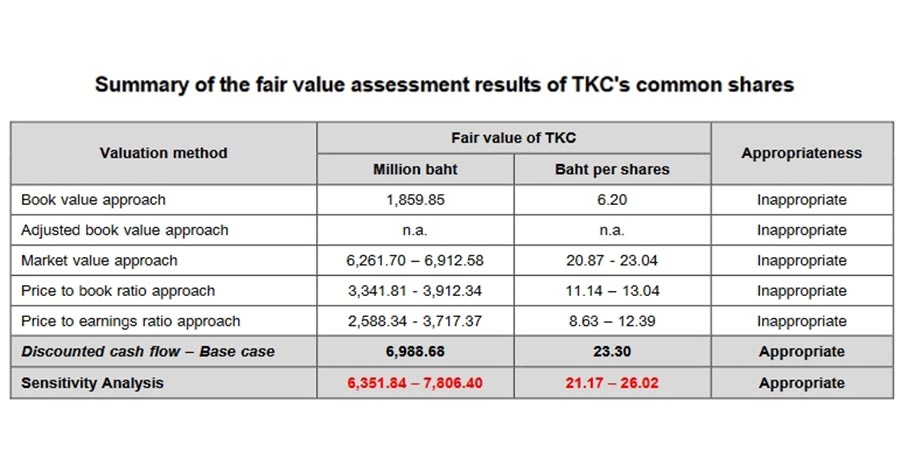

Meanwhile, the IFA opined that the opinion that the fair value of TKC’s ordinary shares by the discounted cash flow approach is an appropriate approach to evaluate the fair value of TKC’s ordinary shares because it reflects the operating results and taking into account the ability to generate future cash flow. The fair value of ordinary shares of TKC calculated from the discounted cash flow approach is between 7,806.40 – 6,351.84 million baht or equivalent to 21.17 – 26.02 baht per share and has a base case fair value of 6,988.68 million baht. and the share value is 23.30 baht per share, so it can be analyzed that the trading price of 25.00 baht is higher than the base price on the day the restructuring was completed.

Meanwhile, the IFA opined that the opinion that the fair value of TKC’s ordinary shares by the discounted cash flow approach is an appropriate approach to evaluate the fair value of TKC’s ordinary shares because it reflects the operating results and taking into account the ability to generate future cash flow. The fair value of ordinary shares of TKC calculated from the discounted cash flow approach is between 7,806.40 – 6,351.84 million baht or equivalent to 21.17 – 26.02 baht per share and has a base case fair value of 6,988.68 million baht. and the share value is 23.30 baht per share, so it can be analyzed that the trading price of 25.00 baht is higher than the base price on the day the restructuring was completed.

Based on the above reasons, the IFA is of the view that the Share Purchase Transaction of AIT and TKC Share Allocation Transaction are reasonable. Therefore, the company’s shareholders should approve the transaction at this time. However, the shareholders should consider the rationale and opinion of the IFA. which is based on the assumption that information, documents and draft documents received Including interviews with executives and related persons are true, complete and accurate and shareholders should consider the conditions and conditions of entering into such transactions.