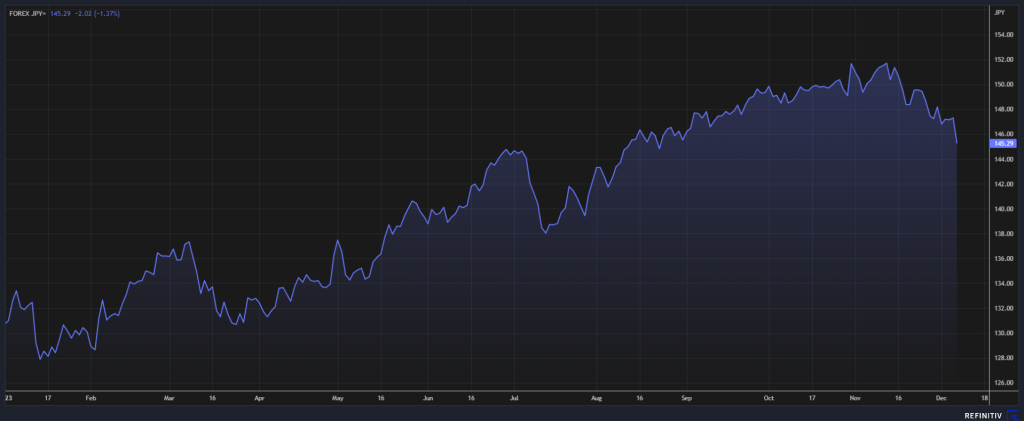

The Japanese yen outperformed other currencies in the region today as it rose 1.5% against the US dollar for the biggest one-day gain since January and the strongest in more than three months.

The Bank of Japan (BOJ) is a black sheep among major central banks as it maintains a policy of ultra-low rates that has sent its own currency to decades low against the greenback several times in recent years that forced the government to intervene in the market.

Expectations are growing in the foreign exchange market for BOJ to finally give a signal that it will soon relax the ultra-low interest rates policy at the meeting scheduled next week.

Kazuo Ueda, BOJ Governor, noted that once the central bank pulls short-term borrowing costs out of negative territory, it will give several options on the monetary policy.

The yen was last up 1.48% against the US dollar at 145.16.

Meanwhile, the dollar index, which is a basket of the greenback against major currencies, dipped 0.28% to 103.86 as markets see an imminent rate cut by the Fed of around 125bps next year.