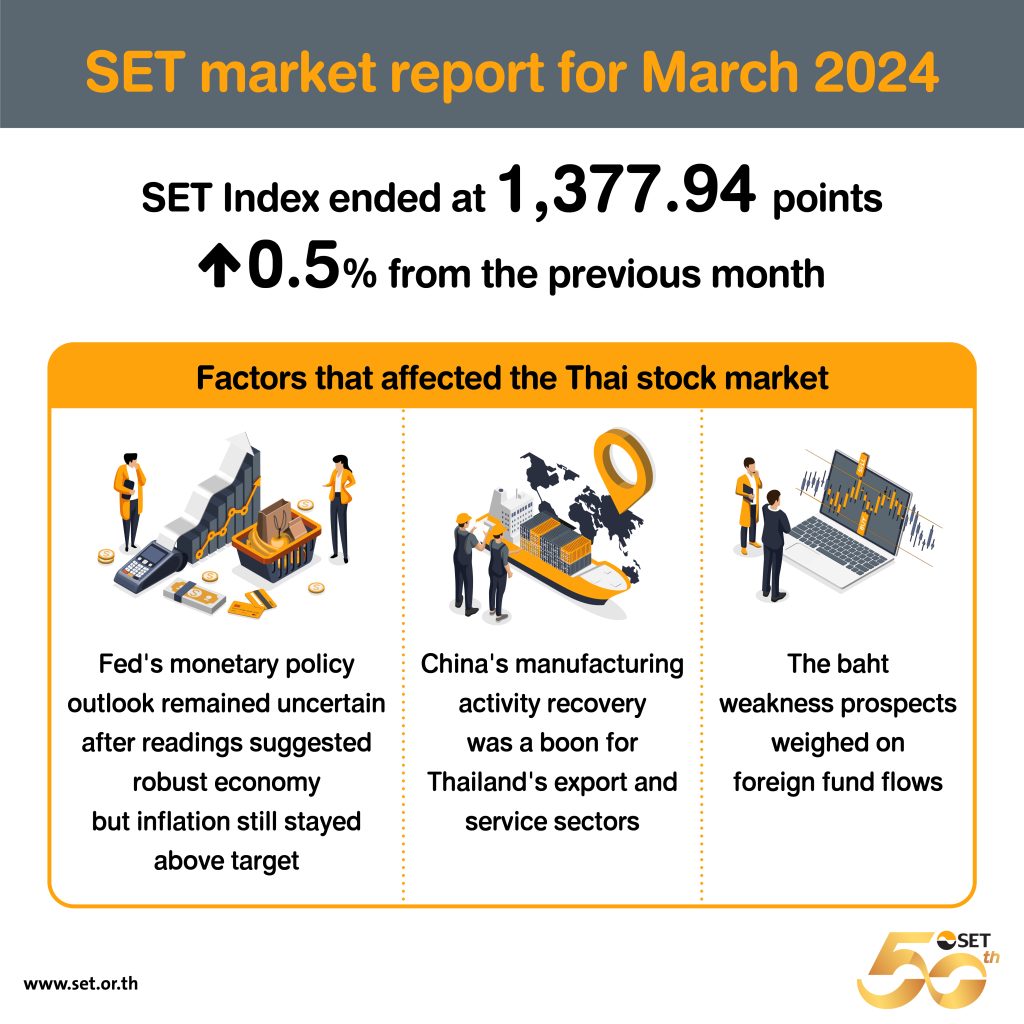

The global economic growth deceleration is looming, but it has not yet entered a recession. Monetary policy divergence is apparent after inflation has not been eased as much as expected. According to the latest US labor market’s readings, non-farm payroll is still healthy while unemployment rate remains at a low level, resulting in the slower-than-expected decline in inflation. Even though the Federal Reserve (Fed) sees rate cuts on the horizon, investors are increasingly concerned that Fed pivot could be delayed and the baht’s downside bias remains intact, accordingly. Moreover, offshore fund outflows from the equity market, particularly big-cap stocks, are expected to continue but small to mid-cap stocks are increasingly catching investors’ eyes.

SET Senior Executive Vice President Soraphol Tulayasathien said that the Chinese National People’s Congress in March set a 5 percent economic growth target for the year 2024. China’s Purchasing Managers’ Index (PMI) in March expanded to 50.8 from 49.1 in February, beating analysts’ forecasts and reaching the highest level since March 2023, which was the period after the strict COVID-19 measures were lifted. Rebound of the world’s second largest economy will come as a boon to Thailand’s export and service sectors, helping the domestic consumption recover at a faster pace. Consequently, analysts started to raise profit forecasts of related businesses and their share prices yielded higher returns than the market’s average.

Key highlights for March

- At the end of March 2024, SET Index rose by 0.5 percent from the previous month to close at 1,377.94 points, moving in line with the regional peers. However, the benchmark fell 2.7 percent from the end of 2023.

- In March, industry groups that outpaced SET Index when compared with the end of 2023 were Consumer Products, Services, Financials, and Resources.

- SET’s and Market for Alternative Investment (mai)’s average daily trading value in March 2024 dropped 30.2 percent from a year earlier to THB 42.78 billion (approx. USD 1.17 billion). Foreign investors turned to sell Thai shares with a net THB 41.24 billion in the month, constituting their net sales of THB 68.86 billion for the three months to March. Foreign investors’ trading ratio was higher than any other types of investors for 23 consecutive months.

- In March 2024, there was a newly SET-listed company: Bangkok Genomics Innovation pcl (BKGI).

- The Thai stock exchange’s forward P/E ratio at the end of March 2024 was 14.6 times, above the Asian stock market’s average of 12.5 times. The historical P/E ratio stood at 16.7 times, surpassing the Asian stock market’s average of 15.5 times.

- Dividend yield ratio at the end of March 2024 was 3.30 percent, exceeding the Asian stock market’s average of 3.23 percent.

Derivatives Market

- Thailand Futures Exchange (TFEX)’s daily trading volume in March 2024 averaged 499,897 contracts, surging 26.9 percent from the previous month largely due to the increase in trading volume of SET50 Index Futures and Single Stock Futures. For the first quarter of 2024. TFEX’s daily trading volume fell 27.5 percent from the preceding year to 432,895 contracts mainly due to the decline in trading volume of Single Stock Futures and SET50 Index Futures.