The share price of JAS rose 25.8% at the opening on Monday to THB3.60 per share after the company announced a share repurchase program that was nearly 75% higher from its closing price last Friday at THB2.86 per share.

Jasmine International Public Company Limited (SET: JAS) has announced that in accordance with the Board of Directors meeting on April 19, 2024, approved the share repurchase program for financial management purposes, while also issuing a warrant to existing shareholders at a ratio of 2:1.

The share repurchase program will commence by way of an offer to general shareholders with a maximum amount not exceeding THB 1,504 million, at the price of THB 5 per share, which is the price applied to all shares, and the number of shares repurchased not exceeding 300,748,563 shares, which is equivalent to 3.50 percent of the Company’s current total paid-up shares.

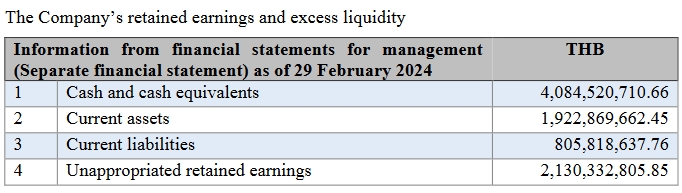

This program is for financial management purposes, utilizing remaining cash from asset disposal transactions in November 2023 and the interim dividend payments (special) to the Company’s shareholders on 26 December 2023. The program will be open to the Company’s shareholders to express their intention to sell shares back to the Company between 25 June 2024 to 23 July 2024.

Moreover, the Board also approved the principle of issuance and offering of warrants to subscribe for newly issued ordinary shares of JAS (JAS-W4) to the Company’s existing shareholders in an amount not exceeding 4,146,033,754 units without consideration (“JAS-W4 Warrants”), in proportion to their shareholding (Rights Offering), in a ratio of 2 existing ordinary shares (at the par value of THB 0.50 per share) to 1 unit of JAS-W4 Warrants (2:1). The Company will not allot JAS-W4 Warrants to shares that have been repurchased by the Company.

The issuance and offering of JAS-W4 Warrants and accommodated ordinary shares is expected to be no later than mid-October 2024.

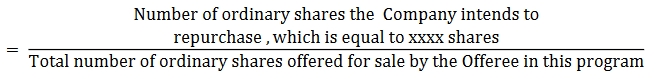

In the event that the total number of ordinary shares offered for sale is higher than the number of ordinary shares the Company intends to repurchase, the Company will repurchase the offered ordinary shares by allocating the shares to be repurchased in proportion to the total number of ordinary shares offered for sale at this time (pro rata), with the following calculation formula:

The proportion of ordinary shares that the Company will repurchase per the number of shares offered for sale by each Offeree.