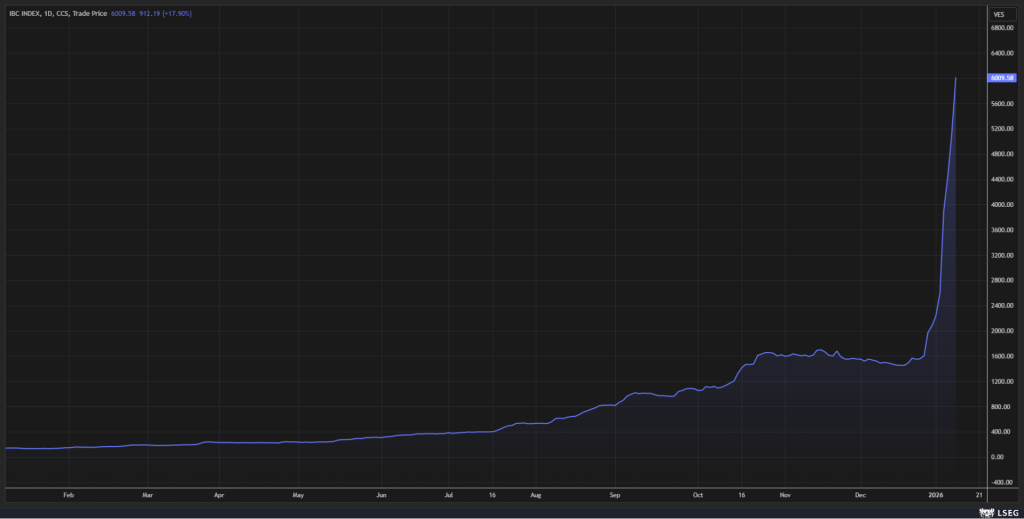

Venezuela’s stock market has soared to unprecedented heights in the wake of former President Nicolás Maduro’s capture by U.S. forces, defying initial concerns and signaling renewed confidence among investors. The country’s principal index, the Indice Bursatil de Capitalizacion (IBC), has climbed more than 188% since the start of the year.

Market participants view this rally as a reflection of growing optimism that the nation could emerge from years of economic turmoil, stringent sanctions, and bond defaults. Analysts attribute the surge to heightened expectations that a reshaped government might attract much-needed investment, boost oil production, and potentially mend diplomatic and economic ties with the United States.

Research firm BMI indicated that current developments are likely to result in a government that largely continues existing policies but exhibits new behaviors rather than undergoing sweeping democratic reforms or total systemic failure. Such an outcome could serve U.S. interests by bolstering its influence in the region and facilitating access to Venezuela’s oil sector under attractive conditions.

Investment director from Aberdeen observes that many investors—ranging from well-established emerging market fund managers to hedge funds and specialists in distressed assets—are seeking opportunities in anticipation of a shift in policy direction following Maduro’s removal, viewing this as a precursor to loosening of sanctions and viable debt restructuring.

Despite this renewed enthusiasm, experts caution that Venezuela’s stock market remains limited in size, offers little liquidity, and is difficult for international investors to access, often resulting in sharp price fluctuations.

Beyond equities, Venezuelan sovereign and state energy bonds have also seen a surge in buying activity since Maduro’s detainment. The surge is underpinned by optimism that long-awaited debt restructuring efforts could soon materialize, potentially unlocking value in securities that have been dormant since the country’s default in 2017, says an expert from Aegon Asset Management.

However, the expert also warns that much of the current advance in equities may be influenced by breaking news rather than fundamental changes, and that a genuine turnaround would require more comprehensive shifts in leadership and governance.

Meanwhile, the nation still faces an enormous debt overhang, including arbitration claims and bilateral obligations estimated at $150 billion to $170 billion, per Reuters.