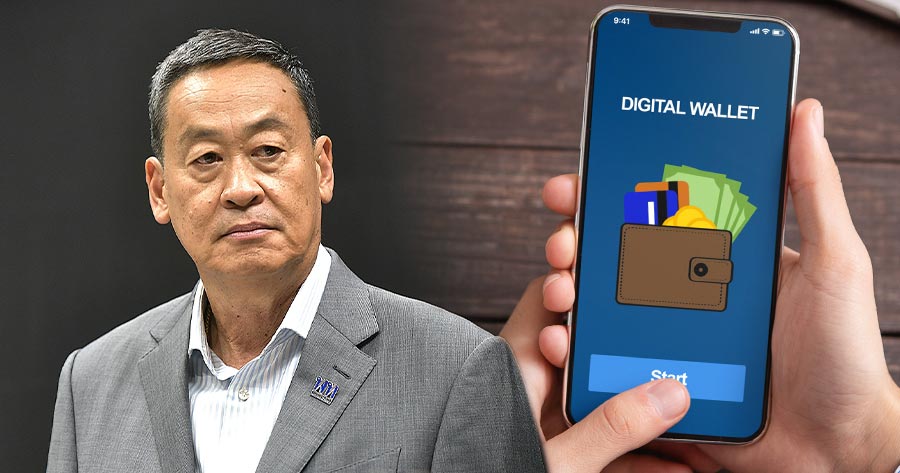

The 10,000-baht digital wallet measure from the new Thai Prime Minister, Srettha Thavisin raised criticisms ever since the election campaign from economists both left and right that showed concerns, especially on the country’s public debt.

According to the Ministry of Finance, Thailand’s current public debt is at 61.7% which is higher than the aftermath of the crisis in 2000, and almost at 11 trillion baht as of last July.

Thailand’s public debt was at around 15% to GDP in 1996 and had been hiked over 40% since the 1997 Southeast Asian crisis (Tom Yum Kung crisis). Thailand seems able to manage debt to GDP at around 40% during the 2005 to 2019 period, without any major effects taken from the subprime crisis in 2007 to 2009. Public debt started to rise over 50% in 2020 when the kingdom was hit by the Covid-19 pandemic.

Compared the public debt to nearby Asian emerging market countries, Thailand seems to be relatively in the middle of the group as China and India have over 80% and 67% in Malaysia. Meanwhile, debt in Laos just hit 123%, according to the data from the International Monetary Fund (IMF).

On the other hand, the Philippines, Indonesia, and Vietnam have lower debt than Thailand at 56%, 40% and 36%, respectively.

The average public debt in Asia Pacific is 93.2%, possibly due to the self-sustained 258% debt in Japan, while the average level of Southeast Asia is 60%.

According to Thailand’s Public Debt Management Office, the total foreign debt is at 157 billion baht in August 2023, which is around 1.43% compared to the total 11 trillion baht of debt to GDP.

The low ratio of foreign debt means it’s more manageable and negotiable as the debtor resides in the country, for example, Japan’s over 200% public debt to GDP. In contrast to Greece’s over 150% public debt to GDP that usually needs assistance from many debtors in the EU, along with the conditions that create dissatisfaction among the citizens.

As Thailand’s public debt is currently at a record high, the measure could take it up a notch to the all-time high at 14 trillion baht, which will break the current 70% debt to GDP ceiling in three years, according to Mr. Naris Sathapholdeja, Deputy Chief Executive Officer Head of the Economic Analysis Center of ttb analytics.

Thailand’s budget has been in deficit for decades, due to low tax incomes in contrast to continuously higher expenses. This caused the Thai government to keep borrowing to compensate for those deficits around 3-5% of GDP, and push the outstanding public debt to increase by 6-8% per year.

The handout policy would cost 560 billion baht. This larger numerator will move the public debt over 65%, and will reach 70% if there’s no structural reform in three years. The deputy chief noted that the policy could generate 0.5% GDP if the digital money could circulate for one cycle.

Meanwhile, the GDP as a denominator is expected to grow next year by 3.2% without the policy and 3.7% if total the policy effect. The GDP would grow over 4% if the money circulates through grassroot business which produces more money velocity or circulating circles.

The latter half of Thailand GDP is expected to grow by 3.4%, which is more than the first half due to the free visa for Chinese tourists and better exports from the lower base calculation.

ttb analytics revised its estimated total GDP growth to 2.8% in 2023 and 3.2% in 2024. Even though this is a positive number, ttb reminded that Thailand is still under many uncertainties from both domestic and global factors. The risk from geopolitical, low domestic demand, climate change and government investment spending, could cause Thailand’s GDP to miss the target or the lesser growth on GDP as a denominator of the debt ratio.

The deputy CEO recommended an aversion from universal policy and kept focus on the target group that needed to increase policy efficiency. The digital wallet could take advantage of a programmable restriction to keep the spending only on the essential.

In the meantime, Thailand’s Prime Minister Srettha Thavisin met with its central bank governor on Monday (2 Oct.) to exchange opinions on economics and finance. The meeting between the heads of fiscal and monetary policy was unorthodox, due to the unwritten violation of independence between both parties. However, the Thai PM said, “it was productive, and we will have these meetings on a monthly basis.”

Srettha has been pushing the economic stimulus measures, namely the 10,000-baht digital wallet which clashed with Bank of Thailand (BoT)’s view that recommended the government to be specific on the handout. As a regulator that handles and approves all of digital money and currencies, it’s the BoT mission to help facilitate all of the country’s digital financial infrastructure as it deems appropriate.

On the other hand, the BoT has another mission to control foreign exchange rate to Thai baht via the interest rate, which is also the same tool that is used to control the inflation as well.

The weakening of Thai baht over 37 baht per USD prompted the BoT to raise an interest rate to 10-year high at 2.5% last week, which is detrimental to the PM’s economic agenda to raise GDP by 5% each year. Moreover, the continuous strengthening of USD raises concerns that the central bank might need to push its benchmark rate for higher.

The direction of the 10,000-baht digital wallet is still inconclusive at the moment as many aspects are required to be discussed before the initial launch. Furthermore, the PM’s policy promises of a rising minimum wage over 400 baht is still waiting on the line as well.