On 28 June 2023, the Internal Revenue Department (“IRD”) issued Interpretation Statement No. 1/2023 (“IS 1/2023”) clarifying the Personal Income Tax (“PIT“) treatment of housing and medical benefits given to employees.

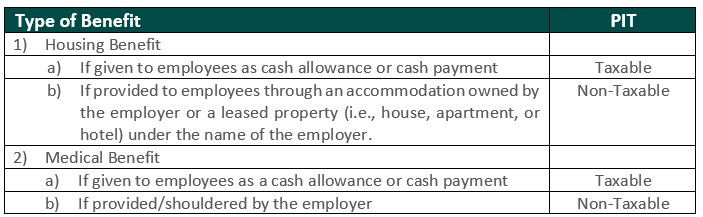

IS 1/2023 clarifies the taxation of fees, commissions, or perquisites received in lieu of or in addition to any salary or wages received by an individual as per Section 9 of the Income Tax Law (i.e., taxation of salaries). Under this Statement, if the employer paid the employee an additional amount in the form of a cash allowance, or paid the employee as a form of rental, then such additional payments will be taxable to the individual and subject to PIT in Myanmar. However, the following types of housing/accommodation are exempt from PIT:

(a) Accommodations provided by the employer to the employee where the building/property is owned by the employer; and

(b) Leased property (whether house, apartment, or hotel for long stay) by the employer for the benefit of the employee.

Furthermore, IS 1/2023 also applies the same treatment on housing benefits to medical costs paid to employees.

We provide below the taxation of housing and medical benefits as per IS 1/2023:

Note that for taxable cash allowances, they will form part of the income subject to the graduated PIT rates of 0-25% (based on the individual’s taxable income). For pure compensation income earners (or those deriving income from employment), the employer is required to withhold the tax on behalf of the employee.

For further information, please contact Diberjohn Balinas, Tax Director, Myanmar, [email protected]