On July 31, 2025, the White House issued a significant Executive Order titled “Further Modifying the Reciprocal Tariff Rates”, which imposes new and increased U.S. import tariffs on a wide range of foreign-origin goods, including from nearly all ASEAN member states.

This action builds upon Executive Order 14257 (April 2, 2025), which declared that persistent trade deficits and non-reciprocal trade barriers posed an extraordinary threat to U.S. national security. The July 31 Order further escalates the reciprocal tariff regime by modifying the Harmonized Tariff Schedule of the United States (HTSUS) and assigning country-specific ad valorem duties, many of which target Southeast Asia.

Key Provisions of the Executive Order

- Effective Date: 7 days from the date of the Order (i.e., August 7, 2025) for most goods, except for those already in transit and entered before October 5, 2025.

- New Tariff Rates: Additional ad valorem duties imposed based on each trading partner’s engagement in trade negotiations and alignment with U.S. national security objectives.

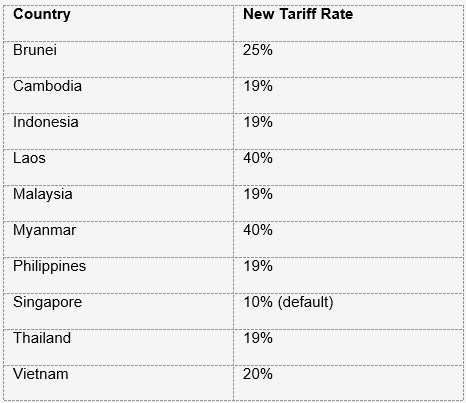

- A 19% Tariff rate was selected for most of the major ASEAN trading powers, except Vietnam which received a 20% Tariff due to the large size of its trade deficit with the US. Both Myanmar and Laos are penalized with a 40% tariff. Singapore, enjoys the 10% base Tariff.

- Default Tariff: 10% for countries not specifically listed in Annex I (e.g., Singapore).

- Anti-Transshipment Measures: Goods found to be transshipped to evade tariffs may face a 40% duty, fines, and full customs liabilities.

Tariff Impact on ASEAN Countries

Compliance & Strategic Considerations

- Exporters & Manufacturers: ASEAN-based producers targeting U.S. markets must assess how these new tariffs affect pricing, margin, and competitiveness—particularly in electronics, apparel, and processed goods.

- U.S. Importers: Companies sourcing from ASEAN should review existing supply chains and contracts for tariff adjustment clauses or alternative sourcing strategies.

- Customs Compliance: Strict enforcement of anti-transshipment rules may expose trading hubs (e.g., Thailand, Malaysia, Vietnam) to audits and penalties. Documented country of origin compliance is now critical.

- Trade Negotiation Outlook: The Order explicitly provides for future tariff suspensions or modifications if affected countries conclude meaningful trade and security agreements with the United States. ASEAN governments and businesses should monitor or engage in relevant bilateral talks.

Next Steps for Clients

- Evaluate Tariff Exposure: Conduct a full review of U.S.-bound exports subject to new tariff rates.

- Review Supply Chain Contracts: Ensure appropriate pass-through or renegotiation mechanisms exist.

- Monitor U.S. Trade Developments: Stay informed on future Executive Orders or bilateral negotiations that could alter tariff treatment.

- Assess Transshipment exposure: evaluate your supply chain to reduce use of components that could be considered “Transshiped” under the Executive Order.

- Country of Origin scrutiny: Assess and evaluate your local teams’ understanding of the importance of obtaining accurate and valid trade documents, such as Certificates of Origin, commercial invoices and shipping documents, that truthfully identify the Country of Origin and would be acceptable the US Customs and Border Protection agency.

- Engage Experts: Consider engaging trade counsel in ASEAN and USA, such as DFDL, to undertake a strategic review of your company’s trade risk exposure.

Future client alerts will focus on the rules related to Transshipment, which incur a 40% tariff, the importance of the “FIRST SALE RULE” for valuation, and other key issues that would help you navigate the constrains arising from the executive orders.

*This Client Alert is for informational purposes only and does not constitute legal advice. Specific advice should be sought for your particular circumstances.*

For further guidance on how these tariff changes may affect your company or sector, please contact David Doran.

For further detail on the US tariffs implementation, please visit DFDL.