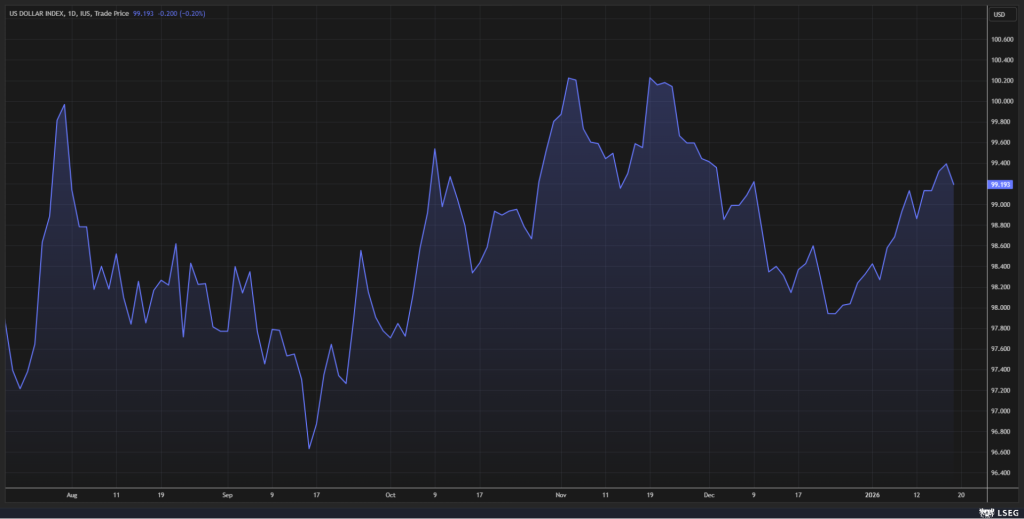

The Dollar Index slipped 0.18% on Monday after news surfaced that BRICS nations may pursue the use of interconnected digital currencies for cross-border trade and tourism. The proposal could weaken the dominance of the U.S. dollar in international payments, attracting close attention from investors.

According to sources cited by Reuters, India’s central bank has put forward a plan for BRICS countries—Brazil, Russia, India, China, and South Africa—to establish links between their respective central bank digital currencies (CBDCs). This initiative, aimed at streamlining cross-border commerce and travel payments, could offer participating nations an alternative to the U.S. dollar at a time of heightened geopolitical tension.

The BRICS is a forum for cooperation among a group of leading emerging economies. The BRICS includes 10 countries – Brazil, China, Egypt, Ethiopia, India, Indonesia, Iran, Russian, South Africa, United Arab Emirates. The group has a growing list of partner nations, with Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda, Uzbekistan, and Vietnam.

The Reserve Bank of India (RBI) has formally suggested that this digital currency linkage be added to the agenda of the BRICS 2026 summit, which will take place in India later this year. Should the government accept the recommendation, the matter would be included for discussion at the summit for the first time. In 2025, Brazil hosted the previous BRICS summit in July.

Meanwhile, data from the Atlantic Council highlights the growing adoption of non-dollar payment alternatives. Transactions facilitated by ‘mBridge’—a digital currency platform led by China and used by several regional central banks—have surpassed $55 billion. Since its pilot phase began in 2022, the platform has handled more than 4,000 cross-border payments, with the digital yuan (e-CNY) making up around 95% of total transaction volume.

Recent figures from the People’s Bank of China show the e-CNY system has processed in excess of 3.4 billion transactions, with a cumulative value of approximately 16.7 trillion yuan ($2.4 trillion). This reflects an increase of more than 800% from levels seen in 2023.

The proposed agenda item for the 2026 BRICS summit in India could mark the first formal push to connect member states’ digital currencies if approved.

The digital yuan, or e-CNY, operates in a manner resembling existing mobile wallets, but it incorporates a set of distinctive characteristics. Unlike widely used private-sector applications like Alipay and WeChat Pay, the digital yuan holds the status of legal tender in China, obligating merchants to accept it. Transactions are generally free for both merchants and consumers, while the system also incorporates mechanisms for “controllable anonymity” in lower-value purchases.