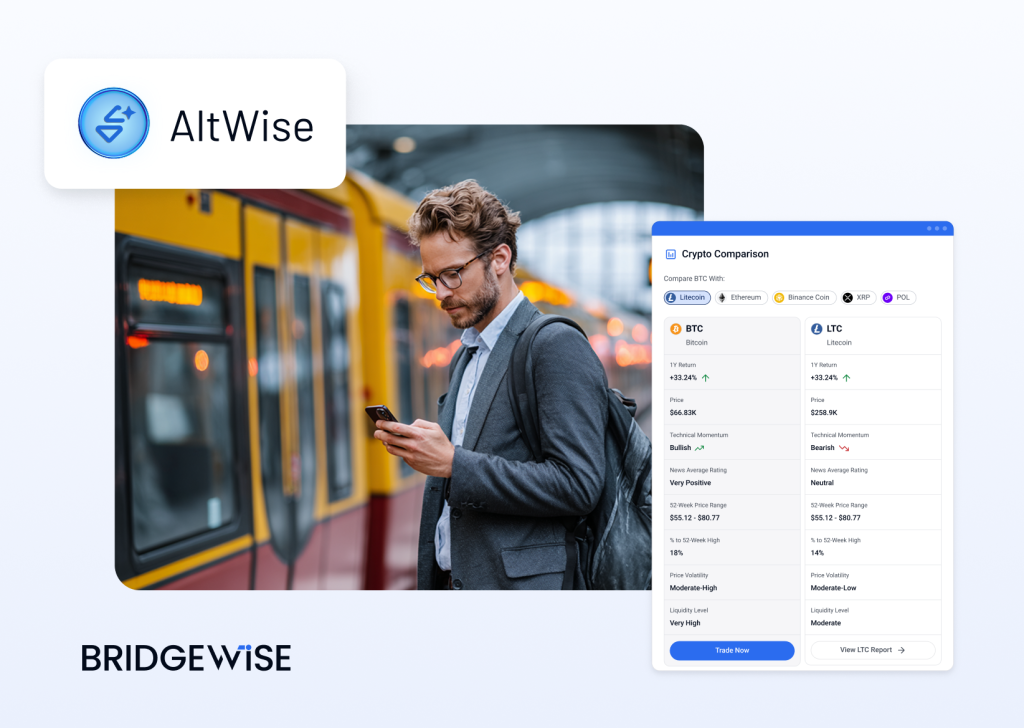

Within today’s rapidly evolving financial environment, BridgeWise, a global leader in AI for investments has introduced AltWise, an AI-based analytical solution built to help brokers and traders navigate the increasingly complex world of alternative assets, spanning crypto, forex, and commodities.

As global markets enter a new era of financial transformation, investors are turning their eyes beyond traditional stocks and bonds. Gold has soared above USD 3,900 per ounce, reaching new record highs amid uncertainty surrounding the U.S. government shutdown and expectations of further Federal Reserve rate cuts. Meanwhile, cryptocurrencies continue to draw interest as hedging tools, with Altcoins emerging as an alternative for investors seeking to diversify away from dollar-denominated assets.

AltWise arrives as a timely solution for brokers regulated by the Securities and Exchange Commission (SEC) Thailand, enabling them to provide clients with smarter, AI-powered insights across volatile alternative markets. Powered by BridgeWise’s proprietary Small Language Model (SLM) — purpose-built for financial markets — the platform delivers deep, multilingual, multi-asset analysis through customizable widgets, including EOD technical analysis and news sentiment. These can be embedded directly into trading platforms, offering traders timely insights into alternative assets.

This global shift is also taking root in Thailand. The Securities and Exchange Commission (SEC) reported in September 2025 that the country’s digital asset market capitalization reached 104.5 billion baht, up from 91 billion baht the previous year. Monthly trading value stood at 2.49 billion baht, driven largely by Tether (45%), Bitcoin (12%), Ethereum (10%), Dogecoin (7%), and Ripple (4%), across more than 300 listed altcoins. According to the SEC, there were 2.92 million accounts opened with local digital asset exchanges, with around 218,000 accounts actively trading monthly, and retail investors making up nearly 60% of the market.

“Brokerage companies serve retail clients who often have a more limited understanding of the markets compared with institutional or more experienced traders,” said Dor Eligula, Co-Founder and Chief Business Officer of BridgeWise. “That’s where AI can make a real difference. By integrating analytical tools like AltWise, brokers can enhance the way investors make decisions and improve their experience, especially in markets like Thailand, where retail participation is strong and digital assets are becoming mainstream,” Dor added.

By combining multilingual data processing with second-to-none accuracy, BridgeWise aims to help brokers reduce information asymmetry while empowering retail investors to make data-driven, well-informed decisions in complex markets such as cryptocurrencies.

Thailand’s Digital Currency Future

Importantly, this shift toward digital and tokenized assets is not limited to private investments. Thailand’s digital asset sector shows strong growth potential, driven by several ongoing projects. The Bank of Thailand (BoT) and the Ministry of Finance are advancing their digital-currency roadmap, including initiatives such as G-Token, a government-backed digital bond, and ongoing research into central bank digital currency (CBDC) as part of the nation’s financial modernization efforts that are well worth watching.

“In Thailand, we see one of the most dynamic digital-asset markets in Southeast Asia,” Dor Eligula added. “The SEC’s progressive stance on token regulation, together with the Bank of Thailand’s experiments in digital currency, signals a financial ecosystem ready to evolve. Tools like AltWise can support that evolution—not by replacing human judgment, but by bringing clarity to complex data.”

AltWise, together with other BridgeWise solutions, including StockWise, SignalWise, Bridget™, and more, is now available for brokerage companies, trading platforms, and financial institutions. For more information, visit: https://bridgewise.com/