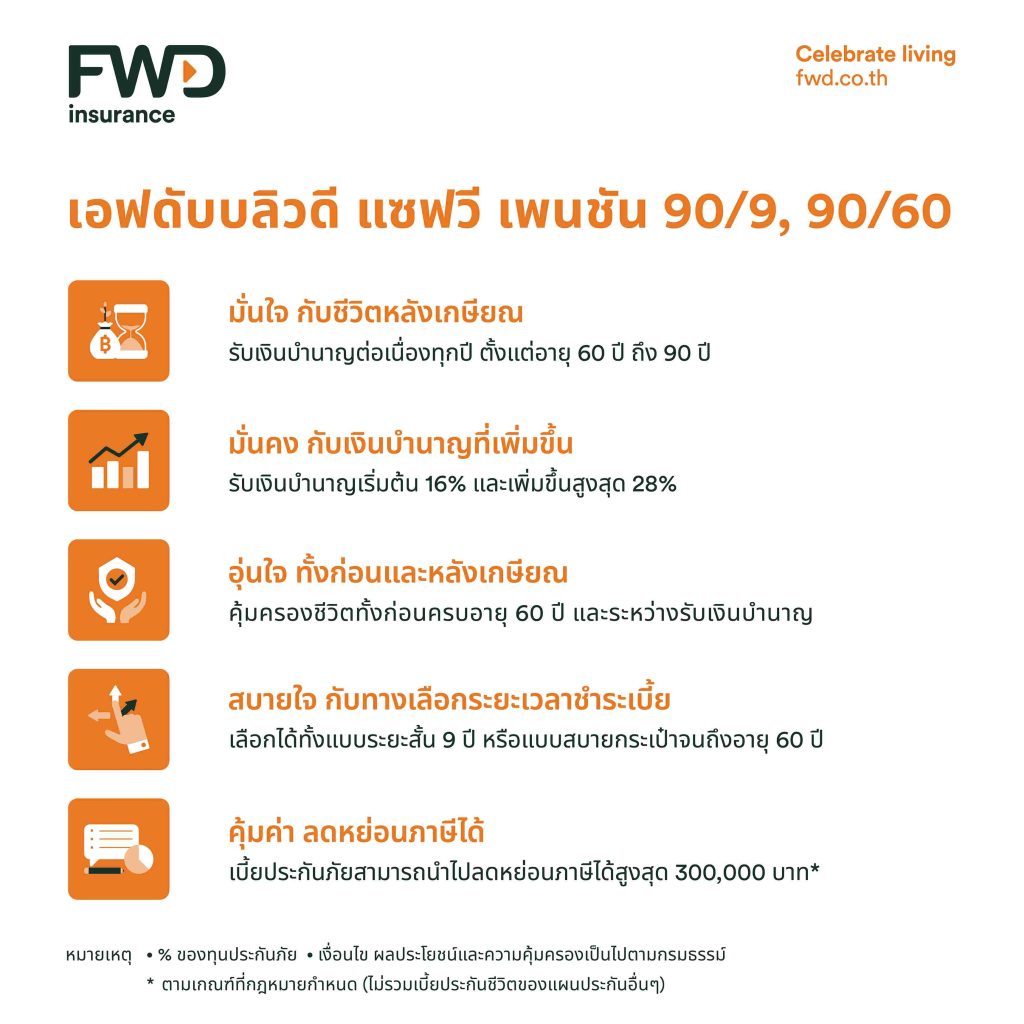

FWD Life Insurance Plc. (“FWD Insurance”) has unveiled a new insurance product for its agency channel called “FWD Savvy Pension 90/9, 90/60”. This product is designed to cater to individuals who are looking for financial tools to prepare for their retirement in alignment with their preferences. It offers two payment options, giving customers the flexibility to choose between a short 9-year premium payment period or comfortable payments until they reach the age of 60. This product aims to instill confidence in retirement planning, even in anticipation of potential future increases in living costs. Notably, the pension amount increases proportionally, reaching up to 28% of the sum assured. It provides coverage up to the age of 90 and offers tax deductions of up to 300,000 Baht. Begin shaping the retirement lifestyle you envision today.

Ms. Alisa Areepong, Chief Proposition Officer of FWD Insurance, pointed out that longer life expectancies and enhanced quality of life, driven by advancements in fields such as medical technology and healthcare, have led to extended post-retirement phases in the lives of Thai individuals. Concurrently, healthcare and medical expenses are on the rise. Therefore, comprehensive financial planning, supported by dependable financial instruments, plays a pivotal role in establishing financial security for retirement. FWD Insurance, guided by its customer-led approach, has developed the “FWD Savvy Pension 90/9, 90/60” insurance product to cater to the needs of working-age individuals who are actively planning for their future retirement and ensuring financial readiness for the various stages of life. Additionally, the premiums are eligible for tax deductions of up to 300,000 Baht, in accordance with the law.

The “FWD Savvy Pension 90/9, 90/60″ plan serves as the “initial step for individuals to tailor their retirement plans.” It offers continuous retirement income that begins at age 60 and extends up to age 90. The payouts progressively increase, starting at 16% of the sum assured and reaching a maximum of 28%. The plan provides flexibility in selecting the premium payment period, with options for a brief 9-year term, available for individuals aged 20 to 50, or payments until age 60, open to individuals aged 20 to 55.